Solana Token Plunges to $95 Amid Broader Market Selloff in Bitcoin, AI Equities and Precious Metals: Dip-Buying Opportunity?

Solana's native token reaches its lowest point since April 2025, though the disconnect between price and underlying fundamentals coupled with macro market correlations could offer optimism for market participants.

Key takeaways:

- Solana's native token dropped to 2026 lows amid technology sector workforce reductions and mounting concerns over artificial intelligence revenue projections.

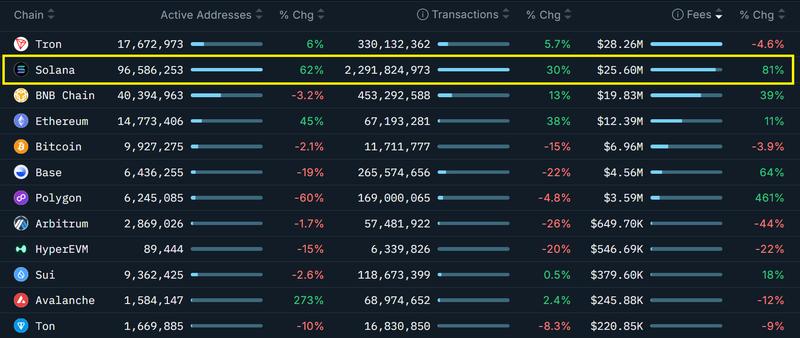

- Notwithstanding the bearish market conditions, Solana maintained its competitive edge with network fees surging 81%, cementing its second-place position.

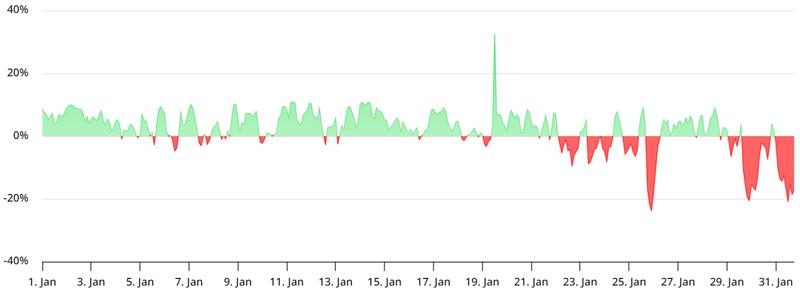

The native token of the Solana blockchain, SOL, experienced a decline to $100.30 during Saturday's trading session, marking the token's weakest performance since April 2025. Although the 18% price decline across the 30-day period caught market participants off guard, the price action predominantly reflected wider trends observed in the broader altcoin market capitalization. An abrupt 26% collapse in silver valuations on Friday subsequently led cryptocurrency market participants to prepare for potential further downward movement.

The SOL token managed to recover above the $102 threshold on Saturday, though market sentiment continued to deteriorate following the forced liquidation of $165 million worth of leveraged long positions. Market mood further soured as geopolitical tensions surrounding Iran intensified and economic recession fears mounted after Amazon (AMZN US) revealed plans to eliminate 16,000 white-collar positions on Wednesday.

Market participants became increasingly risk-averse after discovering that OpenAI represented 45% of Microsoft's (MSFT US) Azure cloud computing order backlog. Further anxiety emerged from a Wall Street Journal publication indicating that Nvidia (NVDA US) would withdraw its planned $100 billion investment in OpenAI. The company behind ChatGPT is projected to experience $14 billion in net losses throughout 2026, based on reporting from The Information.

Notwithstanding the challenging socio-political landscape, onchain activity metrics for Solana have exceeded those of competing blockchain networks, strengthening its position as the second-ranked network by both fee generation and Total Value Locked (TVL). Robust onchain performance metrics deliver dual advantages for the native token: they boost staking yields to encourage long-term token retention while generating consistent demand for transaction processing fees.

Network fees generated on Solana increased by 81% beyond the average trend during the most recent 30-day period, based on data from Nansen. Furthermore, active wallet addresses expanded by 62%, while total transactions climbed to 2.29 billion. By contrast, the entire Ethereum ecosystem—incorporating layer-2 scaling solutions—recorded a combined 623 million transactions, whereas Ethereum's base layer fees expanded by a modest 11%. Solana maintained its dominant position in decentralized application (DApp) usage.

Appetite for leveraged long positions on SOL evaporated as market participants retreated to cash holdings and short-duration government securities. Several multi-billion dollar technology corporations, including Unity (U US), AppLovin (APP US), Figma, and HubSpot (HUB US), experienced price declines exceeding 30% within the 30-day timeframe. Even gold, traditionally regarded as a safe-haven asset, declined 13% from its all-time peak of $5,600 achieved on Thursday.

The annualized funding rate for SOL perpetual futures contracts dropped to -17%, indicating that short sellers (bearish traders) are compensating to maintain their positions. This market condition is atypical, typically proves unsustainable, and reflects an extreme absence of leverage demand from bullish traders. This development occurred simultaneously with political disagreements concerning United States government funding legislation.

Congressional approval for a funding package was secured by the US Senate on Friday, accompanied by a two-week interim measure to provide additional time for resolving government funding disagreements over Department of Homeland Security appropriations following Democratic opposition to immigration enforcement policies. The US House of Representatives is scheduled to conduct a vote on the final legislative version on Monday.

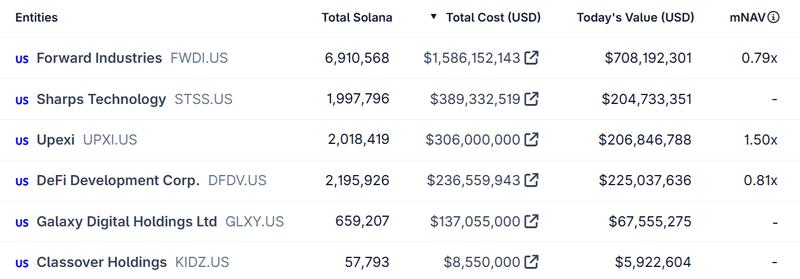

Exchange-traded funds (ETFs) holding Solana experienced net capital outflows totaling $11 million on Friday, based on data compiled by CoinGlass. Concurrently, publicly-traded corporations employing SOL as part of their treasury reserve strategies face mounting pressure. Stock valuations for Forward Industries (FWDI US), Upexi (UPXI US), and Sharps Technology (STSS US) traded at discounts of 20% or greater relative to their respective net asset values.

The trajectory for SOL to restore bullish price momentum hinges predominantly on the restoration of confidence in worldwide economic expansion and diminished socio-political uncertainties, which may not emerge in the immediate timeframe.