Research Reveals Community Banks Losing Deposits to Coinbase Platform

Transaction data from 92 regional banking institutions shows $78.3 million in net outflows to Coinbase during a 13-month period, with money market accounts experiencing the largest withdrawals.

Recent research from banking analytics firm KlariVis has revealed that 90% of community banks included in their analysis had account holders conducting transactions with Coinbase. Among 53 financial institutions where the flow of funds could be tracked, the data showed $2.77 moving toward the cryptocurrency platform for every $1.00 coming back, creating a net deposit exodus of $78.3 million during a 13-month timeframe.

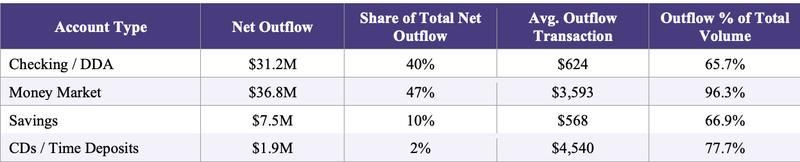

The research examined 225,577 transactions linked to Coinbase across 92 community banking institutions and discovered that fund movements were predominantly concentrated in money market accounts, where 96.3% of traceable transaction activity consisted of deposits departing banks for the cryptocurrency exchange.

"In general, community banks can be defined as those owned by organizations with less than $10 billion in assets," the Federal Reserve says on its website.

According to KlariVis, if the trends identified in their sample are representative of the broader market, more than 3,500 out of approximately 3,950 community banks nationwide could be experiencing comparable customer behavior related to Coinbase fund transfers.

The 53 banks with directional information ranged in size from $185 million to $4.5 billion in total deposits, with smaller banking institutions demonstrating greater relative vulnerability. Among banks holding less than $1 billion in deposits, approximately 82% to 84% of transactions involving Coinbase consisted of outgoing funds, while banks exceeding $1 billion saw roughly 66% to 67% outflows.

Among these financial institutions, aggregate outflows totaled $122.4 million versus $44.2 million in deposits returning. The typical outbound transaction measured $851, whereas incoming transfers averaged $2,999 but happened with considerably less frequency.

Money market deposit accounts were responsible for $36.8 million of the total net exodus, with mean transfer amounts reaching $3,593, substantially exceeding the size of checking account transactions.

Regional banks collectively maintain approximately $4.9 trillion in customer deposits and provide funding for roughly 60% of small business loans below $1 million and 80% of loans to agricultural operations, the report states, suggesting that continued deposit displacement could impact the availability of credit at the local level.

Applying academic research indicating that smaller banks typically decrease lending by approximately $0.39 for each $1 reduction in deposits, KlariVis calculated that the $78.3 million net withdrawal could result in roughly $30.5 million in diminished lending capability.

CLARITY Act stalled by debate over stablecoin yield

This research emerges amid ongoing discussions among the US Congress, traditional banks and cryptocurrency-focused firms regarding the CLARITY Act, legislation designed to establish the regulatory structure for digital asset markets and settle whether crypto platforms and stablecoin intermediaries should be permitted to provide yield on customer deposits.

Although the GENIUS Act, which became law in July 2025, prohibits stablecoin issuers from directly paying interest, it does not prevent third-party intermediaries like Coinbase from providing yield on stablecoin holdings, a distinction that has emerged as a significant source of conflict between traditional financial institutions and cryptocurrency enterprises.

In August, Banking groups, led by the Bank Policy Institute, urged lawmakers to address what they describe as a "loophole" in the law, warning that allowing exchanges to offer indirect yield could accelerate deposit outflows, disrupt credit flows and shift up to $6.6 trillion from the traditional banking system.

Last month, Bank of America CEO Brian Moynihan echoed that sentiment, saying interest-bearing stablecoins could draw up to $6 trillion from the US banking system, citing US Treasury-backed research suggesting deposits could migrate if issuers are allowed to pay yield.

In contrast, Coinbase CEO Brian Armstrong has strongly opposed limitations on stablecoin rewards. In January, he withdrew support for a version of the bill, writing on X: "We'd rather have no bill than a bad bill." He raised several concerns about the draft, one of which was that it would eliminate stablecoin yield and protect banks from competition.

Notwithstanding the continuing friction between traditional banks and cryptocurrency firms, US Senator Bernie Moreno stated on Wednesday he believes the CLARITY Act could move forward through Congress by April. Prediction marketplace Polymarket currently shows an 83% chance that the legislation will be signed into law this year.