Netherlands Parliament Approves Divisive 36% Taxation Proposal

A legislative measure imposing a 36% tax on liquid financial assets, regardless of whether they're liquidated, has successfully passed through the Dutch Parliament's lower house.

On Thursday, the Dutch House of Representatives moved forward with a controversial legislative measure that would establish a 36% capital gains tax on savings accounts and the majority of liquid investment vehicles, cryptocurrencies included.

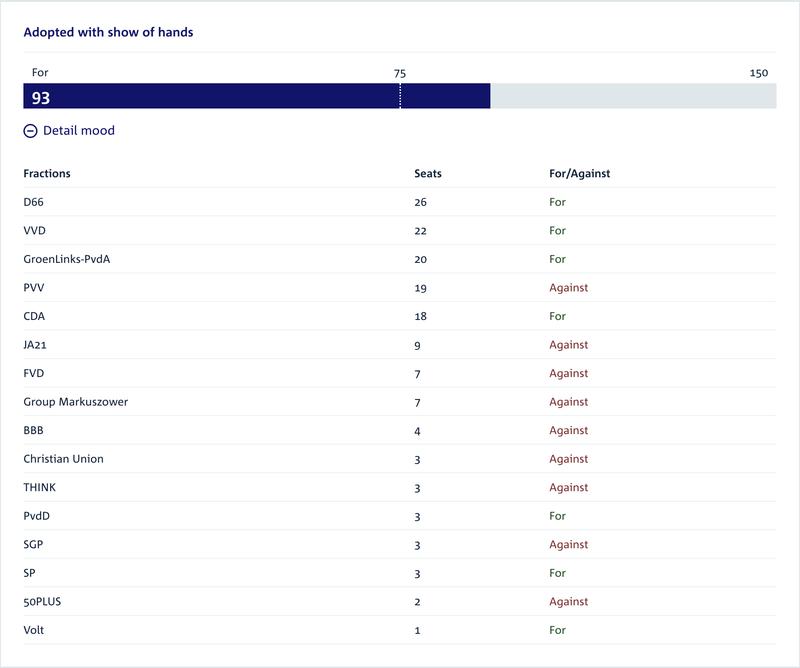

According to the official House count, the legislation successfully surpassed the required 75-vote minimum needed for advancement, securing support from 93 members of parliament.

The proposed legislation stipulates that savings accounts, digital currencies, the majority of stock investments, and profits derived from interest-generating financial products would all fall under the taxation scheme, irrespective of whether these holdings are liquidated or remain in possession.

Investors say the tax is out of touch and will backfire

"France did this in 1997 and saw a massive exodus of entrepreneurs leaving the country,"Denis Payre, co-founder of logistics company Kiala said.

Crypto market analyst Michaël van de Poppe said the proposal is

"the dumbest thing I've seen in a long time."

"The number of people willing to flee the country is going to be bananas,"he added, echoing the calls of other industry analysts and executives.

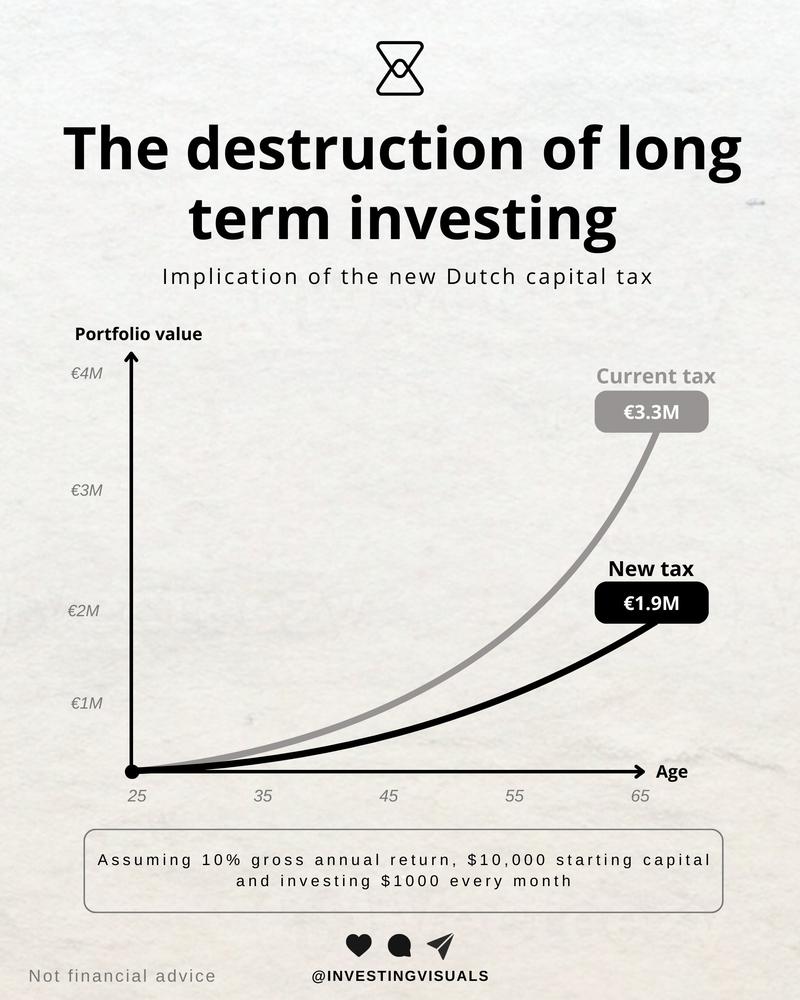

According to calculations from Investing Visuals, an individual investor beginning with 10,000 euros ($11,871) and making monthly contributions of 1,000 euros throughout a 40-year period would accumulate approximately 3,320,000 euros at the conclusion of those four decades.

Yet with the implementation of the new 36% taxation policy, that same investment strategy would yield only about 1,885,000 euros after the same 40-year timeframe, representing a shortfall of 1,435,000 euros, as reported by Investing Visuals.

Technology industry leaders and cryptocurrency executives based in the United States expressed comparable reservations regarding California's proposed wealth tax targeting billionaires. That particular proposal detailed a 5% tax on an individual's net worth above the $1 billion threshold, igniting a torrent of backlash and tech entrepreneurs announcing that they were leaving the state of California.