Institutional crypto adoption gains momentum as BlackRock ventures into DeFi: Finance Redefined

Major cryptocurrencies showed modest gains despite significant ETF withdrawals, as BlackRock made its DeFi debut and Binance finalized its billion-dollar Bitcoin reserve transition.

The world's largest asset manager, BlackRock, took its inaugural step into the decentralized finance ecosystem during the past week by introducing its tokenized Treasury fund to Uniswap, even as Bitcoin and Ether managed only limited price recoveries against a backdrop of substantial ETF capital outflows.

Over the seven-day period, both Bitcoin (BTC) and Ether (ETH) experienced approximately 2.5% price increases, yet neither digital asset succeeded in breaking through significant psychological price thresholds amid contradictory exchange-traded fund (ETF) movement patterns and cryptocurrency investor confidence declining to unprecedented lows.

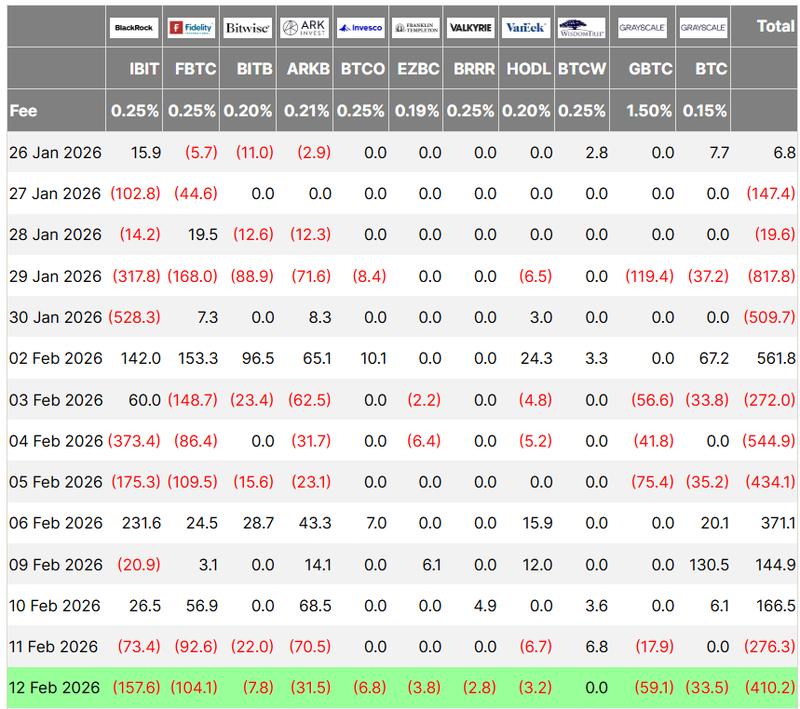

The week began with Bitcoin ETFs recording capital inflows for two straight days, though this positive trend rapidly shifted course with outflows totaling $276 million on Wednesday, followed by an even larger $410 million exodus on Thursday.

A comparable pattern emerged in Ether ETFs, which witnessed two days of relatively small inflows before experiencing withdrawals of $129 million on Wednesday and an additional $113 million on Thursday, based on information from Farside Investors data.

Offering a potentially positive perspective on the recent market correction, Bitcoin's steep decline to the $59,930 level could represent an important "halfway point" within the ongoing bear market phase, placing markets at a crucial juncture that may determine whether the traditional four-year cycle theory remains applicable, according to analysis from Kaiko Research.

Notwithstanding the declining valuations across the cryptocurrency sector, major financial institutions are persistently investigating cryptocurrency integration opportunities, most notably the planet's biggest asset management firm, BlackRock, which revealed its initial venture into decentralized finance (DeFi) on Wednesday.

BlackRock ventures into DeFi space, leverages Uniswap for institutional token transactions

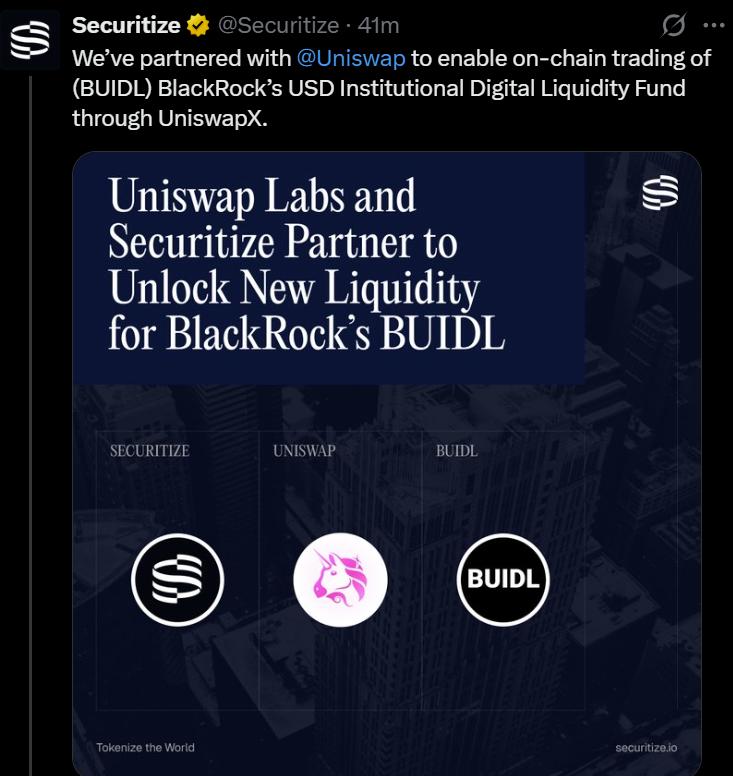

The investment management powerhouse BlackRock is taking its inaugural formal step into the decentralized finance landscape by deploying its tokenized US Treasury fund onto Uniswap, representing a significant milestone for institutional integration with DeFi platforms.

Based on an announcement made Wednesday, BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) will receive a listing on the Uniswap decentralized trading platform, enabling institutional market participants to execute purchases and sales of the tokenized financial instrument.

As an additional component of this partnership, BlackRock is also acquiring an unspecified quantity of Uniswap's native governance token, UNI, the announcement revealed.

This cooperative effort is being orchestrated through tokenization platform Securitize, which previously collaborated with the global asset management leader on BUIDL's initial launch.

Based on reporting from Fortune, trading activities will commence with a restricted group of qualified institutional participants and market makers prior to a more extensive rollout.

"For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,"

Carlos Domingo, Securitize CEO

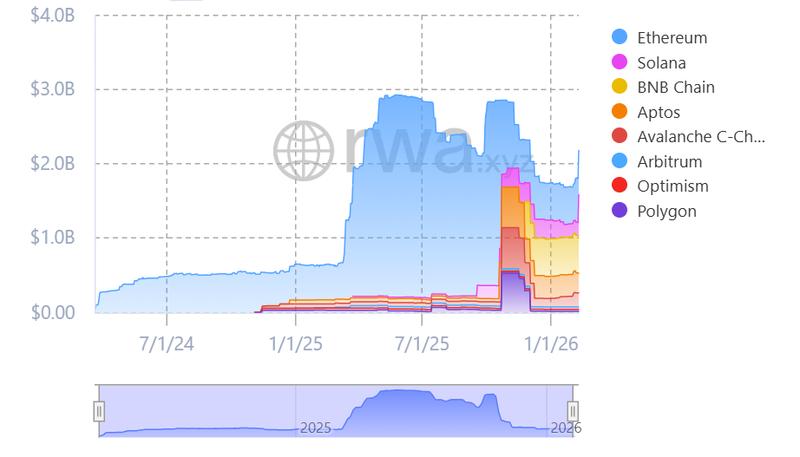

BUIDL currently holds the position as the largest tokenized money market fund globally, managing in excess of $2.18 billion in aggregate assets, per statistics gathered by RWA.xyz. The fund maintains issuance across several blockchain networks, encompassing Ethereum, Solana, BNB Chain, Aptos and Avalanche.

During December, BUIDL achieved an important benchmark, crossing the $100 million threshold in total cumulative distributions generated from its Treasury position holdings.

Trump family's WLFI announces FX and remittance platform plans: Report

World Liberty Financial (WLFI), a decentralized finance (DeFi) ecosystem supported by the family of US President Donald Trump, revealed on Thursday plans to introduce foreign currency exchange (FX) and remittance capabilities for platform users.

The forthcoming foreign exchange and remittance infrastructure, designated as World Swap, aims to compete with conventional remittance and FX service companies by offering reduced fees combined with a more streamlined user experience, based on Reuters reporting.

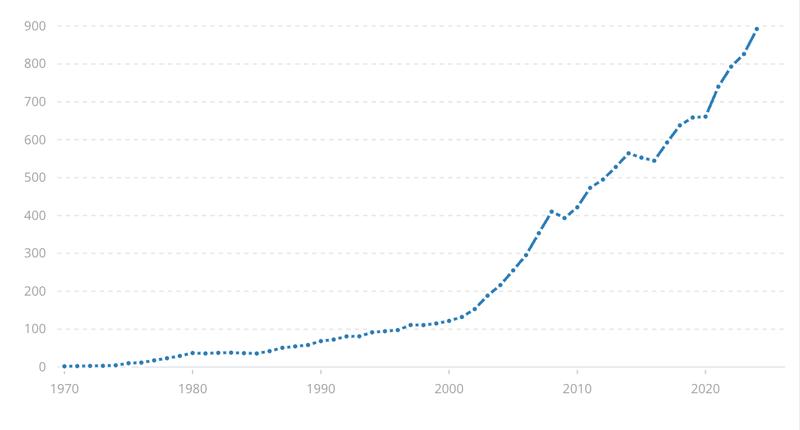

Global FX trading activity on a daily basis exceeded $9.6 trillion during April 2025, per a publication from the Bank for International Settlements (BIS), while the international personal remittances sector surpassed $892 billion in yearly volume throughout 2024, according to statistics from the World Bank.

A specific timeline for the platform's deployment was not provided. Cointelegraph contacted World Liberty Financial for additional details but had not obtained a reply before publication.

This expansion into foreign exchange and remittance services comes after WLFI's submission for a national trust bank charter during January and the introduction of World Liberty Markets, a lending service platform, as WLFI proceeds with its growth trajectory while facing examination from Democratic legislators in the United States.

Uniswap secures preliminary victory as US judge dismisses Bancor patent lawsuit

A federal judge in New York dismissed a patent infringement legal action initiated by entities affiliated with Bancor against Uniswap, determining that the patents in question claim abstract concepts and do not qualify for protection under United States patent legislation.

Through a memorandum opinion and order issued on Tuesday, Judge John G. Koeltl of the US District Court for the Southern District of New York approved the defendant's request to dismiss the complaint submitted by Bprotocol Foundation and LocalCoin Ltd. against Universal Navigation Inc. and the Uniswap Foundation.

The court determined that the patents address the abstract concept of calculating cryptocurrency exchange rates and consequently do not satisfy the two-step examination for patent eligibility defined by the US Supreme Court.

This decision represents a procedural victory for Uniswap, though it does not constitute a final resolution. The case received dismissal without prejudice, providing the plaintiffs with a 21-day window to submit an amended complaint. Should no amended complaint be forthcoming, the dismissal will transform into one with prejudice.

Following the court's decision, Uniswap founder Hayden Adams posted on X, "A lawyer just told me we won."

"Uniswap Labs has always been proud to build in public — it's a core value of DeFi. We're pleased that the court recognized that this lawsuit was meritless."

Uniswap Labs spokesperson

Cointelegraph contacted representatives from Bprotocol Foundation seeking commentary but had not received any response by the time of publication.

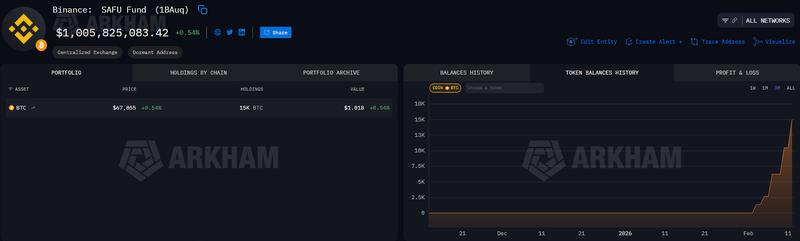

Binance finalizes $1 billion Bitcoin acquisition for SAFU emergency reserve

Binance has successfully completed the $1 billion Bitcoin acquisition for its emergency protection fund, demonstrating its commitment to maintaining Bitcoin as the primary reserve asset.

The cryptocurrency exchange Binance acquired an additional $304 million in Bitcoin (BTC) on Thursday, thereby completing the $1 billion Bitcoin conversion for its Secure Asset Fund for Users (SAFU) wallet, per data from Arkham.

The emergency fund currently maintains 15,000 Bitcoin, valued above $1 billion, purchased at an average aggregate cost basis of $67,000 per individual coin, Binance disclosed in a Thursday X post.

"With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset."

This final tranche of BTC arrived three days following Binance's prior $300 million purchase on Monday.

The trading platform initially disclosed its intention to convert its $1 billion user protection fund into Bitcoin on Jan. 30, originally committing to a 30-day timeframe for the purchases, which ultimately concluded in fewer than two weeks.

The exchange indicated it would execute rebalancing operations for the fund should volatility cause its value to drop below $800 million.

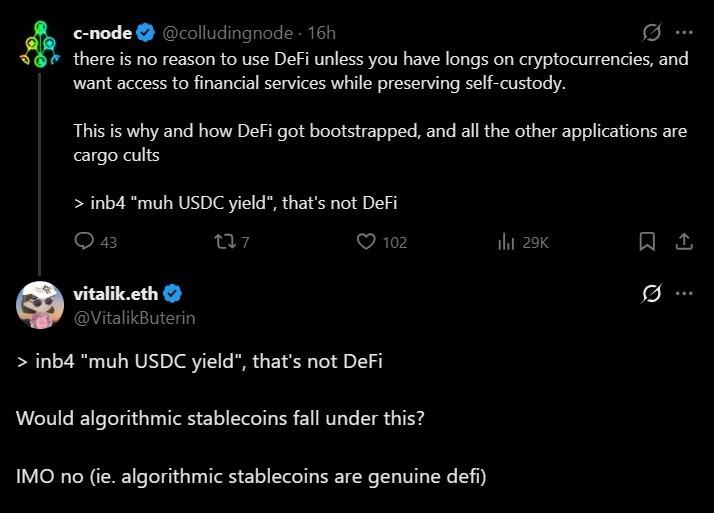

Vitalik distinguishes between "real DeFi" and centralized yield stablecoin products

Ethereum co-founder Vitalik Buterin established a distinct boundary defining what he regards as "real" decentralized finance (DeFi), challenging yield-focused stablecoin approaches that he contends do not genuinely transform risk management.

During a conversation on X, Buterin articulated that DeFi obtains its fundamental value from modifying the allocation and management of risk, rather than merely producing yield on centralized financial instruments.

Buterin's remarks emerge during a period of intensified examination regarding DeFi's predominant applications, especially within lending markets constructed around fiat-backed stablecoins such as USDC (USDC).

Though he refrained from identifying particular protocols, Buterin directed criticism toward what he characterized as "USDC yield" offerings, stating they maintain substantial dependence on centralized issuers while providing minimal reduction in issuer or counterparty risk exposure.

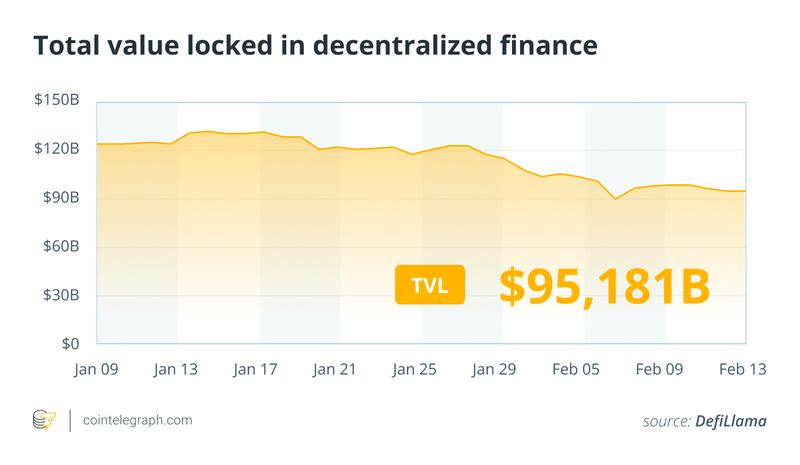

DeFi market analysis overview

Based on statistics from Cointelegraph Markets Pro and TradingView, the majority of the 100 largest cryptocurrencies measured by market capitalization concluded the week posting positive returns.

The Pippin (PIPPIN) token experienced a 195% surge as the week's most substantial gainer among the top 100, with the Humanity Protocol (H) token following behind, advancing 57% throughout the past week.