YouTube Star Logan Paul's $16.5M Pokémon Card Sale Breaks Record Despite NFT Controversy

In 2022, Paul divided ownership of the valuable Pokémon card through Liquid Marketplace before the platform ceased operations, triggering legal action from investors seeking refunds.

Internet personality and content creator Logan Paul has secured a place in the Guinness World Records by completing the sale of his prized Pokémon card for approximately $16.5 million this Monday — marking it as the highest-priced card transaction ever recorded — although the landmark deal has sparked renewed debate and criticism.

The competitive bidding process for the Pikachu Illustrator Pokémon card — among just 39 produced for a promotional contest during the 1990s — concluded with AJ Scaramucci, offspring of prominent American financier Anthony Scaramucci, emerging victorious after competing against numerous bidders who submitted proposals ranging from seven to eight figures.

Following the deduction of auction-related expenses on Monday, Paul is estimated to have earned roughly $8 million in profit. His original acquisition of the card occurred in July 2021 for $5.3 million.

.@LoganPaul's rare @Pokemon card becomes most expensive ever sold in record-setting auction.

The PSA-10 Pikachu Illustrator went on sale via @GoldinCo and eventually sold for $16,492,000.

— Guinness World Records (@GWR) February 16, 2026

The historic transaction, however, has brought back into focus the backlash Paul received following his decision to divide ownership of the collectible card into fractionalized shares through Liquid Marketplace in 2022, before the service ceased functioning, which left investors seeking compensation and resulted in legal proceedings initiated in Canada.

Through a message posted on X this Monday, Gabriel Shapiro, who serves as general counsel for Delphi Labs, characterized Paul's "Pikachu NFT fractionalization fiasco" as a textbook example of "slop tokenization."

According to Shapiro, "The token is basically just 'juxtaposed' with property but has no rights to it," as he encouraged investors to carefully review terms of service agreements and avoid hastily entering what he described as "legal scams."

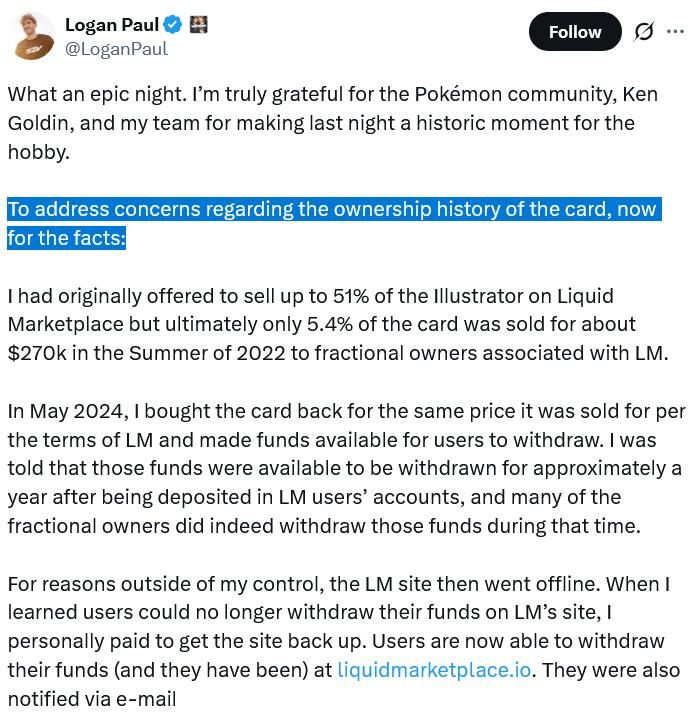

In response to the renewed criticism, Paul clarified that Liquid Marketplace's shutdown occurred due to circumstances outside his sphere of influence, and that upon discovering the problem, he personally funded the restoration of the platform to enable users to retrieve their investments.

Paul pointed out that merely 5.4% of the card had been divided among fractional owners who collectively paid approximately $270,000.

The lawsuit against Liquid Marketplace, which was filed by the Ontario Securities Commission, Canada's primary securities regulatory authority, in June 2024, does not list Paul as a defendant. Court proceedings are slated to commence in June.

Logan Paul's past NFT drama

This is far from being Paul's initial occasion having to provide justification regarding his participation in NFT-related ventures. His CryptoZoo NFT initiative fell short of launching its advertised play-to-earn gaming platform, resulting in investor dissatisfaction and a collective legal action filed in 2023.

Paul established a repurchase initiative and ultimately compensated investors following their consent to relinquish legal claims, with the class-action fraud litigation being formally dismissed in 2025.

Additional NFT acquisitions made by Paul have similarly depreciated significantly, including an anime-inspired digital character from the 0N1 Force series that he purchased for approximately $635,000 in 2021 and is currently worth less than $2,000.

NFT market continues to slide

The record-breaking Pokémon card transaction also presents a stark comparison to the faltering NFT marketplace, which specializes in trading digital collectible items.

Although the NFT sector demonstrated robust performance during the opening two weeks of 2026, the overall NFT market capitalization has subsequently declined by over 50%, dropping from $3.2 billion down to $1.55 billion during a wider market downturn.

During the previous month, NFT trading platforms Rodeo and Nifty Gateway made announcements in late January regarding their decisions to cease operations and shut down, contributing to an increasing list of prominent closures within the industry.