Social welfare programs ready for blockchain distribution, says compliance expert

Governments in Hong Kong, Thailand, and the Marshall Islands are testing blockchain-based social benefit distribution and tokenized government debt.

According to Julie Myers Wood, CEO of Guidepost Solutions, a consulting firm specializing in compliance and monitoring, blockchain infrastructure offers an efficient platform for managing social benefit programs, though significant compliance hurdles persist.

The Republic of the Marshall Islands' government received advisory services from Guidepost Solutions regarding regulatory compliance and a sanctions framework for the USDM1 bond, which represents a tokenized government debt instrument with 1:1 backing by short-term US Treasuries.

In November 2025, the Marshall Islands government initiated a Universal Basic Income (UBI) program delivering quarterly benefit payments to citizens via a mobile wallet interface. In her conversation with Cointelegraph, Wood stated:

Any benefit that is currently being distributed through analog means should be explored for a digital delivery option for several reasons. Digital delivery speeds up the process and can provide an auditable trail for provisioning and expenditures.

Multiple governments are experimenting with tokenized debt instruments and blockchain-based social benefit program administration to remove settlement delays and expensive transaction costs that are built into traditional finance through disintermediation of the issuing and clearing mechanisms.

Sanctions compliance and regulatory challenges persist amid expanding tokenized bond market

Tokenized bonds and other blockchain-based instruments provide cost reduction benefits and nearly instantaneous settlement capabilities that democratize financial system access for people without access to conventional banking services.

Wood explained to Cointelegraph that anti-money laundering (AML) requirements and sanctions compliance represent two of the most significant regulatory challenges for governments that issue onchain bonds to citizens.

According to Wood, governments that issue tokenized bonds must additionally gather know-your-customer (KYC) data to verify that resources reach their intended beneficiaries.

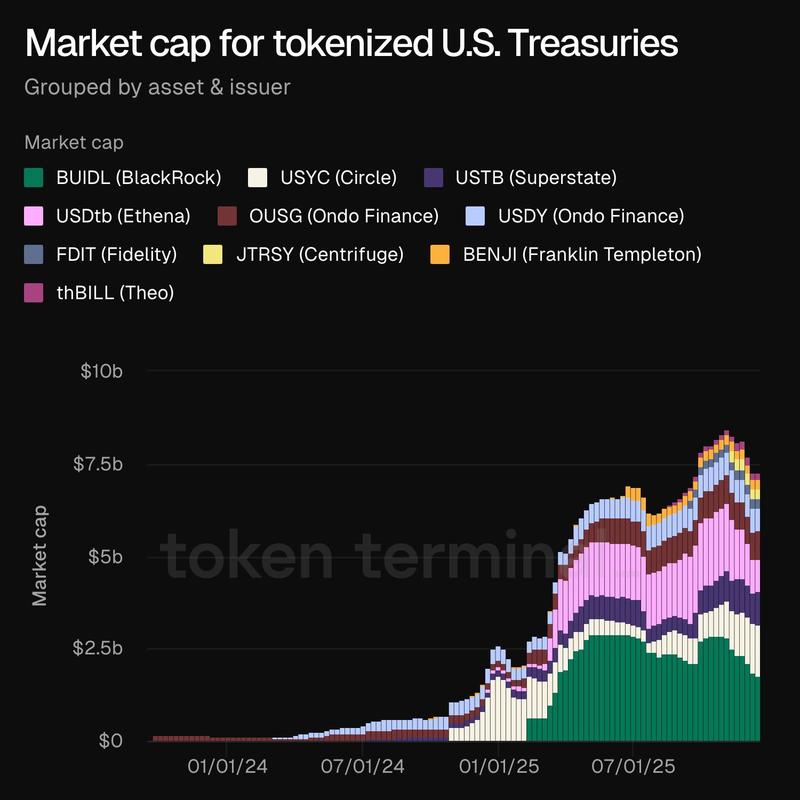

Data from Token Terminal, a crypto analysis platform, indicates that the tokenized US Treasury market experienced growth exceeding 50x since 2024.

Lamine Brahimi, co-founder of Taurus SA, a digital asset services company focused on enterprise clients, has projected that the tokenized bond market may climb to $300 billion.

According to Brahimi's comments to Cointelegraph, decreased settlement times, lower transaction costs, and asset fractionalization—which enables individuals to buy fractional portions of financial assets—collectively broaden investor participation in the global financial system.