Mystery Hong Kong Firm Emerges as Major IBIT Purchaser Amid $105M Bitcoin ETF Withdrawals

Spot Bitcoin ETF outflows in the United States show signs of deceleration while market participants scrutinize institutional Q4 2025 disclosures revealing cryptocurrency ETF trading patterns.

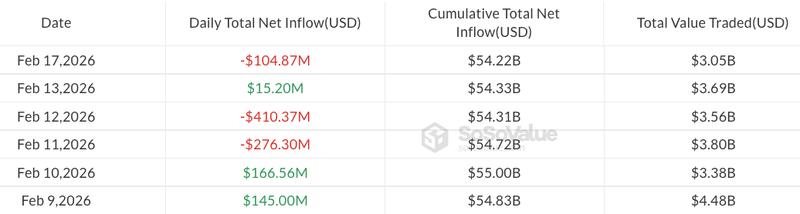

On Tuesday, during the initial trading session of the week, United States spot Bitcoin exchange-traded funds (ETFs) recorded net withdrawals totaling $104.9 million.

Trading volume for spot Bitcoin (BTC) ETFs declined to slightly above $3 billion, representing a drop of nearly 80% compared to the all-time high of $14.7 billion recorded on Feb. 5, indicating an ongoing deceleration in market activity, based on data from SoSoValue.

These withdrawals occurred as institutional investors filed another wave of disclosures detailing their Bitcoin ETF positions during the fourth quarter of 2025, with Jane Street emerging as the second-biggest purchaser of BlackRock's iShares Bitcoin ETF (IBIT) throughout Q4, accumulating $276 million worth of shares.

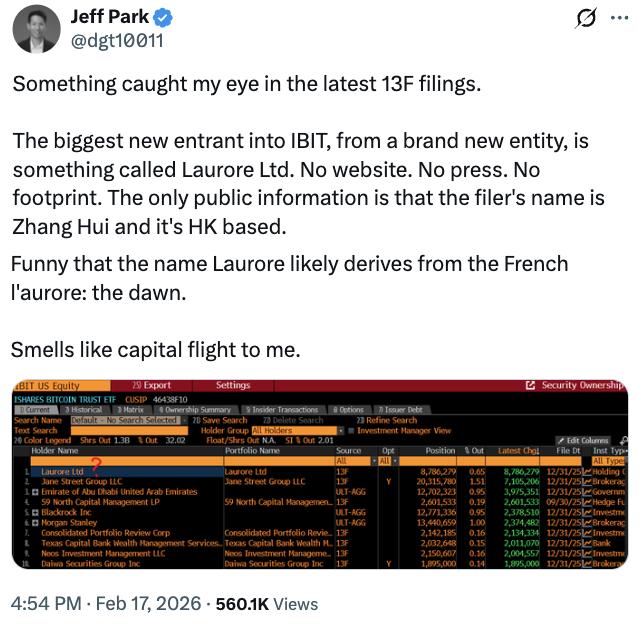

The fourth quarter additionally witnessed a new participant in IBIT, a relatively unknown Hong Kong-based entity named Laurore, which purchased $436.2 million of the ETF in one single transaction as disclosed to the US Securities and Exchange Commission.

Could this signal Chinese institutional interest in Bitcoin?

Jeff Park, an advisor at Bitwise Investments, suggests that Laurore's recently revealed IBIT position might represent an initial signal of Chinese institutional money flowing into Bitcoin.

According to Park, Laurore maintains virtually no public presence — lacking both a website and media coverage — with the sole accessible detail being that the filing individual's name is Zhang Hui, which in Chinese culture is comparable to "John Smith" in English-speaking countries.

Although Park theorized that this investment might be connected to capital outflow activities, certain observers raised questions about why the firm would opt to purchase Bitcoin via an ETF instead of acquiring it directly.

Brevan Howard cuts IBIT position by 85%

In addition to Laurore and Jane Street, numerous other institutional players executed substantial transactions involving IBIT during Q4 2025. Weiss Asset Management purportedly acquired approximately 2.8 million shares (valued at $107.5 million), while 59 North Capital expanded its stake by 2.6 million shares (worth $99.8 million).

Mubadala Investment, the state-owned investment company based in Abu Dhabi, enhanced its IBIT position by 45%, climbing from 8.7 million shares during Q3 to 12.7 million throughout Q4, representing a value of $630.7 million.

Conversely, certain firms reduced their Bitcoin ETF allocations throughout Q4 2025. Brevan Howard significantly decreased its IBIT position, slashing approximately 85% from 37 million shares (valued at $2.4 billion) in Q3 2025 down to roughly 5.5 million shares (worth $273.5 million) in Q4.

Goldman Sachs similarly pared back its IBIT stake by approximately 40%, maintaining around $1 billion in holdings.