XRP Bulls Poised for Comeback? Four Key Indicators Point to $1.12 as Cycle Bottom

Technical analysis, on-chain metrics, and ETP flow data converge to indicate XRP may have established a generational floor at $1.12. Could a bullish reversal be imminent?

Following a dramatic 15-month low of $1.12 on Feb. 6, XRP (XRP) has staged an impressive 50% rally, climbing to $1.67. Although its current intraday trading level of $1.43 sits more than 60% beneath the multi-year peak of $3.66, a range of indicators point toward the $1.12 price level potentially marking a new cycle bottom, with XRP potentially positioned for an extended upward trajectory.

Key takeaways:

- Exchange-held XRP supply has reached its lowest point in five years as token holders transfer assets to self-custody wallets, potentially indicating diminished selling pressure.

- Funding rates have plunged to extreme negative territory, historically a sign of potential market bottoms.

- Spot taker CVD showing positive momentum, combined with consistent ETF capital inflows, demonstrates robust retail and institutional buying appetite for a potential recovery.

Declining exchange reserves present bullish signal for XRP

Exchange holdings of XRP have experienced a significant reduction throughout the previous two years, according to analytics provided by Glassnode. By Tuesday, the total XRP balance residing on centralized exchanges had declined to 12.9 billion XRP, reaching levels not observed since May 2021.

When token balances on centralized platforms decrease, this typically indicates that holders are not planning to liquidate their positions, which could potentially strengthen the case for future price appreciation in XRP.

Supplementary information from CryptoQuant shows that Binance's XRP holdings have experienced a steep decline to approximately 2.57 billion XRP, with the SMA(50) and SMA(100) indicators both trending downward.

"Technically, reserves are declining while price remains near the lows," said CryptoQuant contributor PelinayPA in a Monday Quicktake analysis.

This technical configuration heightens the likelihood of a potential short squeeze scenario materializing in the near term.

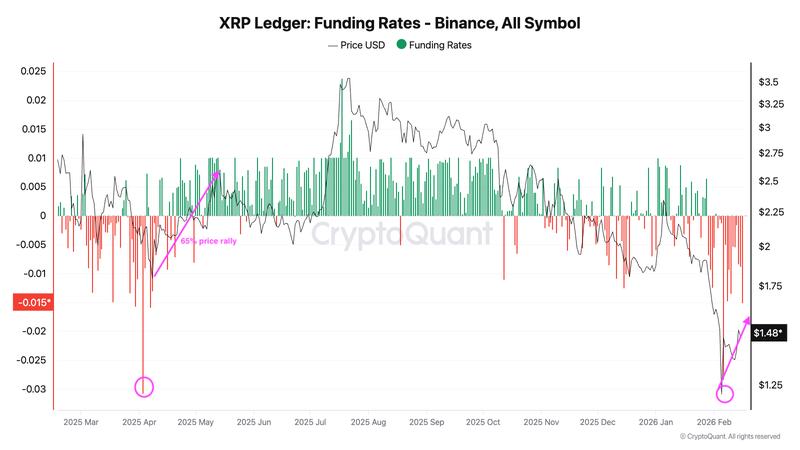

Extreme negative funding rates emerge for XRP

On Binance, funding rates plummeted to -0.028% coinciding with the price decline to $1.12 on Feb. 6, representing the most negative reading since April 2025. When coupled with declining spot valuations, negative funding rates indicate an oversaturation of short positions and capitulation among leveraged long traders.

Throughout market history, extremely negative funding rates have frequently signaled potential price floors or imminent short squeezes, as markets enter oversold conditions.

When funding conditions reached similar extremes in April 2025, the market subsequently experienced a 65% surge to $2.65, starting from $1.60, driven by short position liquidations.

Similar market configurations observed during late 2024 catalyzed aggressive upward price movements as market participants scrambled to exit their positions.

Concurrently, XRP futures open interest (OI) has contracted to approximately $2.53 billion on Tuesday, representing a 55% decline from the $4.55 billion peak registered in early January, based on data compiled by CoinGlass.

This development indicates that leveraged market participants are scaling back their market exposure instead of establishing new positions, suggesting diminishing bearish sentiment and the possibility of a price reversal should buying momentum return to the market.

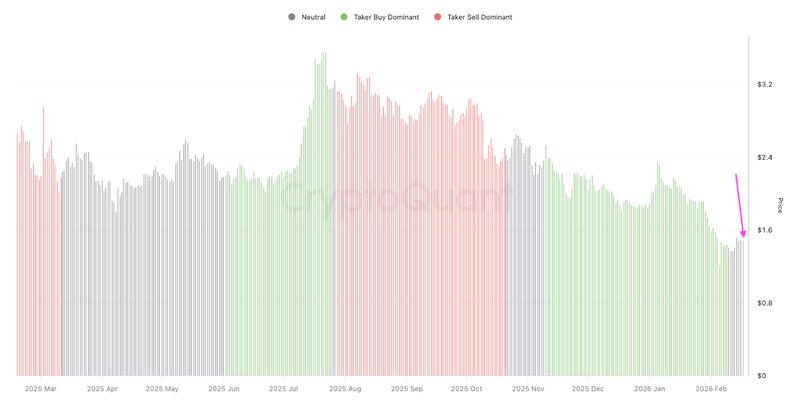

Spot taker CVD for XRP demonstrates elevated purchasing activity

An examination of the 90-day spot taker cumulative volume delta (CVD) shows that aggressive buy orders (taker buy) have regained dominance in recent trading. The CVD indicator calculates the net difference between buying and selling volume across a three-month timeframe.

Through late yesterday, CVD readings remained in neutral territory, suggesting market participants were uncertain about directional movement.

On Tuesday, this indicator shifted into positive territory (illustrated by the green bar in the accompanying chart), signaling a resurgence in market demand, with buying interest reclaiming market control.

Should the CVD maintain its positive trajectory, this would confirm that buyers are actively accumulating at depressed price levels, potentially establishing the foundation for another upward movement phase, consistent with historical recovery patterns.

XRP spot ETF capital inflows persist through market downturn

United States-based spot XRP exchange-traded funds (ETFs) have maintained their appeal among investors, with these financial instruments registering net inflows on 53 out of 59 trading days, demonstrating consistent institutional appetite since their market debut in November 2025.

On Friday, spot XRP ETFs attracted an additional $4.5 million in capital, pushing aggregate inflows to $1.23 billion and elevating total net assets under management beyond the $1.01 billion threshold, based on data compiled by SoSoValue.

Likewise, despite worldwide crypto investment vehicles recording their fourth consecutive week of capital outflows totaling $173 million, XRP ETPs defied the prevailing trend, distinguishing themselves as the leading performer with net inflows reaching $33.4 million throughout the week concluding Feb.13.

This performance underscored the persistent institutional appetite for XRP-based ETPs, maintaining strength even as broader market prices experienced downward pressure.