Three Bitcoin price levels identified by traders as $70K resistance persists

Market analysts outline specific Bitcoin price objectives should the $70,000 threshold maintain its role as a key resistance point. Can bullish investors find reason for optimism?

Market analysts tracking Bitcoin (BTC) have identified crucial price points for observation as attention turns toward the $58,000 to $65,000 range, which appears to serve as a critical defensive zone for the cryptocurrency.

Bitcoin price is wedged between two key levels

The leading cryptocurrency finds itself currently positioned between its 200-week simple moving average (SMA) positioned at $68,300 and its 200-week exponential moving average (EMA) situated at $58,400.

Historical price action analysis reveals that significant BTC bottoms have typically emerged within the zone bounded by the 200-week SMA and EMA, as noted by analyst Jelle. This historical pattern indicates that Bitcoin could potentially be establishing a bottom within this technical framework.

Despite Bitcoin managing to secure a weekly closing price above its 200-week EMA for two consecutive weeks, trader and analyst Rekt Capital cautioned in a Monday X post that "this doesn't mean it is now in the clear," further stating:

"The absence of any meaningful upside from here going forward, there is a risk that BTC loses the 200-week EMA in time, triggering additional downside."

Cryptocurrency investor and business entrepreneur Ted Pillows provided a broader perspective, highlighting $71,000 as the critical threshold for a bullish reversal scenario.

Through a Tuesday publication on X, Ted Pillows emphasized that Bitcoin requires a daily closing price exceeding the $71,000 mark to enhance the probability of an upward momentum shift, further noting:

"And if a breakdown happens below $66,000, BTC might revisit $60,000."

Previous Cointelegraph coverage highlighted that the CME gap spanning between $80,000 and $84,000 may serve as a price magnet, signifying the upper objective for Bitcoin pricing. Given that nine out of 10 CME gaps have been filled since August 2025, the $80,000–$84,000 range emerges as the critical level worth monitoring for potential upside movement.

Bitcoin bulls must hold the price above $65,000

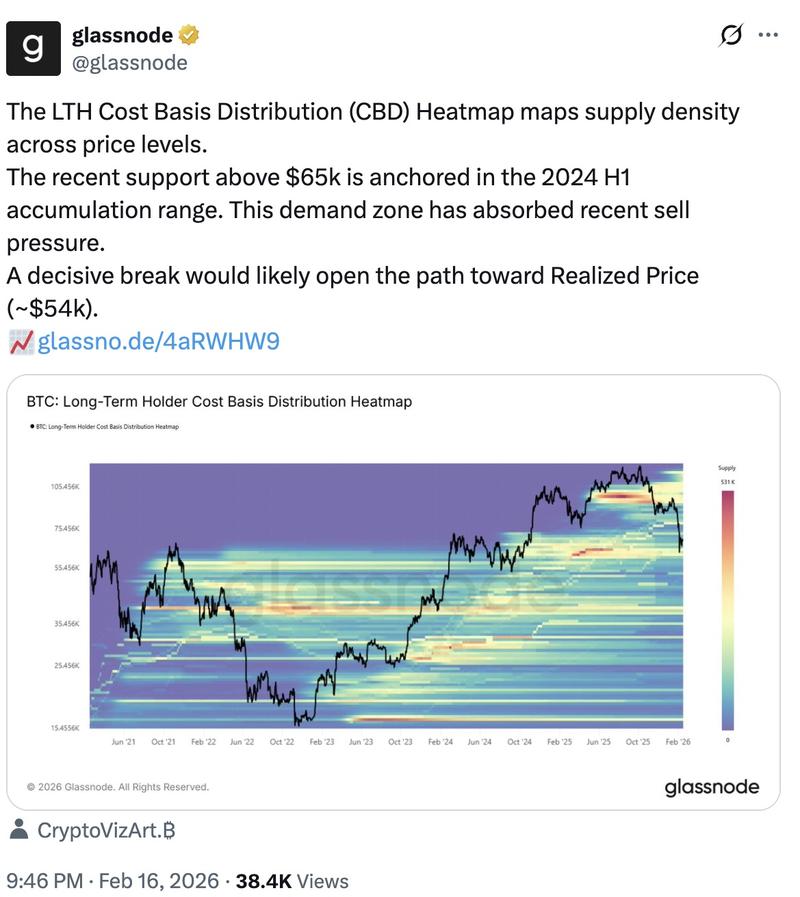

Following its rejection from the $72,000 level during the previous week, Bitcoin discovered buying support at the $65,000 mark. Data from Glassnode's cost basis distribution heatmap indicates a substantial support zone that has recently formed within the $63,000 to $65,000 range, where long-term holders have recently accumulated roughly 372,240 BTC.

Should this level be decisively breached to the downside, it "would likely open the path toward the realized Price" situated around $55,000, Glassnode stated in a Monday post on X.

Present market analysis indicates that bearish traders may target keeping BTC price suppressed beneath $65,000 to maintain their market dominance. Should they prove successful in this endeavor, the BTC/USDT pair could potentially test the crucial $60,000 threshold once again. In the event that the $60,000 support level fails to hold, the subsequent destination would likely be the $52,500 price point.