Chorus One acquisition by Bitwise reported amid staking expansion

Wait times for Ethereum validators have climbed past 70 days as the queue exceeds 4 million ETH, with staking now accounting for more than 30% of the total supply.

According to reports, Bitwise Asset Management is set to acquire Chorus One, a leading institutional staking service provider, marking another significant step in the firm's expansion into cryptocurrency yield-generating services.

The deal brings a significant staking infrastructure operation under Bitwise's umbrella as appetite grows for onchain yield-generating products across both institutional and retail investor segments.

According to information on its website, Chorus One operates staking infrastructure for decentralized networks and manages $2.2 billion in staked assets.

Bloomberg reported on Wednesday that the specific financial details of the transaction remain undisclosed, based on statements provided by both organizations.

Cointelegraph contacted both Bitwise and Chorus One to request additional comment, but neither organization had responded at the time of publication.

Ethereum staking demand surges as validator queue swells

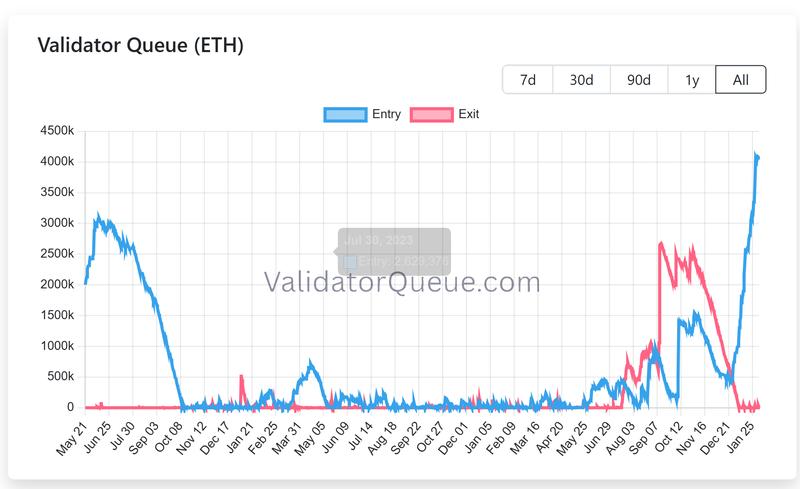

Data tracking Ethereum's validator queue reveals a substantial spike in demand for staking Ether (ETH). The backlog for new validators has expanded beyond 4 million ETH, resulting in wait times that now exceed 70 days.

Currently, almost 37 million ETH, representing just over 30% of the entire supply, is committed to staking, with nearly 1 million validators actively participating in network security. This indicates that an increasing number of token holders are willing to lock up their ETH despite extended waiting periods.

The growing appetite for staking has prompted other prominent asset managers to incorporate yield generation into their regulated cryptocurrency offerings. Morgan Stanley submitted filings to launch a spot Ether exchange-traded fund (ETF) designed to stake a portion of its assets to produce passive income. Additionally, Grayscale is getting ready to distribute staking rewards from its Ethereum Trust ETF, marking the first such distribution connected to onchain staking by a spot crypto exchange-traded product listed in the United States.

Crypto M&A hits record

The Bitwise acquisition comes on the heels of unprecedented merger and acquisition activity within the cryptocurrency sector in 2025, with deal value reaching $8.6 billion spread across a record-breaking 133 transactions by November, exceeding the aggregate total of the prior four years combined.

Coinbase emerged as the most active acquirer, completing six separate acquisitions, most notably the $2.9 billion acquisition of Deribit, a crypto derivatives exchange.