Market Experts Detail Why XRP Could Potentially Fall Under $1 Threshold

Trading at $1.40, XRP displayed mounting bearish signals, with technical analysis pointing to the possibility of prices dropping beneath the $1 mark in upcoming weeks.

The cryptocurrency XRP (XRP) has pulled back approximately 63% from its recent multi-year peak of $3.66, settling at $1.36 during Wednesday's trading session. This technical configuration could carry bearish consequences for the token's valuation, a market analyst has indicated.

Key takeaways:

- Trading beneath the $1.40 threshold, XRP exhibited bearish characteristics, with technical chart patterns suggesting a potential decline toward the $0.70-$1 range.

- Continuous inflows into spot XRP ETFs, accumulation by large holders, and increased active addresses might nullify the negative price outlook.

What level could represent XRP's price floor?

Through a Tuesday publication on X, analyst Chart Nerd indicated that historical patterns from the monthly Gaussian Channel indicator point to the possibility of XRP experiencing additional downside pressure throughout the forthcoming weeks or months.

As a technical analysis tool, the Gaussian Channel serves to identify trending movements, pinpoint potential areas of support and resistance, along with overbought and oversold market conditions.

The analysis chart demonstrates that following each rally in XRP's price action, corrections have occurred that retested the upper regression band of the Gaussian Channel, presently positioned at $1.16.

Based on historical precedent, such movements have resulted in three to four months of "further decline towards the middle regression band of the Gaussian Channel before marking a foundation and continuing the trajectory higher," according to the analyst, who further stated:

"The middle regression band currently ties up around $0.70, which is also a previous year-long resistance level seen back in 2023/2024, and hasn't been backtested for support."

According to Chart Nerd's assessment, this bearish scenario would be confirmed should XRP's price breach the local lows of $1.12, a level that was touched on Friday.

In the meantime, market analyst Crypto Patel suggested that although a decline to the $1 level could offer an attractive entry point for those looking to buy XRP, the "best accumulation zone" might actually be found at lower levels between $0.50-$0.70.

"Currently, XRP/USDT is ~70% down from the recent ATH. After a historical 96% drawdown from $3.28 to $0.1050 in 2018," experiencing a similar magnitude of crash is "unlikely," the technical analyst noted, further explaining:

"A corrective retracement below $1 remains possible."

According to previous reporting by Cointelegraph, the likelihood of XRP declining below the $1 threshold grew after the price encountered resistance at the 200-week moving average near $1.40.

Are there positive indicators for XRP's price rebound?

Notwithstanding XRP's price vulnerability, institutional interest and accumulation by whales has persisted.

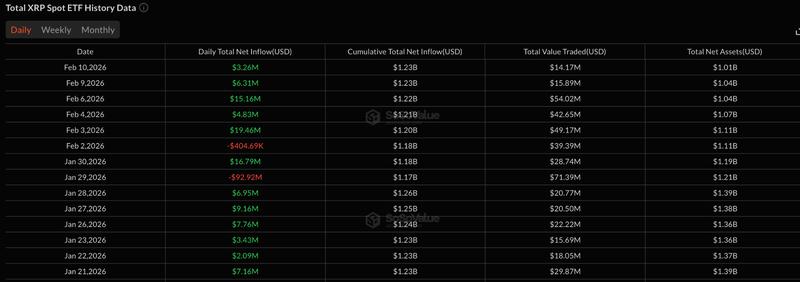

Since their introduction in late 2025, spot XRP exchange-traded funds have accumulated $1.23 billion in cumulative net inflows. Tuesday's $3.26 million in inflows represented the fifth straight day of positive flows, pushing total assets under management to $1.01 billion.

"Institutional demand and XRP ETF inflows continue, with persistent spot ETF net inflows highlighting institutional confidence," market trader Levi commented in a recent X platform post.

The most recent price recovery for XRP, climbing to $1.50 from the $1.12 low, occurred while market participants debated whether the digital asset would break below the $1 level, according to market intelligence platform Santiment in a recent X post.

Bulls can also find encouragement in the fact that large holders accumulated positions during the price decline, as transactions exceeding $100,000 in XRP surged to four-month highs, reaching 1,389.

The count of active addresses on the XRP Ledger "suddenly ballooned to 78,727 in just one 8-hour candle — the highest in 6 months," according to Santiment, which further stated:

"These are both major signals of a price reversal for any asset."