HIVE Digital reports massive 219% revenue surge as AI-mining hybrid model proves successful

Company achieves impressive revenue expansion in Q3 despite declining Bitcoin valuations, while securing fresh AI computing agreements as part of ongoing diversification beyond traditional cryptocurrency mining operations.

HIVE Digital Technologies posted exceptional financial results for its fiscal third quarter even while Bitcoin valuations weakened, indicating that the company's strategic push into artificial intelligence infrastructure and high-performance computing is successfully counterbalancing challenging conditions in the wider cryptocurrency marketplace.

During the three-month period that concluded on Dec. 31, 2025, HIVE posted total revenues of $93.1 million, marking a remarkable 219% jump compared to the same quarter in the previous year. The company's gross operating margin experienced an even more dramatic expansion, climbing more than six times year over year to reach $32.1 million, which accounts for approximately 35% of total revenue.

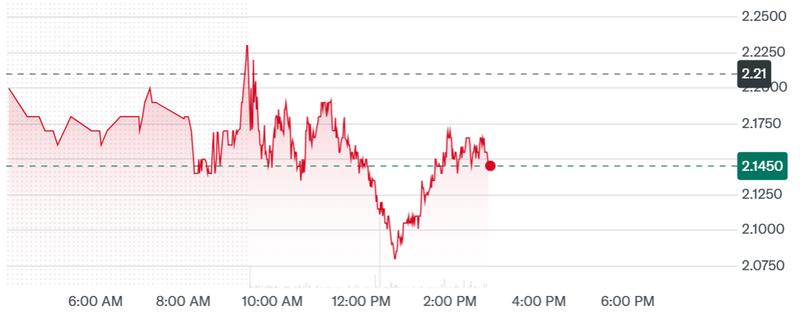

This robust financial performance was achieved despite Bitcoin (BTC) valuations dropping roughly 10% throughout the quarter while network difficulty climbed approximately 15%, creating conditions that have squeezed mining profitability throughout the sector in the aftermath of the 2024 halving event.

During this timeframe, HIVE successfully mined 885 Bitcoin, representing a 23% increase compared to the previous quarter, while simultaneously expanding its operational hashrate capacity to 25 exahashes per second (EH/s).

Outside of its cryptocurrency mining operations, the organization is actively developing its artificial intelligence and high-performance computing (HPC) division. During February, HIVE executed a two-year agreement valued at $30 million for the deployment of 504 Nvidia B200 GPUs dedicated to enterprise-grade AI cloud computing services.

This agreement is projected to contribute approximately $15 million in annual recurring revenue and increase HIVE's HPC annualized revenue run rate by roughly 75%.

The organization has set a goal of achieving $140 million in annual recurring AI cloud revenue by the fourth quarter of 2026, forming part of an ambitious strategy to expand total HPC revenue to $225 million through the enlargement of GPU cloud infrastructure and colocation capabilities.

HIVE's expansion beyond Bitcoin mining gains traction

HIVE ranked among the pioneering publicly traded Bitcoin mining companies, though the organization initiated its transition toward HPC infrastructure multiple years ago as leadership foresaw mounting competitive pressures and shrinking profit margins within the mining industry.

This strategic diversification has proven increasingly important. Mining profitability experienced a severe downturn following the 2024 halving event that cut block rewards in half, while climbing network difficulty and unpredictable Bitcoin price movements created additional challenges. The situation became more acute after Bitcoin pulled back from its October 2025 peak levels, compelling numerous mining operations to reevaluate their capital deployment strategies and infrastructure priorities.

HIVE's "dual-engine" approach, leveraging Bitcoin mining operations as a cash-flow engine while simultaneously developing consistent AI and HPC revenue streams, demonstrates a wider transformation among publicly traded mining companies pursuing greater stability independent of Bitcoin's cyclical price fluctuations.

Multiple other Bitcoin mining enterprises, including IREN and TeraWulf, have pivoted toward AI-focused workloads, illustrating an emerging consensus among industry analysts that the upcoming infrastructure "supercycle" will be driven primarily by artificial intelligence applications rather than cryptocurrency-related demand.