Bitcoin price movements primarily linked to T-bill issuance, new analysis reveals

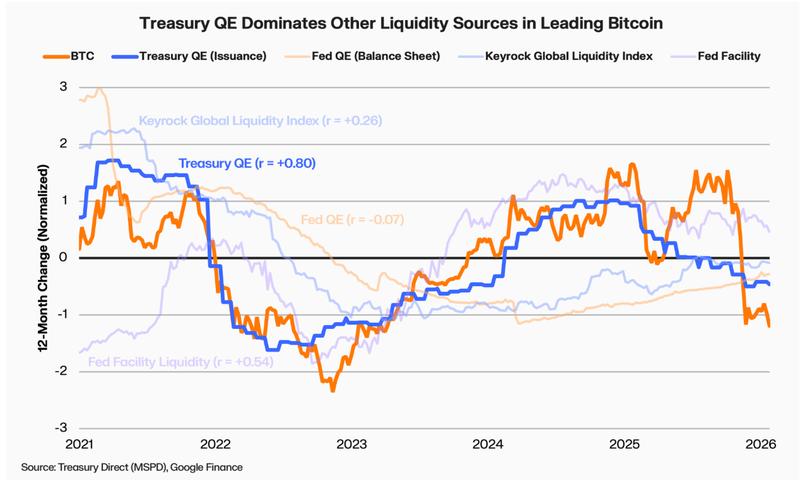

Keyrock's latest analysis reveals that freshly injected capital doesn't uniformly affect risk assets, depending on the channels through which new liquidity enters the economic system.

The dominant liquidity indicator influencing Bitcoin's (BTC) valuation is the issuance of Treasury bills rather than the balance sheet adjustments of the Federal Reserve or other central banking institutions, a recent analysis from cryptocurrency investment firm and market maker Keyrock has determined.

A 1% shift in worldwide liquidity metrics translates to a 7.6% movement in BTC's valuation during the subsequent business quarter following the introduction of new capital. That said, liquidity doesn't influence risk asset valuations uniformly across different sources, noted Keyrock researcher Amir Hajian.

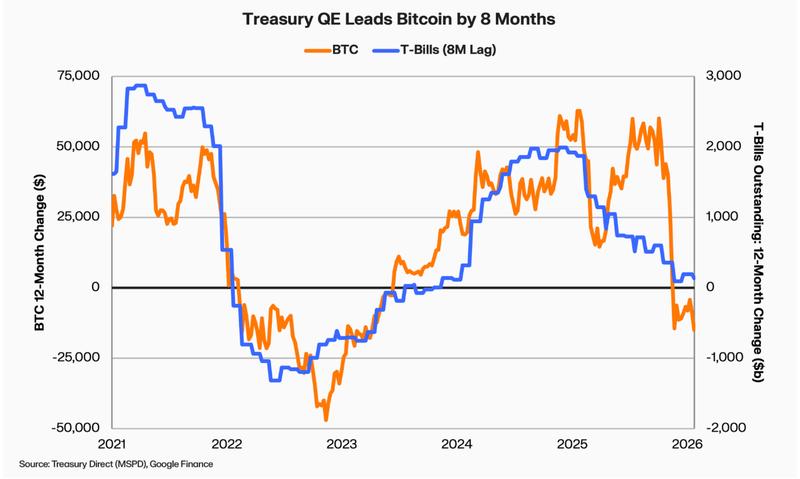

Since 2021, the correlation between Treasury bill issuance and BTC valuations stands at approximately 80%, with this particular metric serving as a leading indicator for BTC prices by roughly eight months, the analysis shows. The researcher explained:

"When the Treasury ramps up Treasury bill issuance, it is financing spending that flows into the real economy, and eventually into risk assets like Bitcoin. When Treasury bill issuance falls or turns negative, that fiscal tailwind fades."

Throughout history, increasing net treasury bill issuance has demonstrated a predictive statistical correlation with Bitcoin performance gains," the analysis added.

Notwithstanding this strong correlation, the involvement of institutions and exchange-traded funds (ETFs) has reduced Bitcoin's responsiveness to liquidity dynamics by approximately 23%.

The research challenges the commonly held belief that the Federal Reserve's interest rate policies serve as the main liquidity driver affecting risk asset valuations and projects that worldwide liquidity conditions will influence BTC valuations during the latter part of 2026 and the beginning of 2027.

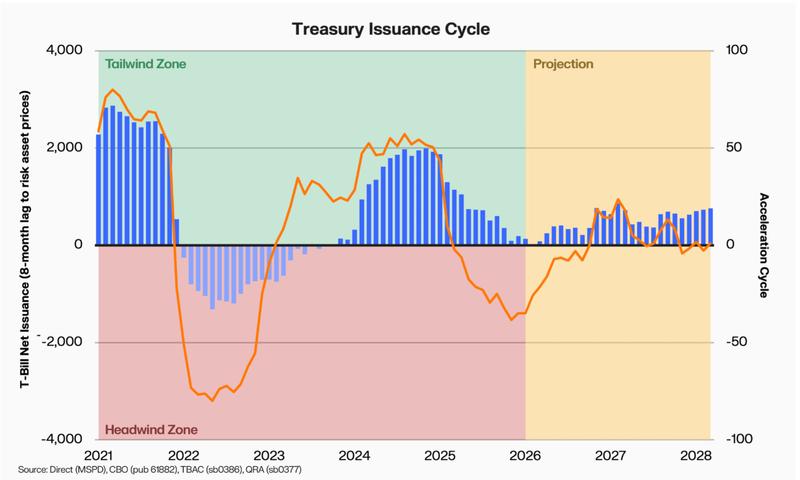

Looming wall of US debt maturity means more liquidity is coming

Worldwide liquidity stands at an "inflection" juncture, according to Keyrock's analysis, which notes that a substantial portion of the $38 trillion US national debt is reaching maturity within the coming four years.

As a result, the US Treasury will be required to refinance this obligation at elevated interest rates, despite much of it having been originally financed during a period of near-zero interest rates.

The United States will probably increase Treasury bill issuance to facilitate the rollover of this debt, according to the Keyrock analyst.

"T-bill issuance is projected to reach and sustain $600 billion to $800 billion per year through 2028," the Keyrock report said.