ETH Price Eyes $2.5K Milestone Driven by Staking ETF Debut and Real-World Asset Expansion

Major university endowments pivot toward Ethereum, BlackRock introduces staking ETF product, while Ethereum's leadership in real-world asset tokenization attracts traditional finance capital.

Key takeaways:

- Elite institutional funds are demonstrating a sentiment change toward ETH by moving capital away from Bitcoin into Ether-based ETF products.

- The ETH ETF from BlackRock combines reliable staking mechanisms with an attractive 0.25% fee structure, marking a significant advancement for crypto's mainstream accessibility.

- Ethereum's commanding position in the $20 billion real-world asset tokenization market demonstrates that institutional capital values network reliability above transaction cost efficiency.

Since Jan. 31, Ether (ETH) has struggled to break back above the $2,500 threshold, prompting market participants to wonder what catalyst could drive sustained upward momentum. Market observers are seeking concrete evidence of improving sentiment conditions; in the meantime, three separate developments may indicate the conclusion of the downward trend that reached its lowest point at $1,744 on Feb. 6.

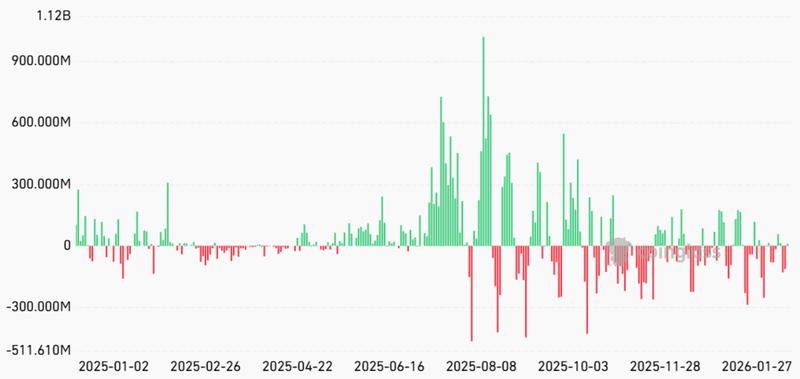

On the surface, February's $327 million net withdrawal from spot Ether exchange-traded funds (ETFs) appears somewhat troubling. The seeming absence of institutional demand while ETH trades 60% beneath its historical peak might suggest doubt about the sustainability of the $1,800 support zone. Nevertheless, these withdrawals account for under 3% of total assets under management across Ether ETF products.

New Ether ETF developments could provide upward price momentum

Although market participants presently concentrate nearly entirely on immediate flow patterns, the significance of recent Ether ETF advancements will ultimately translate into positive ETH price action. During bearish market conditions, favorable announcements are frequently disregarded or minimized, yet strategic initiatives from the planet's largest asset management firms can rapidly transform investor risk assessment.

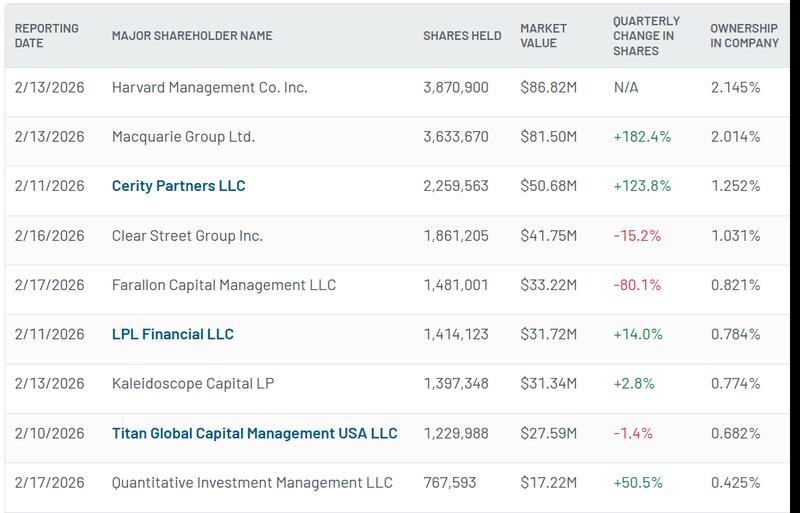

Fresh filings with the US Securities and Exchange Commission disclosed on Monday that Harvard's endowment fund established an $87 million stake in BlackRock's iShares Ethereum Trust throughout the fourth quarter of 2025. Notably, this expression of confidence coincided with Harvard decreasing its iShares Bitcoin Trust allocation to $266 million, a reduction from $443 million in September 2025.

Simultaneously, BlackRock modified its Staked Ethereum ETF filing on Tuesday to specify an 18% retention of aggregate staking rewards designated as service fees. Although certain market observers have critiqued the substantial fee structure, the ETF provider needs to reimburse intermediary services like Coinbase for staking operations. Additionally, the comparatively modest 0.25% expense ratio continues to represent a favorable development for the broader industry.

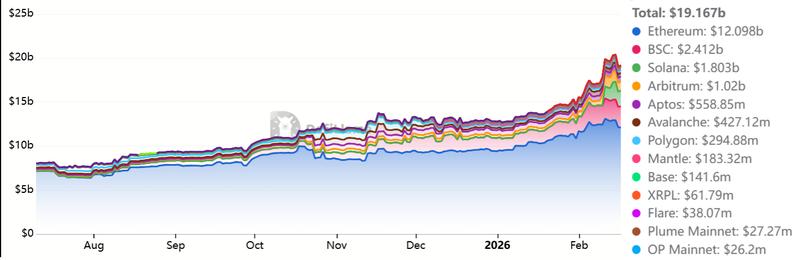

The third indication demonstrating expanding institutional acceptance resides in real world asset (RWA) tokenization, a category that has exceeded $20 billion in total assets. Ethereum maintains its position as the undisputed frontrunner, supporting products from BlackRock, JPMorgan, Fidelity, and Franklin Templeton. This convergence of blockchain technology and conventional finance has the potential to generate persistent demand for ETH.

Approximately half of the $13 billion in RWA holdings on Ethereum consists of tokenized gold products, although capital deployed in US Treasurys, bonds, and money market instruments expanded to a notable $5.2 billion. In contrast, the aggregate RWA offerings on BNB Chain and Solana total $4.2 billion—a compelling demonstration that institutional investors prioritize security considerations over transaction cost optimization.

While RWA providers presently concentrate on restricted ecosystems utilizing proprietary decentralized finance liquidity pools or dedicated layer-2 solutions, intermediary platforms will inevitably establish connections with the wider Ethereum infrastructure. The recent $650 million funding round secured by crypto venture capital firm Dragonfly Capital reflects robust demand for tokenized equity and private credit products.

Instead of allocating resources to layer-1 blockchain networks and consumer-oriented decentralized applications, capital providers are channeling investments toward RWA infrastructure development, institutional-grade custody solutions, and professional trading platforms—an unmistakable indication of industry maturation. While the timeframe for these transformations to influence Ether's market value remains uncertain, these developments unmistakably suggest that a recovery toward $2,500 in the immediate future represents a realistic possibility.