US Dollar Faces Potential 10% Plunge if Federal Reserve Exceeds Rate Cut Expectations, State Street Cautions

According to State Street analysts, the greenback risks dropping to its lowest levels in years should the Federal Reserve pursue more aggressive interest rate reductions, potentially driving investment flows into Bitcoin and other higher-risk assets.

Market strategists from State Street, which ranks among the globe's most prominent asset management firms, have indicated that the US dollar's most challenging period in close to ten years could intensify should the Federal Reserve implement monetary policy easing beyond current market projections, a scenario that appears increasingly plausible given potential changes in the central bank's leadership structure.

During remarks delivered at a Miami conference, Lee Ferridge, a strategist with State Street, projected that the greenback might experience a drop of up to 10% throughout this year should financial conditions become looser. Though he characterized two interest rate reductions as a "reasonable base case," Ferridge cautioned that probability favors additional cuts. "Three is possible," Ferridge stated.

Reduced interest rates in the United States typically diminish the attractiveness of assets denominated in dollars, particularly among international investors. When rate differentials become narrower, foreign investors show greater inclination to expand their currency hedging activities, a process that requires selling dollars to safeguard their investment returns. This heightened hedging activity can intensify downward momentum on the currency.

The potential weakening of the dollar might also be connected to Kevin Warsh, whom US President Donald Trump has nominated to replace Jerome Powell in the position of Fed chair. Should his confirmation proceed, Warsh is broadly anticipated to support a more vigorous timeline for implementing rate reductions.

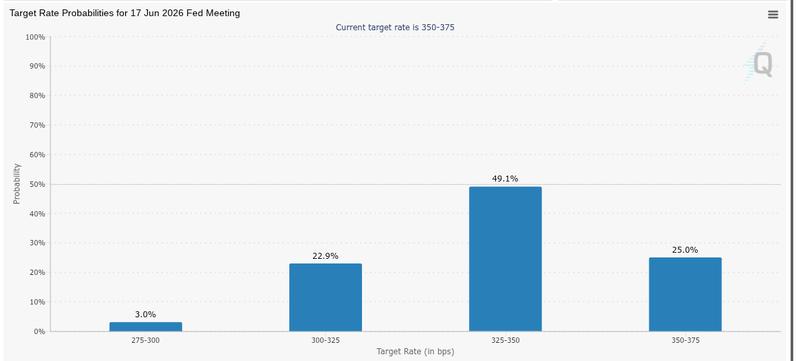

Given the central bank's present target rate corridor of 3.50%-3.75%, market participants currently align with the more conservative outlook. Based on data from CME Group's FedWatch Tool, market participants are anticipating two rate reductions throughout this year, with the initial cut probably occurring in June. Two policy-setting meetings are on the calendar prior to that date.

Diminished dollar strength viewed as potential trigger for Bitcoin rally

A declining US dollar has frequently aligned with increased appetite for risk-oriented assets, encompassing Bitcoin (BTC) and additional digital currencies. Market analysts routinely highlight a negative correlation between the US Dollar Index and Bitcoin, with intervals of dollar depreciation generally establishing more conducive conditions for cryptocurrency valuations.

A depreciating dollar has the capacity to relax financial conditions, enhance worldwide liquidity and direct investors toward assets perceived as substitutes for traditional fiat currencies. This market dynamic has provided support for Bitcoin throughout multiple previous episodes of dollar depreciation.

Nevertheless, this correlation is not guaranteed or mechanical. Contemporary market analysis indicates that Bitcoin's near-term price action has not reliably mirrored dollar weakness, and during certain intervals, cryptocurrency prices have actually declined in tandem with the greenback's descent.

Factors including profit-taking behavior, investor portfolio positioning, wider risk appetite sentiment and ambiguity surrounding monetary policy direction can all moderate the influence of currency fluctuations.