ETH plunges 30% to spearhead cryptocurrency market decline: Bottom price targets analyzed

Technical analysis and blockchain data suggest Ether's descent may extend into the $1,000-$1,400 territory as bearish indicators converge.

Over the past week, Ether (ETH) has experienced a severe 30% correction, plummeting from $2,800 down to $1,900. This dramatic price movement was mirrored by a substantial reduction in derivatives market participation, with open interest in Ether futures contracts decreasing by over $15 billion during the identical timeframe.

Market observers are now examining critical long-term technical support zones and blockchain-based metrics that could indicate a significant bottom formation for ETH's valuation.

Key takeaways:

- A 30% weekly decline has pushed Ether beneath the psychologically important $2,000 threshold.

- The recent price collapse positions the $1,000-$1,400 range as the next area of interest.

ETH drops with the crypto market

For the first time since May 2025, the ETH/USD trading pair fell beneath the $2,000 mark, touching a 9-month nadir of $1,740 on Friday. Despite a modest rebound to $1,900 as of this writing, Ether has registered the steepest weekly percentage decline of 30% among major capitalization cryptocurrencies.

The cryptocurrency market's flagship asset, Bitcoin (BTC), is currently valued at $66,340, representing a 21% decrease across the previous seven-day period. XRP (XRP), occupying the fifth position by market cap, has shed over 21% during the past week, now trading marginally above $1.37. Among the top 10 digital assets, Solana (SOL) has similarly experienced substantial depreciation, falling 29% throughout the same timeframe.

Consequently, the aggregate cryptocurrency market valuation has contracted by 20% week-over-week, settling at $2.23 trillion as of Friday.

This week's precipitous decline in Ether has been accompanied by substantial forced liquidations of long positions amounting to $400 million within the most recent 24-hour window, demonstrating aggressive sell-side pressure from leveraged market participants.

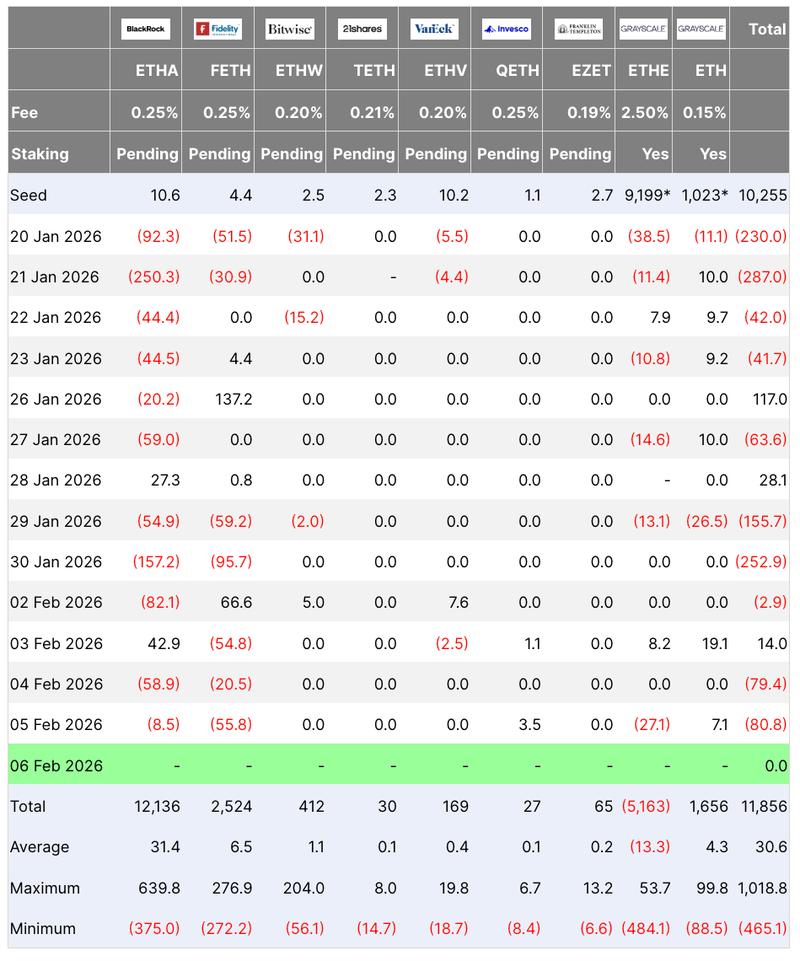

Additional selling pressure originated from United States-based spot Ethereum ETFs, which have experienced aggregate net withdrawals totaling $1.1 billion across the preceding two-week span.

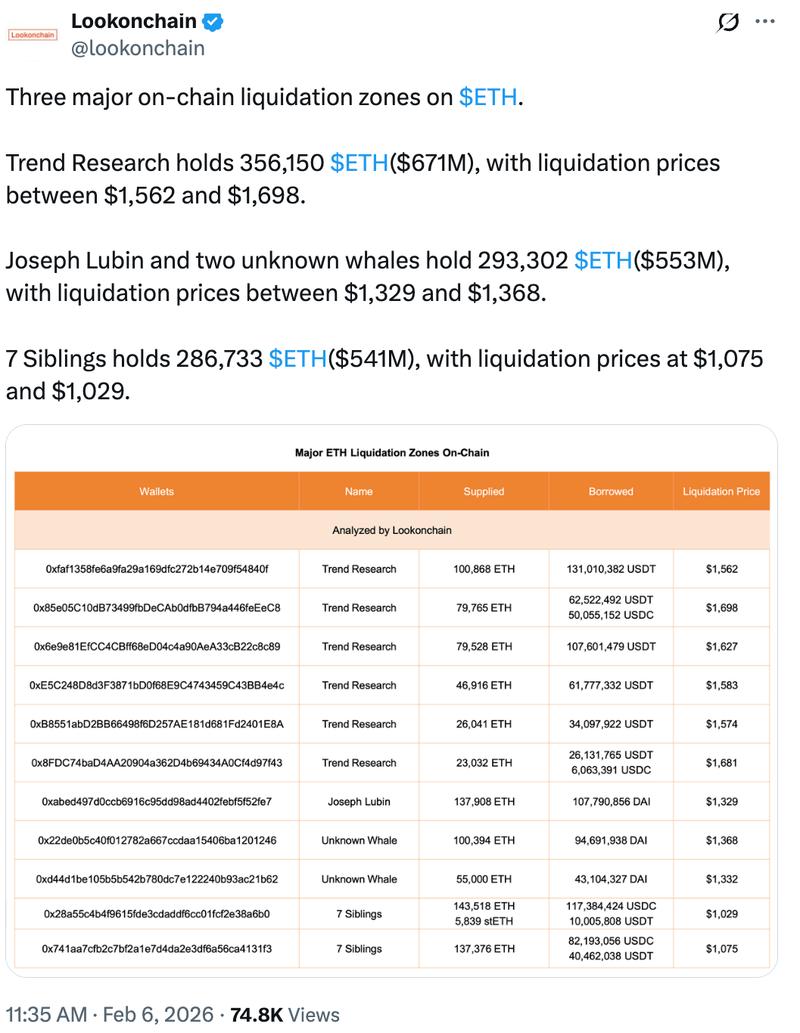

When combined with intensified distribution from other significant ETH stakeholders including Trend Research, along with Ethereum co-founder Vitalik Buterin, this indicates persistent overhead resistance that may drive ETH's price to lower levels.

How low can ETH price go?

Throughout the last fortnight, Ether's bearish momentum has resulted in the loss of two critical support thresholds, namely the 200-week simple moving average (SMA) alongside the psychologically significant $3,000 and $2,000 price levels.

The previous instance when ETH conclusively broke below its 200-week SMA occurred in March 2025, subsequently triggering a 45% price correction.

Should historical patterns recur, the ETH/USD pair may continue its downward trajectory toward the $1,400 zone.

This price level corresponds with the bearish projection derived from an inverse V-shaped formation targeting $1,385, which would constitute a 28% decline from present valuation.

According to Cointelegraph's previous coverage, an inverse cup-and-handle chart pattern establishes a downside objective at $1,665, whereas MVRV band analysis suggests a potential target of $1,725.

Blockchain analytics service Lookonchain has identified three significant liquidation concentration zones situated around $1,500, $1,300, and $1,000, which may serve as price magnets for Ether ahead of establishing a definitive bottom.

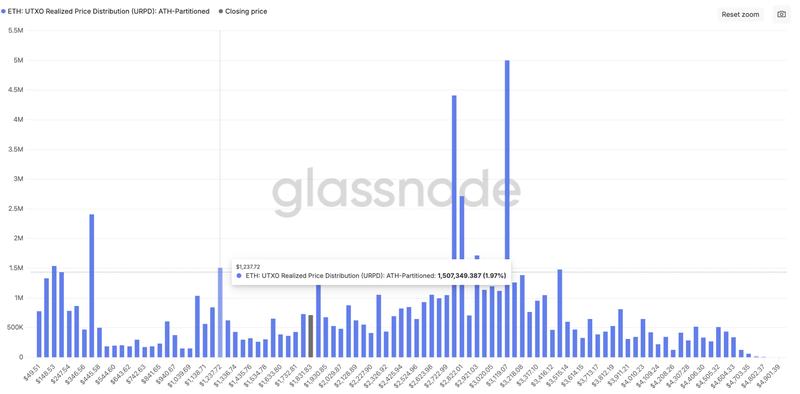

Glassnode's UTXO realized price distribution (URPD) metric, which illustrates the mean acquisition costs for SOL holders' positions, indicates minimal historical trading volume below the $1,900 level. Put differently, substantial buying interest may remain absent until the price reaches the previously mentioned support areas.

The subsequent noteworthy support zone is located at $1,200, representing a price point where roughly 1.5 million ETH tokens were historically accumulated.