BTC tumbles below $70K amid Iran crisis despite Strategy's $168M purchase

The leading cryptocurrency kicks off the traditional finance trading week in the United States with a liquidity sweep beneath $67,000 during a comprehensive risk-asset selloff.

The price of Bitcoin (BTC) slipped beneath the $67,000 threshold during Tuesday's opening hours on Wall Street as risk-oriented assets reacted to fresh geopolitical tensions.

Key points:

- The leading cryptocurrency follows equities in a geopolitically-influenced downturn as the US traditional finance trading week commences.

- Buy-side liquidity experiences compression while the BTC price continues trading within its established range.

- Strategy's latest addition to its Bitcoin holdings provided no support for those bullish on the cryptocurrency.

Geopolitical turmoil in Iran maintains downward pressure on Bitcoin

Information from TradingView revealed that BTC price experienced daily losses exceeding 3.8% on the Bitstamp exchange.

The flagship cryptocurrency along with alternative digital assets participated in a downturn alongside American equities at the commencement of the week's initial United States trading session due to market anxiety surrounding military exercises conducted by Iran in the Strait of Hormuz — a critical passageway for oil transportation.

Diplomatic discussions between the United States and Iran, which Tehran characterized as "serious and constructive," wrapped up approximately during the same timeframe.

Both the S&P 500 and Nasdaq Composite Index experienced declines of up to 1.25% during the period under review, whereas the price of gold retreated to lows of $4,842 per ounce.

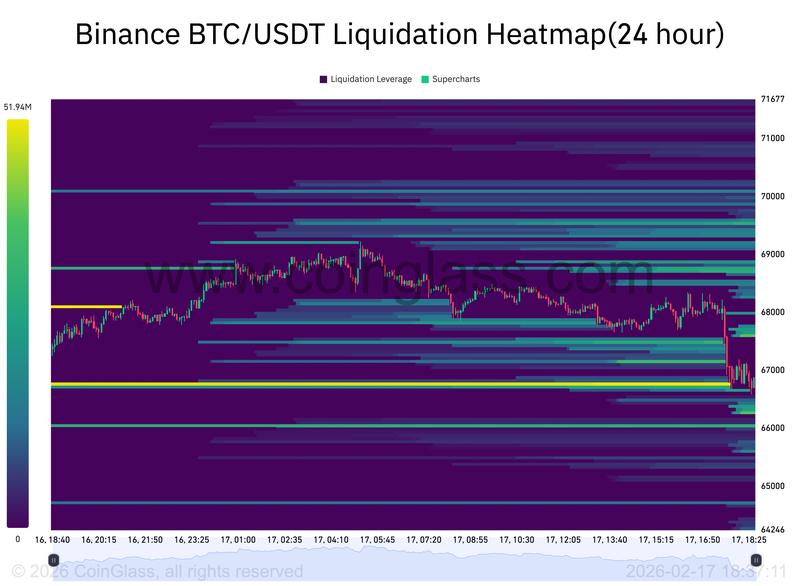

When examining the exchange liquidity environment throughout the day, the X commentary account Exitpump was among market observers anticipating a sweep of the range's lower bounds for the BTC/USD trading pair as the next move.

"Really huge bids are still sitting there in the spot orderbooks around 60K level," the account observed regarding information from both the Binance and Coinbase trading platforms.

Information provided by the monitoring resource CoinGlass demonstrated the price cutting through adjacent bid liquidity throughout the descent.

During the previous day, liquidity dynamics constituted the primary driver of price swings for Bitcoin, with both bullish and bearish positions facing elimination.

"Nothing special on $BTC," cryptocurrency trader, analyst and entrepreneur Michaël van de Poppe offered as his assessment.

"It's stuck in a range and simply consolidating, through which it's a waiting game until volatility slows down and the expansion is about to game."

Kevin O'Leary reiterates concerns about quantum computing threat to Bitcoin

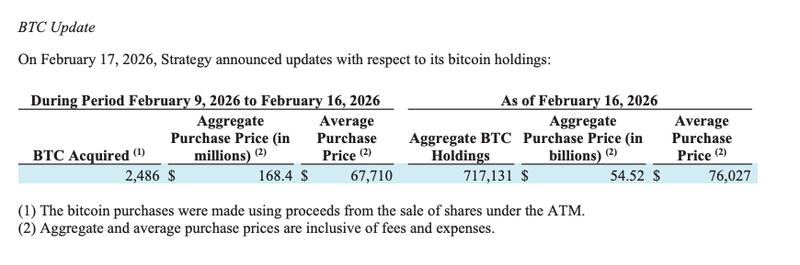

Reports that Strategy, the corporation maintaining the world's most substantial Bitcoin corporate treasury, had acquired approximately 2,500 BTC during the preceding week, did not succeed in influencing market sentiment.

According to confirmation provided by CEO Michael Saylor, the total Bitcoin holdings of Strategy increased to 717,131 BTC, with the company's average acquisition cost basis sitting just above $76,000.

During the same period, blockchain data monitored possible capital withdrawals from the United States spot Bitcoin exchange-traded funds (ETFs).

Over the weekend, Kevin O'Leary, Shark Tank cohost and venture capitalist, informed mainstream media outlets that the potential risk of quantum computing breaking Bitcoin's security framework was deterring institutional investors.

"I'm still long this, but there's a new concern floating around for 10% of the people out there: quantum, the idea that a quantum computer can break the chain," he said in an interview on FOX News.

According to O'Leary, potential investment exposure was being limited to 3% of institutional portfolios due to this concern.