Strategy Acquires $75.3M Worth of Bitcoin During Brief Price Drop Under $75K

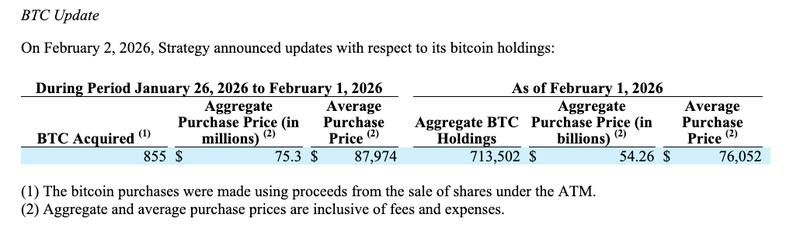

Recent SEC disclosures reveal Strategy purchased 855 Bitcoin at approximately $88,000 per coin during last week's trading, marking the first instance of BTC trading below the company's average acquisition price since 2023.

Strategy, led by Michael Saylor and recognized as the largest publicly traded company holding Bitcoin, revealed additional BTC acquisitions during a week when cryptocurrency prices temporarily declined beneath the $75,000 threshold.

According to documentation submitted to the US Securities and Exchange Commission on Monday, Strategy purchased 855 Bitcoin (BTC) worth $75.3 million throughout the previous week.

These Bitcoin acquisitions occurred at an average cost of $87,974 per BTC, during a period when Bitcoin began the week trading above $87,700, subsequently climbed to $90,000, before experiencing a sharp decline to below $75,000 on Sunday, data from CoinGecko indicates.

Following this latest acquisition, Strategy's cumulative Bitcoin portfolio has reached 713,502 BTC, representing a total investment of approximately $54.26 billion with an average cost per coin of $76,052.

This acquisition occurred during a period when Bitcoin temporarily declined below Strategy's average acquisition cost, representing the first occurrence of trading beneath the company's cost basis since the latter part of 2023.

Not the first time Bitcoin has fallen below Strategy's cost basis

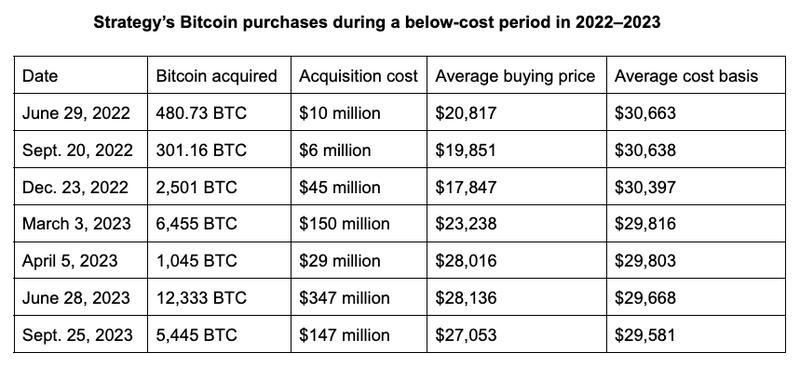

The Bitcoin Standard initiative was introduced by Strategy in August 2020. Following two years of implementation, Bitcoin's market price fell below the company's average acquisition cost for the initial time. In May 2022, Bitcoin descended below $30,000, whereas the company's average purchase price stood at approximately $30,600.

This price decline compelled Strategy to reduce its purchasing activity, ultimately resulting in the acquisition of merely 8,109 BTC throughout 2022. Bitcoin continued trading below Strategy's cost basis until the end of August 2023, with another short-lived decline occurring afterward, culminating in seven separate purchases totaling 28,560 BTC throughout this below-cost timeframe.

The quantity purchased during this period represented approximately 22% of Strategy's aggregate 129,218 BTC portfolio at the commencement of that timeframe.

Polymarket puts 81% odds on Strategy's Bitcoin holdings topping 800,000 BTC

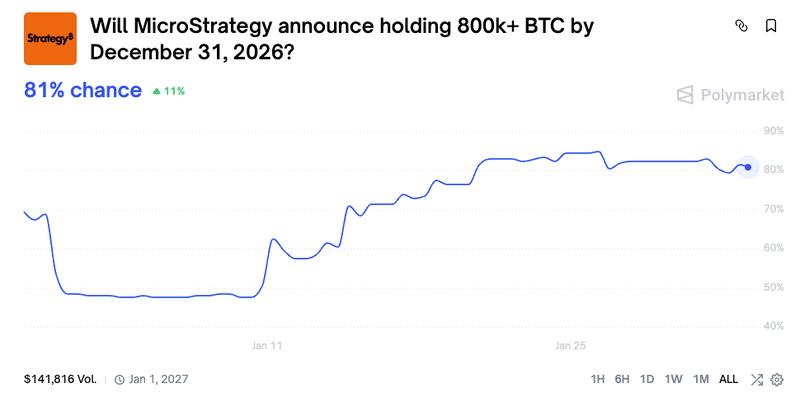

Notwithstanding the increasing bearish sentiment surrounding Bitcoin valuations following the weekend market downturn, participants on Polymarket continue to express optimism regarding Strategy's accumulation trajectory throughout 2026.

Although the likelihood of Bitcoin declining below $65,000 during this year increased to 72% on Monday, Polymarket data simultaneously reveals an 81% probability indicating that Strategy's Bitcoin portfolio will achieve 800,000 BTC.

Achieving this milestone would necessitate the company acquiring a minimum of 87,000 BTC before the conclusion of 2026.

During the previous year, Saylor, who founded Strategy, made a prediction that Bitcoin would achieve a price of $21 million per coin by the year 2046.