IREN and CleanSpark Mining Stocks Tumble Following Disappointing Financial Results

Mining stocks in the cryptocurrency sector experienced widespread losses on Thursday, coinciding with a nearly 9% drop in total crypto market valuation.

Stock prices for cryptocurrency mining firms IREN and CleanSpark experienced significant drops on Thursday following quarterly earnings reports that failed to meet Wall Street's projections, compounded by Bitcoin's downward trajectory that prompted investors to adopt a risk-averse stance.

Bitcoin (BTC) experienced a 12% decline during the previous 24-hour period, momentarily dropping to a low point of $60,000 in the early hours of Friday. At the same time, the overall cryptocurrency market capitalization decreased by nearly 9%, based on data from CoinMarketCap.

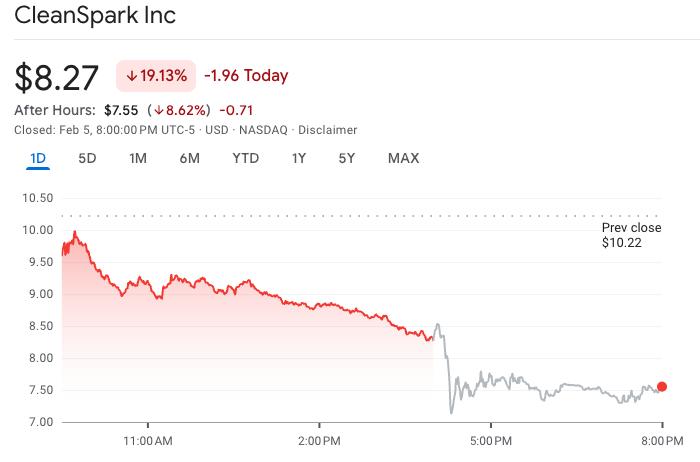

CleanSpark (CLSK) experienced the steepest decline among the miners, ending Thursday's trading session down 19.13% before dropping an additional 8.6% in after-hours trading to reach $7.55, following the release of quarterly results for the period ending Dec. 31 that fell short of what analysts had anticipated.

In its Thursday announcement, CleanSpark disclosed that quarterly revenues for the period ending Dec. 31 totaled $181.20 million, falling short of the analyst consensus estimate of $186.66 million by approximately 2.9%.

CleanSpark misses earnings, but eyes AI as profit booster

According to analysts from Zacks, the diminished mining rewards that resulted from the Bitcoin halving event in April 2024 probably contributed to "lower mining efficiency" and consequently may have "constrained profit" throughout this timeframe.

The company disclosed a net loss of $378.7 million, representing a dramatic year-over-year reversal when compared to the net profit of $246.8 million that was reported during the corresponding period in 2024.

Gary Vecchiarelli, who serves as CleanSpark's chief financial officer and president, emphasized that the company is "no longer a single-track business," highlighting its strategic pivot toward artificial intelligence as a mechanism for enhancing profitability.

Bitcoin mining generates the cash flow, AI infrastructure monetizes the assets over the long term, and our Digital Asset Management function optimizes capital and liquidity across cycles.

Gary Vecchiarelli, CleanSpark CFO and President

IREN shares fall on earnings miss

IREN Ltd, a company that has transitioned its primary operations away from Bitcoin mining toward the provision of AI infrastructure, similarly failed to meet earnings expectations on Thursday, with stock prices ending the trading day down 11.46% before declining an additional 18.5% during after-hours trading to reach $32.42.

The company disclosed revenues totaling $184.69 million for the final quarter of 2025, falling short of Wall Street's projections by 16.49%. IREN recorded a net loss of $155.4 million, representing a stark contrast to the net income of $384.6 million reported during the comparable quarter from the previous year.

Additional prominent cryptocurrency mining stocks experienced substantial losses on Thursday as well, with RIOT Platforms (RIOT) declining 14.71% and MARA Holding (MARA) dropping 18.72%, based on data from Google Finance.

Given that Bitcoin's price has decreased 29% during the preceding 30-day period, investor sentiment throughout the cryptocurrency market has plummeted to depths not witnessed in several months.

On Friday, the Crypto Fear & Greed Index dropped to a reading of 9 out of 100, marking its lowest level since the aftermath of the Terra ecosystem collapse that occurred in mid-2022.