Europe's Blockchain Sandbox: Where Regulation Meets Innovation

While the European Union implemented blockchain regulations ahead of other major economic powers, its regulatory sandbox is now demonstrating how structured communication can foster innovation within established legal boundaries.

The European Union has frequently faced accusations of placing regulatory frameworks ahead of fostering innovation, yet officials now cite the European Blockchain Sandbox as evidence that regulation can actually stimulate creative development.

Following three rounds of private consultations, the program has generated a comprehensive 230-page document outlining best practices and attracted participation from approximately 125 regulatory bodies and authorities.

The European Commission selected law firm Bird & Bird along with its consortium collaborators to manage the program, which pairs blockchain applications with relevant regulators for private consultations designed to navigate legal obstacles.

In an interview with Cointelegraph, Marjolein Geus, a partner at Bird & Bird, explained that the methodology has demonstrated that regulatory compliance doesn't have to impede progress.

For use case owners, it helps them better understand the relevant regulations and how those rules apply to their projects. It allows regulators and authorities to deepen their understanding of how those technologies interact with the regulatory frameworks within their areas of competence.

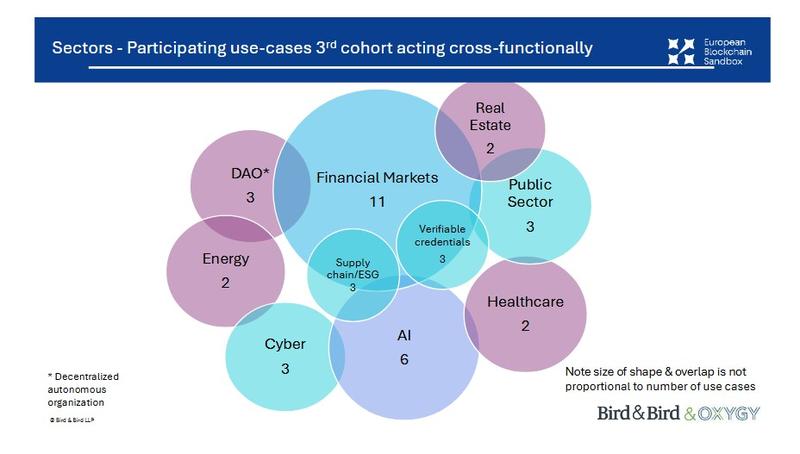

During the most recent cohort, "mature" applications demonstrated growing operational sophistication and integration within industries including energy, healthcare and artificial intelligence, resulting in more nuanced compliance conversations.

How MiCA became a test of regulatory timing for blockchain

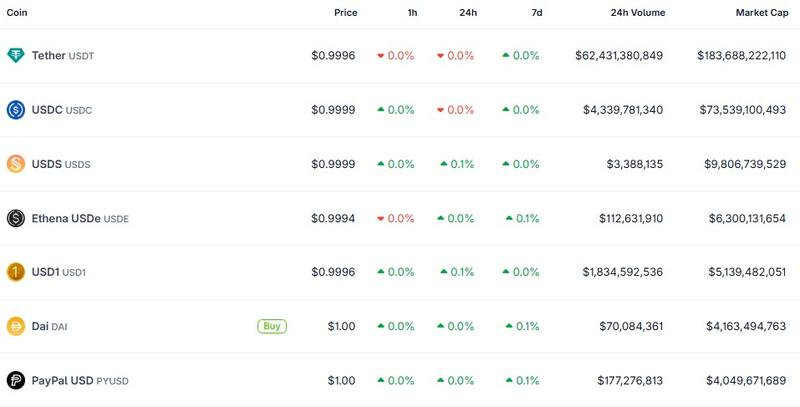

Following the adoption of the Markets in Crypto-Assets Regulation (MiCA), industry commentators expressed concerns that stringent requirements would create obstacles for emerging companies. Stablecoin regulations attracted especially close examination after Tether — the company behind the world's leading stablecoin — chose not to pursue MiCA authorization for USDt (USDT).

The talent migration debate existed well before cryptocurrency emerged. European entrepreneurs have frequently chosen to establish their companies in regions viewed as offering more lenient regulatory environments.

Comparable concerns emerged when the General Data Protection Regulation (GDPR) became enforceable in 2018. Organizations voiced frustrations about interpretive ambiguity and compliance costs. Some international companies reduced their European operations. Nevertheless, GDPR has subsequently evolved into an international benchmark, with numerous multinational corporations adapting their processes to meet its requirements.

The critique that Europe "regulates first and innovates later" is grounded in the notion that legal frameworks should emerge after market evolution. MiCA received approval before the cryptocurrency industry achieved widespread institutional adoption. Theoretically, this sequence creates the risk of confining rapidly evolving technologies within inflexible classifications prematurely.

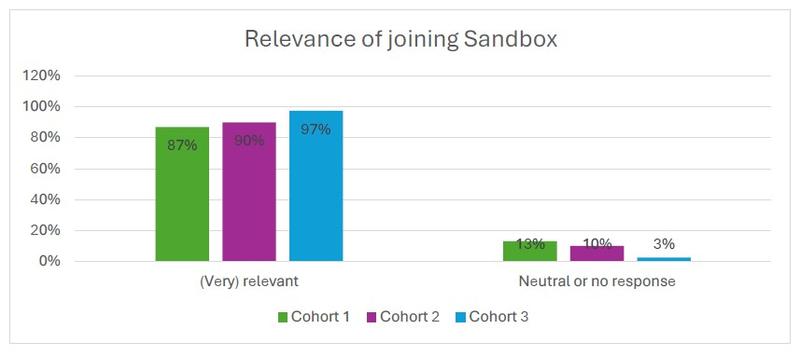

However, the sandbox presented an alternative perspective, indicating that proactive legislation coupled with regulatory engagement can improve transparency and expedite compliance processes. Among third cohort participants, 77% of respondents characterized the sandbox as delivering a crucial or valuable impact on innovation and regulation, with no respondents indicating zero impact.

Where the EU selected early regulatory codification combined with dialogue, the world's largest economy, the US, continues to operate without a unified federal structure for digital assets despite presidential commitments to establish a global hub. Its proposed Digital Asset Market Clarity Act has encountered obstacles after prominent industry stakeholders retracted their endorsement due to specific provisions, including limitations on stablecoin yield.

Smart contracts and the limits of decentralization

Although the best practices report encompasses more than 20 chapters covering numerous regulatory areas, its segments addressing smart contracts and decentralization concentrate on the architectural aspects of blockchain systems at both the code and governance layers.

Virtually all blockchain DLT use cases use smart contracts. They are subject to regulation, with security requirements often relevant, as well as obligations under the GDPR.

Marjolein Geus, Bird & Bird

The consultations investigated how these contracts interface with current EU regulatory structures, extending beyond just MiCA. Based on their operational purpose and the level of authority maintained by identifiable parties, smart contracts may activate requirements spanning from cybersecurity source code audits to operational resilience evaluations and conformity attestations.

The question then becomes how to ensure those smart contracts are secure and GDPR compliant and how to test whether they meet the applicable regulatory frameworks. That is an area where further clarification, harmonization and standardization are needed.

Marjolein Geus, Bird & Bird

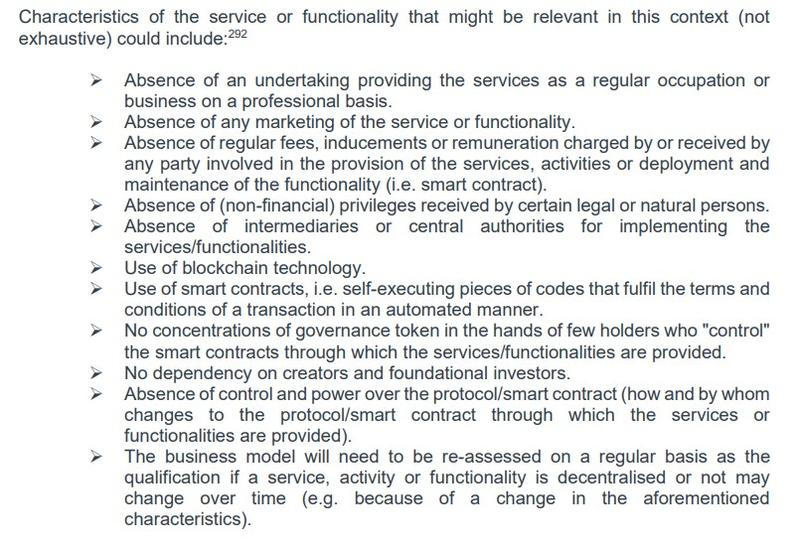

An additional emphasis within the third cohort report centers on the classification of services delivered "in a fully decentralized manner without any intermediary" according to MiCA.

MiCA references the term "fully decentralized" but doesn't define it.

Similar to smart contracts, establishing full decentralization within Europe necessitates additional regulatory guidance. The report made an effort to establish evaluation criteria within the constraints of how MiCA and the Markets in Financial Instruments Directive are organized.

These include identifiable fee recipients or entities capable of modifying the protocol, which may suggest the existence of an intermediary. Where such influence exists, MiCA is likely to apply, and authorization as a crypto service provider may be required.

Crypto in Europe's legal architecture

The European Blockchain Regulatory Sandbox's participation neither implies legal endorsement or regulatory approval nor does it grant derogations from applicable law.

During the third cohort, discussions progressively incorporated horizontal legislation including the GDPR and the Data Act. Projects underwent evaluation not as standalone cryptocurrency trials, but as integrated digital infrastructures interacting with financial, cybersecurity and data governance regulatory structures.

Johannes Wirtz, partner at Bird & Bird's finance regulation group, observed that regulators involved in the dialogues demonstrated deeper familiarity with crypto than expected.

This was actually something which surprised me in certain regards because you always had this assumption that they are more or less bound to the old world, but they have their innovation departments, which are really good at identifying the issues.

Johannes Wirtz, Bird & Bird

While initial critiques of European regulatory strategy presumed that legislation would limit experimentation, Bird & Bird representatives maintained that organized dialogue provides clarity regarding how regulatory boundaries function in practical application.