ETH Drops Under $2,000 Mark as Investor Resolve Undergoes Critical Test

The current price decline in Ether is challenging investor resolve, as on-chain metrics reveal persistent selling from retail holders while institutional players continue accumulating positions.

The native cryptocurrency of the Ethereum network, Ether (ETH), plummeted to an annual low of $1,927 during Thursday's trading session, marking a decline exceeding 60% from its record peak of $4,950.

Market observers indicated that this downturn is putting holders' resolve through a rigorous examination, while blockchain analytics and cryptocurrency exchange deposit patterns suggest the onset of bearish market conditions. Notwithstanding the aggressive selling activity, a particular segment of Ether investors has been actively purchasing, though it remains uncertain whether this buying activity will enable ETH to recapture the $2,000 threshold.

Key takeaways:

- Mid-sized holders (100–10,000 ETH) reduced their holdings, signaling a capitulation phase.

- Large holders (10,000+ ETH) have increased exposure during the last quarter, absorbing sell pressure for the altcoin.

- ETH is trading below the realized price for all investor cohorts, and the rising exchange inflows keep downside risk elevated.

Onchain data shows who's holding, adding and capitulating

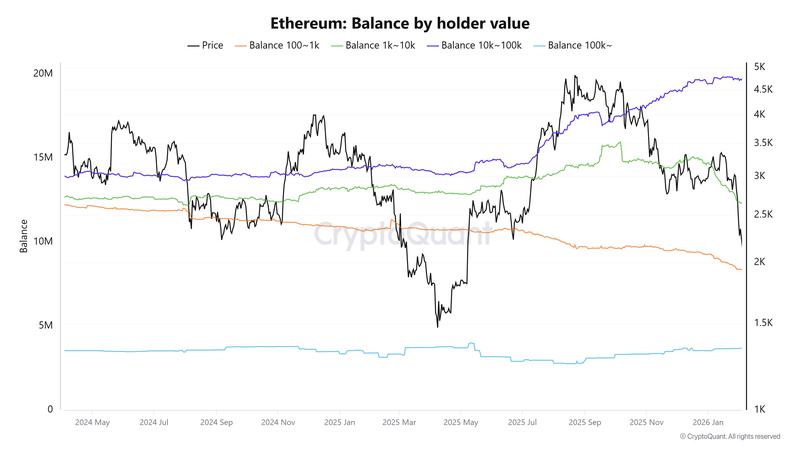

Throughout the preceding five-month period, the Ether balance-by-holder-value metrics have revealed a distinct transformation in trading patterns across various wallet categories.

This indicator provides clarity on which market participants are absorbing the negative price pressure and which ones are making exits as valuations retreat to May 2025 price points.

Information compiled by CryptoQuant indicated that as of August 18, 2025, cryptocurrency wallets containing 100–1,000 ETH held a combined 9.79 million ETH, those with 1,000–10,000 contained 14.51 million ETH, addresses storing 10,000–100,000 possessed 17.18 million ETH, and wallets with 100,000+ maintained 2.75 million ETH.

By Wednesday's close, the aggregate balances within the 100–1,000 and 1,000–10,000 categories had decreased to 8.32 million ETH and 12.26 million ETH, respectively.

Conversely, wallets in the 10,000–100,000 range grew their holdings to 19.77 million ETH, whereas those holding 100,000+ tokens expanded their positions to 3.68 million ETH.

The metrics pointed toward active accumulation by whale investors and institutional entities, whereas retail and medium-sized participants appear to be liquidating positions amid ongoing price deterioration.

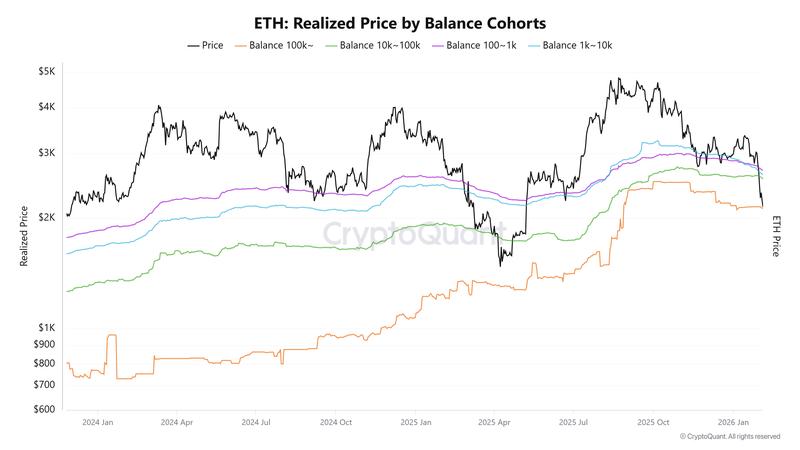

Additionally, Ether is currently trading beneath the realized price for each investor category, which represents the average acquisition cost at which each segment most recently transferred its ETH. The realized prices range between $2,120 for holders with 100,000+ tokens and $2,690 for those in the 100–1,000 category, with ETH momentarily settling below the combined realized price of $2,630 on Jan. 31, a threshold associated with panic-driven liquidations.

Exchange inflows and taker data keep pressure on ETH's price

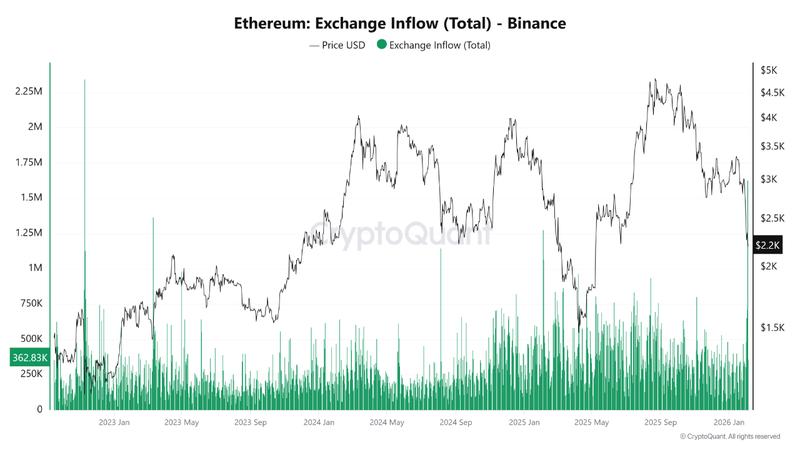

Deposits of Ether to Binance exchange wallets spiked to approximately 1.63 million ETH on Wednesday, representing the largest single-day volume recorded since 2022. Substantial deposit volumes may indicate intentions to liquidate holdings or portfolio restructuring, and the timing of these inflows during a period of declining prices amplifies bearish concerns.

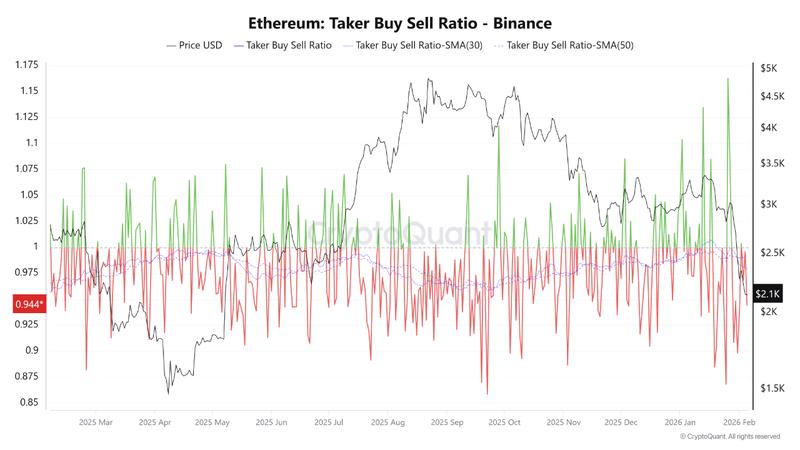

Trading execution metrics further substantiate this outlook. Cryptocurrency market analyst Pelin Ay observed that Ether's Binance taker buy/sell ratio currently stands at approximately 0.94, falling short of the equilibrium point of 1. The 30-day and 50-day moving averages both continue trading beneath 1, indicating that selling momentum represents the prevailing market dynamic instead of a transient occurrence.

Pelin further stated that this pattern may also signal the commencement of a "true bear season" for the cryptocurrency, anticipating that challenging market conditions will continue for an extended period.