Credit market tension timing could determine Bitcoin's next buying opportunity: Analysis

BTC experienced heightened volatility and dropped to new lows amid concerning economic indicators from the United States. Could credit stress metrics provide signals for the upcoming BTC accumulation window?

Bitcoin (BTC) hit fresh lows beneath the $73,000 threshold on Tuesday amid emerging data that reveals concerning macroeconomic headwinds developing underneath markets experiencing increased volatility. Fresh analysis points to credit conditions becoming more restrictive, despite US debt levels and borrowing expenses remaining at elevated levels, with one market observer suggesting that this divergence between credit pricing mechanisms and actual credit market tension could determine the direction of Bitcoin's price movement over the next several months.

Key takeaways:

- The ICE BofA US Corporate Option-Adjusted Spread is at 0.75, its lowest level since 1998.

- US debt stands at $38.5 trillion, while the 10-year Treasury yield is 4.28%.

- Bitcoin whale inflows to exchanges have risen, but the pace of onchain profit-taking is easing.

Compressed credit spreads diverge from mounting economic pressures

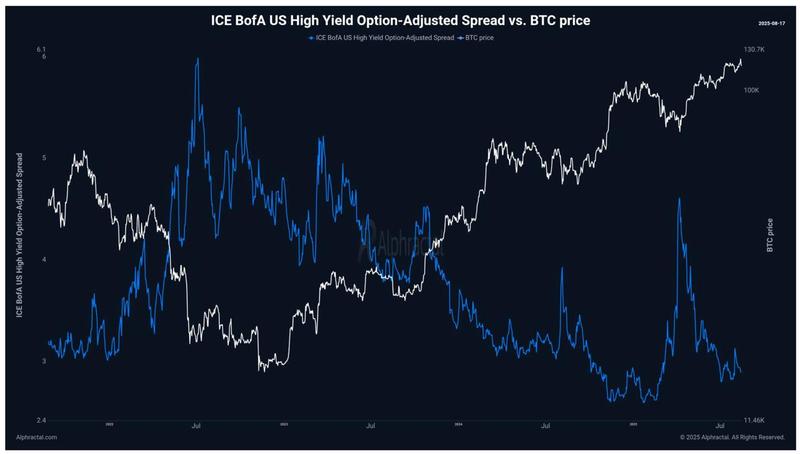

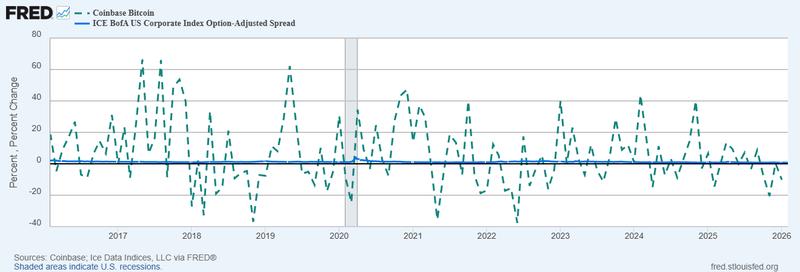

The ICE BofA Corporate Option-Adjusted Spread could serve as an important macroeconomic indicator for Bitcoin's trajectory. This particular metric measures the additional yield that investors require when holding corporate bonds compared to US Treasurys. Widening spreads typically indicate increasing stress within credit markets.

At present, these spreads remain compressed, which implies that market risk continues to be undervalued. This situation is particularly remarkable considering the prevailing market environment. United States government debt climbed to $38.5 trillion by the conclusion of January, while the 10-year Treasury yield, following a brief dip under 4% during October, has rebounded to 4.28%, maintaining tight financial conditions in the present climate.

Throughout past Bitcoin market cycles, encompassing 2018, 2020, and 2022, BTC established a local bottom exclusively after credit spreads started to widen. This progression occurred with a three-to-six-month lag period, as opposed to producing an instantaneous impact.

During August, 2025, Alphractal founder Joao Wedson made the case that should liquidity conditions tighten and credit spreads expand over the forthcoming months, Bitcoin may transition into a fresh accumulation phase ahead of broader market stress becoming apparent.

Large Bitcoin holder selling activity increases, though extended-term pressure shows signs of abating

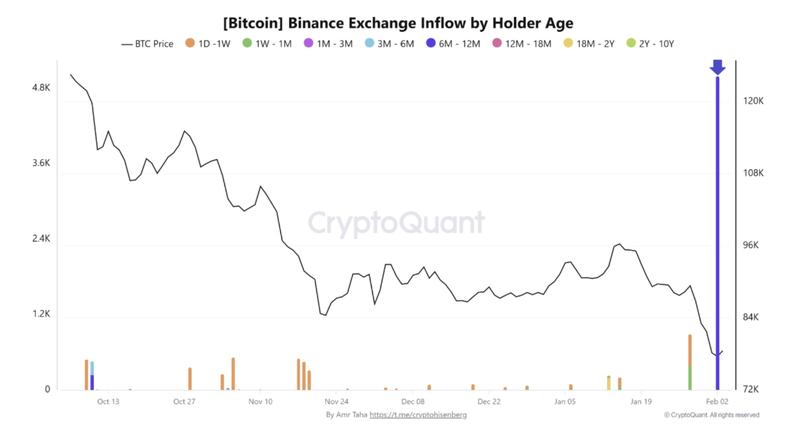

Near-term selling behavior has intensified for Bitcoin during this week. Crypto analyst Amr Taha observed that both large holders and mid-term investors have recently moved substantial quantities of BTC to Binance. During Monday, wallets containing over 1,000 BTC sent approximately 5,000 BTC to exchanges, mirroring a comparable surge observed during December.

Simultaneously, investors from the 6-to-12-month holding period demographic also transferred 5,000 BTC to trading platforms, representing the most substantial inflow from this particular group since the beginning of 2024.

Nevertheless, widespread selling momentum seems to be diminishing. Data from CryptoQuant indicates the spent output profit ratio (SOPR) has declined approaching 1, reaching its lowest point in a year, coinciding with Bitcoin falling to a year-to-date low of $73,900 on Tuesday.

Historical trends indicate that a Bitcoin bottom has materialized between three-to-six months following the commencement of credit spread widening. Increasing Treasury yields could apply pressure to credit markets, potentially pushing spreads toward the 1.5–2% range throughout April.

This scenario may create an accumulation opportunity between May and July 2026, as market participants digest this stress, corresponding with the present SOPR data, which signals exhaustion among long-term sellers.