Retail Crypto Traders Attempting to 'Meta-Analyze' Market Downturn, Santiment Reports

According to Santiment, the growing frequency of the term 'capitulation' appearing in crypto social media discussions may indicate the market has already reached its bottom.

According to crypto sentiment tracking platform Santiment, retail market participants are carefully examining the cryptocurrency markets for indicators that a bottom may have formed, attempting to determine optimal timing for purchasing additional digital assets.

"Retail traders are trying to meta-analyze the market, looking for signs of others quitting to time their own entries, which often happens near bottoms," Santiment said in a report on Saturday.

According to data from the platform, Santiment has connected this phenomenon to the term "capitulation," which has emerged as one of the most frequently discussed cryptocurrency-related words across social media platforms.

This particular term refers to the phenomenon of investors liquidating their positions based on concerns that the market will fail to rebound, a situation that market analysts commonly track when evaluating whether a market floor has been established.

Santiment suggests "capitulation" may be behind us

"If everyone is waiting for 'capitulation,' the bottom might have already happened while they were waiting for a clearer sign," Santiment said.

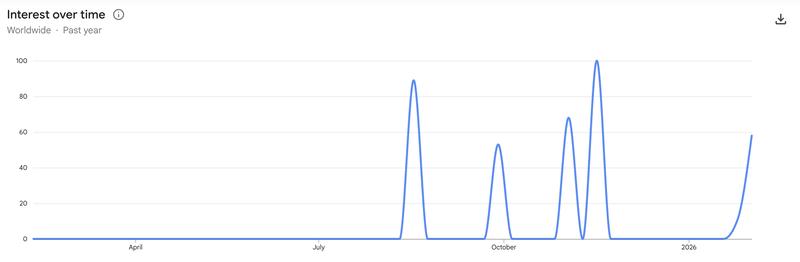

At the same time, information from Google Trends indicates that search queries for "crypto capitulation" have climbed from an index score of 11 to 58 during the period spanning the weeks that concluded on Feb. 1 and Feb. 8.

Cryptocurrency market participants are typically hesitant to declare a market floor prematurely. Historical patterns demonstrate that valuations can continue declining even after the majority of observers believe the downturn has concluded.

Market analyst Caleb Franzen said in an X post on Saturday that while capitulation is the "word of the week," many investors don't understand that "bear markets typically experience multiple capitulation events."

This development occurs as Bitcoin's (BTC) price declined to a low of $60,000 on Thursday, representing a price point not witnessed since October 2024, during its current downward trajectory.

Certain analysts express doubt about the "cycle bottom"

Crypto analyst Ted said in an X post on Friday that "yesterday's dump looks like capitulation, but it's not the cycle bottom."

Expressing a comparable viewpoint, crypto analyst CryptoGoos said, "We haven't seen true Bitcoin capitulation so far."

During the previous 30 days, Bitcoin has experienced a decline of 24.27%, with trading activity at $68,970 at the time of publication, according to CoinMarketCap.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, fell further into the "Extreme Fear" territory on Sunday, with a score of 7, signaling extreme caution among investors.