Dragonfly Capital secures $650M fund as crypto VC landscape pivots to real-world asset tokenization

The fundraising by Dragonfly reflects a strategic transformation in cryptocurrency venture capital, moving toward payments, tokenized real-world assets and fundamental financial infrastructure designed for institutional market entry.

Dragonfly Capital, a cryptocurrency-focused venture capital firm, has successfully closed its fourth investment fund, securing $650 million in capital to deploy across what the firm identifies as the emerging generation of blockchain-based enterprises.

This latest investment vehicle represents Dragonfly's fourth fund to date, as confirmed through a social media post on X by the fund's general partner Rob Hadick. According to Fortune's reporting, instead of pursuing consumer-oriented applications, the firm has indicated a strategic emphasis on conventional financial products constructed on blockchain infrastructure, encompassing credit card-style offerings and money market-type investment vehicles, alongside tokens backed by real-world assets including equities and private credit instruments.

This strategic reorientation mirrors a wider industry transformation within cryptocurrency toward financial infrastructure development and blockchain-based finance, spanning payment systems, lending protocols, stablecoin frameworks and the tokenization of real-world assets.

This is the biggest meta shift I can feel in my entire time in the industry

Tom Schmidt, a general partner at Dragonfly

The capital raise follows what Hadick characterized as a "mass extinction event" within the cryptocurrency venture capital landscape, as elevated interest rate environments combined with declining token valuations reduced the number of active investors in the space.

In its fundraising history, Dragonfly secured approximately $100 million for its inaugural fund in 2018, around $225 million during 2021 and $650 million throughout 2022. This most recent $650 million fund demonstrates that, notwithstanding the slowdown across crypto venture investment activity, substantial capital reserves continue to support initiatives designed to bridge blockchain technology more seamlessly with conventional financial systems.

Crypto VC priorities, focus areas shift

Investment capital directed toward blockchain enterprises experienced a cooling trend in 2025, though this doesn't indicate capital has vanished entirely. Rather, the composition of funding sources has undergone transformation.

Conventional early-stage venture capital transactions decelerated, while increasing amounts of capital started moving through public market listings, private investments in public equity (PIPEs), debt financing arrangements and post-IPO equity offerings — an indication that more established cryptocurrency companies are accessing public capital markets instead of depending exclusively on seed funding rounds.

This transformation seems to be accelerating throughout 2026. During the previous month, 111 cryptocurrency companies collectively raised $2.5 billion spanning IPOs, PIPEs, debt instruments and equity offerings, based on analytics from The TIE. This figure indicates institutional capital is making a return, albeit channeling through alternative pathways compared to the previous bull market cycle.

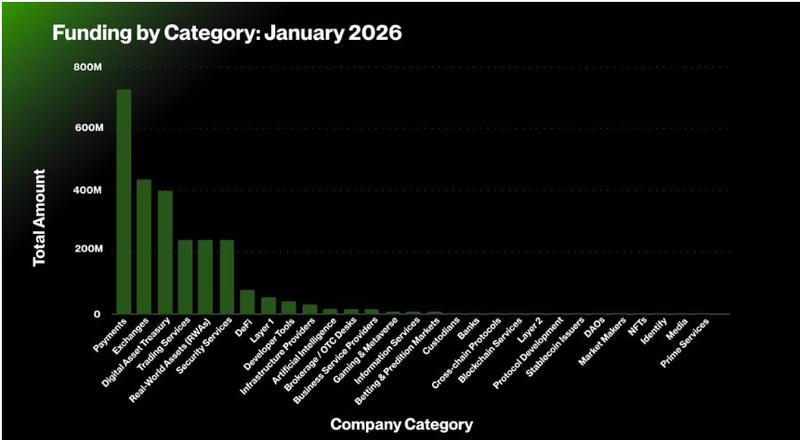

The sectoral concentration has similarly transformed. Rather than financing layer-1 blockchain protocols and consumer-directed applications, investors are channeling capital toward stablecoin infrastructure development, institutional-grade custody solutions, digital asset treasury management strategies and trading platform technologies.