Xapo reports evolution in Bitcoin lending: Users favor extended loan durations over quick cash

Over half of all Bitcoin-collateralized loans at Xapo during 2025 featured maximum 365-day durations, signaling extended financial planning strategies among wealthy clientele.

Loans backed by Bitcoin at Gibraltar-headquartered Xapo Bank are progressively serving long-term wealth management strategies instead of immediate liquidity requirements, the institution's 2025 Digital Wealth Report reveals.

In findings provided exclusively to Cointelegraph, the report indicates that 52% of Bitcoin-collateralized loans originated by Xapo throughout 2025 featured 365-day durations, with a substantial portion of these loans continuing to remain active despite a deceleration in new loan origination during the year's latter months.

The financial institution, whose client base consists predominantly of private banking customers and individuals with significant net worth, indicated this pattern demonstrates clients utilizing Bitcoin as security to access liquidity while maintaining their long-term cryptocurrency positions, as opposed to utilizing loans for immediate, temporary financial requirements.

Long-term Bitcoiners, many of whom are now holding the majority of their wealth in Bitcoin, finally felt comfortable taking some profit. At the same time, the underlying conviction didn't waver. Most of our long-term members continued to hold the bulk of their Bitcoin through periods of heavy market movement.

These findings emerge from Xapo's inaugural full calendar year of providing its Bitcoin-collateralized lending service, which permits eligible customers to obtain US dollar loans secured against their Bitcoin assets. The data provides insight into how Bitcoin functions within regulated financial frameworks as effective collateral incorporated into extended financial planning strategies.

From launch narrative to observed behavior

The Bitcoin-backed USD loan product debuted at Xapo on March 18, 2025, with a focus on serving Bitcoin holders committed to long-term positions who required liquidity without divesting their digital assets.

During the launch phase, the institution framed the offering as a prudent alternative to previous cryptocurrency lending frameworks, providing loan durations extending to 365 days alongside comparatively conservative loan-to-value ratios.

In prior statements to Cointelegraph, Xapo Bank CEO Seamus Rocca explained that increasing confidence surrounding Bitcoin's extended-term prospects was motivating holders to pursue borrowing strategies rather than liquidating their holdings, representing a transition from speculative short-term trading toward more sustained financial planning.

The findings contained in the 2025 report demonstrate that this anticipated behavior has become observable reality. Despite a moderation in new loan origination activity as the year progressed, total outstanding loan balances experienced continued expansion, demonstrating that borrowers maintained their loans actively rather than utilizing them merely for temporary liquidity access.

According to Rocca's commentary in the report, this behavioral pattern exemplifies "disciplined, private-bank-style financial behaviour," where members leverage Bitcoin as productive financial capital rather than employing it solely as a mechanism for short-term liquidity access.

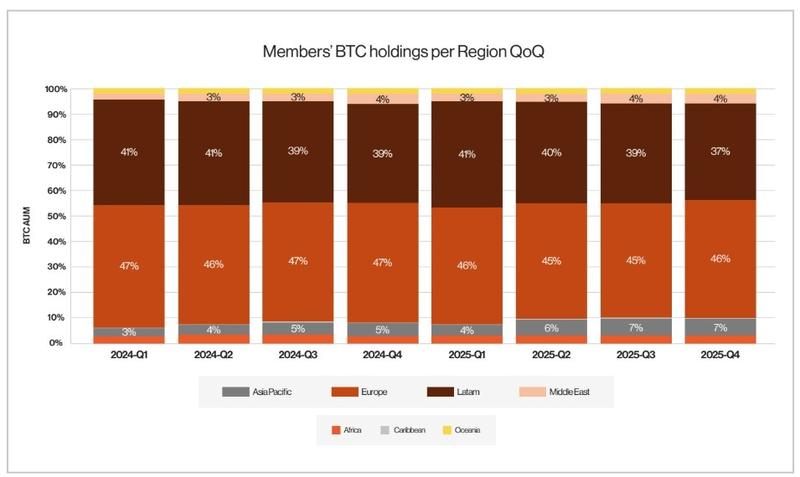

Geographic distribution of loan activity shows strong regional concentration, particularly in Europe and Latin America. Data from Xapo Bank reveals these two regions collectively represented 85% of aggregate loan volume, with Europe accounting for 56% and Latin America contributing 29% respectively.