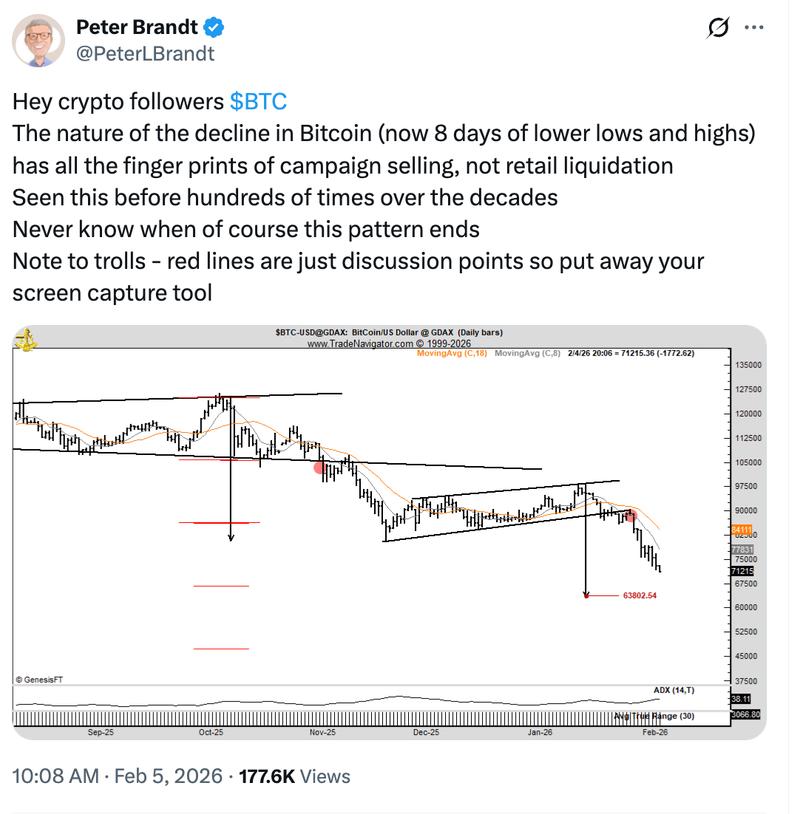

Veteran Trader Warns of 'Campaign Selling' as Bitcoin Could Plunge Below $64K

Sustained selling pressure from cryptocurrency miners and spot Bitcoin ETFs threatens to push BTC lower amid an ongoing bearish trend.

The price of Bitcoin (BTC) experienced a dramatic decline of over 22.5% during the last seven days, reaching $69,000 on Thursday and completely erasing gains accumulated over the previous 15 months. According to seasoned trader Peter Brandt, this downward trend could continue further.

Key takeaways:

- Brandt identifies "campaign selling" as a major factor pressuring BTC, with both miners and ETFs reducing their holdings.

- A possible support zone exists around $54,600–$55,000.

A potential 10% further decline looms as miners and ETFs reduce Bitcoin holdings

The recent BTC decline has created a pattern of consecutive daily lower highs alongside lower lows. In essence, the absence of even minor price recoveries indicates that very few market participants are currently interested in purchasing during the dip.

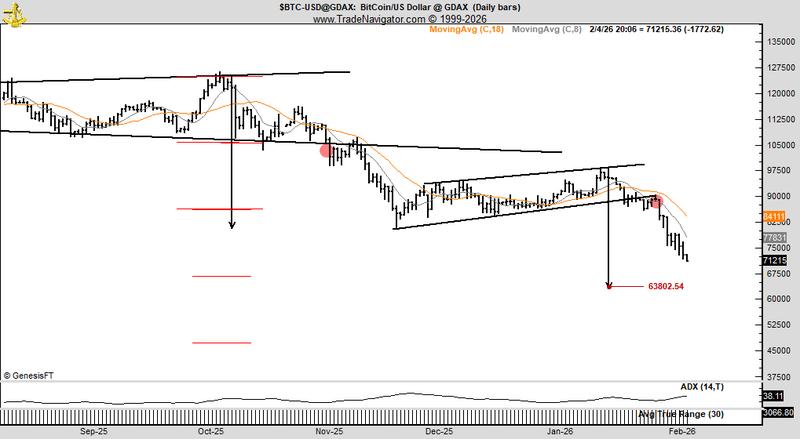

According to Brandt, this pattern bears the "fingerprints of campaign selling," which represents intentional, prolonged distribution by major institutional players rather than panic selling by retail investors.

Blockchain data corroborates Brandt's analysis. As an example, on Thursday, the metric tracking BTC miner net position change revealed a distinct transition toward net distribution during January, with mining operations persistently depositing additional BTC into the marketplace.

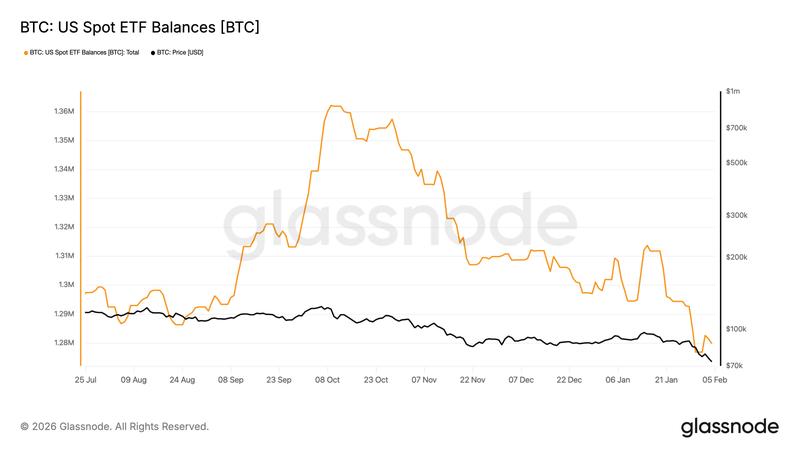

United States spot Bitcoin ETFs have similarly decreased their holdings, with net BTC balances declining to 1.27 million BTC by Wednesday, down from 1.29 million at the year's start.

Additionally, the Coinbase premium, which serves as an indicator of institutional participation, dropped to its lowest point of the year.

This widespread distribution has increased the probability of Bitcoin reaching the bear flag pattern target of approximately $63,800, representing a 10% decline from present price levels, as illustrated in the chart below based on Brandt's technical analysis.

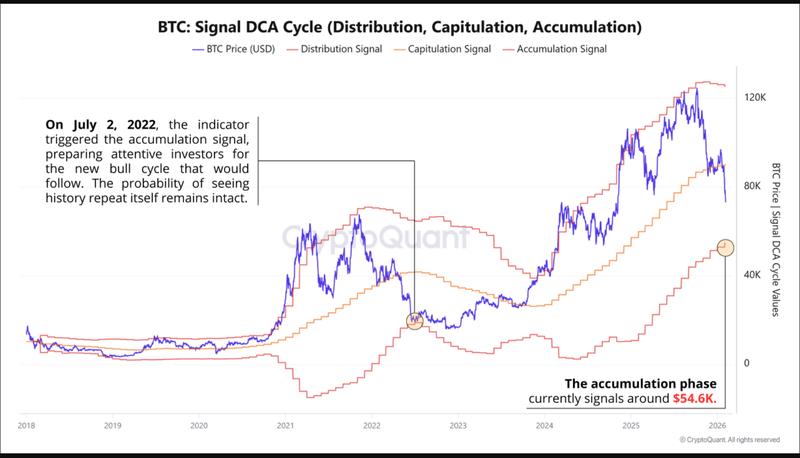

Potential Bitcoin bottom could form below $55,000

According to onchain analyst GugaOnChain, Bitcoin faces the possibility of an even deeper decline toward $54,600 as institutional selling pressure persists.

This downside projection corresponds with the lower zone (red) shown in the BTC DCA Signal Cycle metric presented below. This particular zone represents Bitcoin's one-week to one-month realized price and serves to identify time periods when BTC becomes structurally undervalued.

During 2022, the signal shifted to bullish as BTC dropped beneath the identical red zone around $20,000, establishing a bottom near that level before subsequently rallying to exceed $30,000 within a year.

GugaOnChain stated:

"The current price convergence toward the band signaling the start of the accumulation phase, situated around $54.6K, suggests we are in the critical transition between Capitulation and Accumulation."

In the meantime, a separate analysis points to a potential accumulation opportunity developing after July 2026, drawing on historical lag patterns between expanding credit spreads and Bitcoin market bottoms.