Historic $10,000 Bitcoin Plunge Sparks Predictions of Multi-Year Recovery to $93.5K

For the first time ever, Bitcoin plummeted over $10,000 within 24 hours, with bear market forecasts suggesting recovery could extend into 2028.

As Friday approached, Bitcoin (BTC) witnessed the liquidation of billions worth of positions, with BTC price movements establishing new bearish milestones.

Key points:

- Bitcoin experiences $2.6 billion in liquidations while recording its inaugural $10,000 red daily candle.

- BTC price movements decline more sharply in percentage terms than any single day witnessed since the 2022 bear market period.

- Projections suggest Bitcoin might not surpass $93,500 again until 2028.

Bitcoin records largest single-day dollar decline in its history

According to data from TradingView, BTC/USD began consolidating following a rebound from $59,930 — marking its initial descent beneath the $60,000 threshold since October 2024.

Persistent downward pressure throughout Thursday's US trading hours ultimately triggered a cascade of liquidations, resulting in $2.6 billion worth of cryptocurrency positions being eliminated within a 24-hour period, according to CoinGlass data.

Market observers in the cryptocurrency space highlighted that the liquidation figure exceeded both the March 2020 COVID-19 market crash and the market's response to the FTX exchange collapse in late 2022.

COVID crash: $1.2B in liquidations. FTX crash: $1.5B in liquidations. Random Thursday (today): $1.7B in liquidations.

— Alex Mason (@AlexMasonCrypto) February 5, 2026

The price movement of Bitcoin also resurrected historical bear-market benchmarks in other respects.

When measured in percentage terms, the daily candle from Thursday represented the most significant daily drop since the FTX disaster — an incident that led to the bear-market bottom of $15,600.

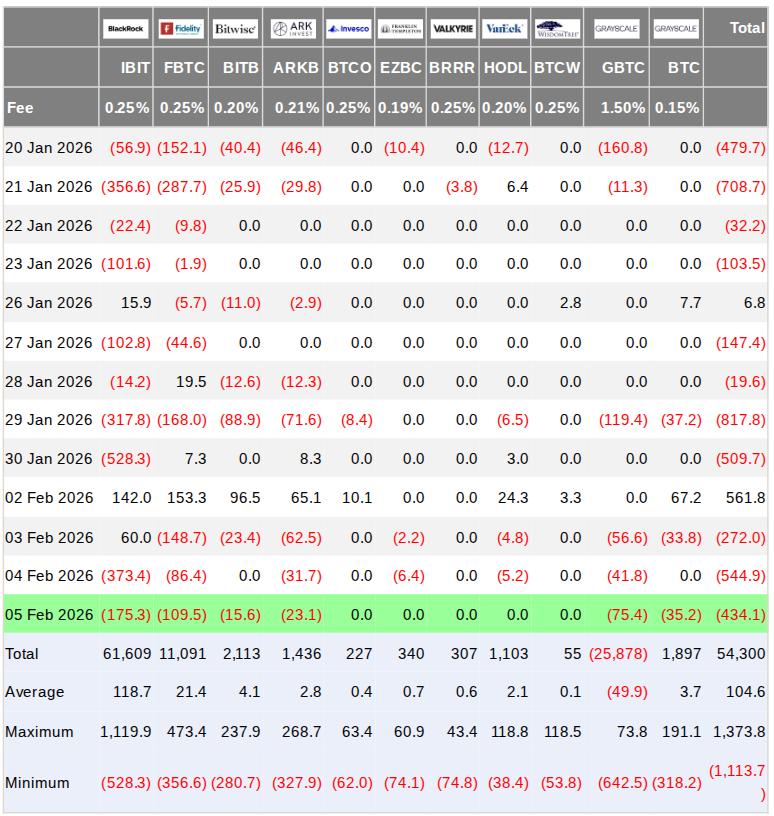

"The ETF holders have never experienced this kind of sell-off," Joe Consorti, head of growth at Bitcoin equity company Horizon, responded on X, referring to institutional investors with exposure to the US spot Bitcoin exchange-traded funds (ETFs).

These ETFs recorded net outflows totaling $434 million on Thursday, based on data from UK-based investment firm Farside Investors.

In the meantime, BTC/USD accomplished an unwelcome new milestone, declining by over $10,000 within a single day for the first time in history.

"Yesterday was the highest volume day on $BTC since August 2024," trader Jelle added.

One for the history books.

BTC price "trend reversal," only in 2028?

Presenting a somber forecast for those bullish on Bitcoin, crypto trader and analyst Rekt Capital indicated that a genuine recovery might not materialize until 2028.

Utilizing the BTC price cycle model as a reference point, including a significant moving average crossover that occurred at the conclusion of January, Rekt Capital anticipates a textbook bear market year throughout 2026.

"Looks like it indeed is the year of the Bitcoin Bear Market," he wrote in an X post.

2027 will be the Bottoming Out year for BTC. And 2028 will be the Trend Reversal year where $93500 would be finally broken.

An additional post cautioned about "bearish acceleration" occurring on BTC/USD, once more replicating patterns observed during the 2022 bear market.

The Bearish Acceleration phase of the Bitcoin cycle is in progress $BTC

— Rekt Capital (@rektcapital) February 5, 2026