Can Bitcoin Recover to $90K Before March Ends?: BTC Options Markets Reveal the Odds

As Bitcoin plunged below 63,000 following disappointing US economic indicators, deteriorating equity markets and concerns about an AI sector bubble, market data reveals slim chances of a recovery to $90,000 by March.

Key takeaways:

- Bitcoin dropped beneath the $63,000 threshold following disappointing US employment figures and mounting worries about artificial intelligence sector investments that triggered heightened risk aversion among investors.

- Options market indicators suggest merely a 6% probability of Bitcoin climbing back to $90,000 before the end of March.

Bitcoin (BTC) tumbled beneath the $63,000 mark on Thursday, reaching its weakest position since November 2024. The cryptocurrency's 30% decline following its unsuccessful effort to surpass $90,500 on Jan. 28 has created widespread skepticism among traders regarding any near-term bullish reversal. The prevailing bearish outlook stems from disappointing US employment statistics and growing apprehensions about substantial capital investments being deployed within the artificial intelligence industry.

Whether Bitcoin's downturn was initiated by macroeconomic factors or not, options market participants are currently assigning only 6% probability to BTC recovering the $90,000 level by March.

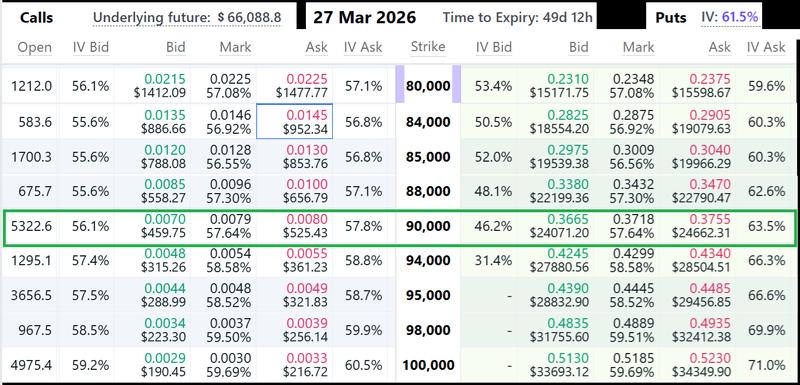

Trading data from the Deribit exchange reveals that the privilege to purchase Bitcoin at $90,000 on March 27 (known as a call option) was valued at $522 on Thursday. Such pricing indicates that market participants view the likelihood of a substantial rally as minimal. When analyzed through the Black-Scholes model, these option prices indicate less than 6% probability of Bitcoin achieving $90,000 by the conclusion of March. By comparison, the privilege to sell Bitcoin at $50,000 (known as a put option) for the identical expiration date was priced at $1,380, which implies a 20% chance of a more severe downturn.

Quantum computing risks and forced liquidation fears drive Bitcoin selling

Market participants have been scaling back cryptocurrency exposure driven by emerging threats from quantum computing technology and anxieties about potential forced sales by corporations that accumulated Bitcoin reserves using borrowed capital and equity financing. During mid-January, Christopher Wood, global head of equity strategy at Jefferies, eliminated a 10% Bitcoin allocation from his model portfolio, pointing to the threat of quantum computers being able to reverse-engineer private keys.

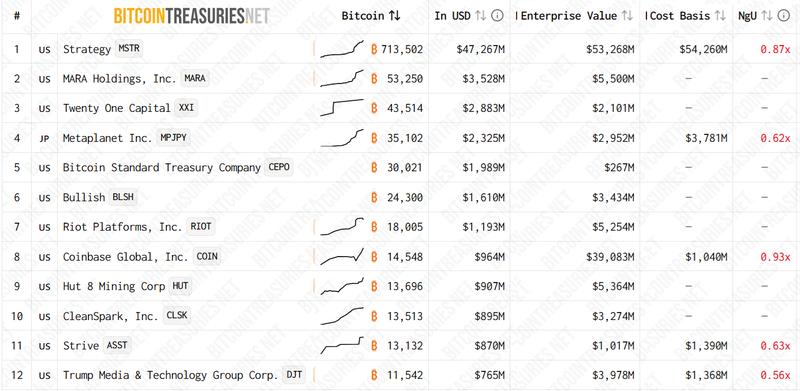

Strategy (MSTR US), which represents the biggest publicly traded corporation holding onchain BTC reserves, recently experienced its enterprise value falling to $53.3 billion, whereas its cost basis remained at $54.2 billion. Japan's Metaplanet (MPJPY US) encountered a comparable discrepancy, with a valuation of $2.95 billion compared to a $3.78 billion acquisition cost. Market participants are expressing concern that an extended bear market could compel these corporations to liquidate their holdings to satisfy debt obligations.

External market forces appear to have played a role in the heightened risk aversion, and even silver, which holds the position of second-largest tradable asset by market capitalization, experienced a 36% weekly price decline following its climb to a $121.70 all-time high on Jan. 29.

Bitcoin's 27% weekly downturn bears a striking resemblance to the losses experienced across multiple billion-dollar publicly traded corporations, among them Thomson Reuters (TRI), PayPal (PYPL), Robinhood (HOOD) and Applovin (APP).

US employers disclosed 108,435 layoffs throughout January, representing a 118% increase from the corresponding period in 2025, based on data from outplacement firm Challenger, Gray & Christmas. This spike represented the most significant number of January workforce reductions since 2009, when the economy was approaching the conclusion of its most severe downturn in 80 years.

Market confidence had already deteriorated following Google (GOOG US) announcing on Wednesday that capital expenditure in 2026 is projected to hit $180 billion, rising from $91.5 billion in 2025. Stock prices for technology giant Qualcomm (QCOM US) declined 8% subsequent to the company providing weaker growth projections, explaining that supplier capacity has been reallocated toward high-bandwidth memory for data centers.

Market participants anticipate that investments within the artificial intelligence sector will require more time to generate returns owing to escalating competition and manufacturing constraints, encompassing energy limitations and scarcity of memory chips.

Bitcoin's descent to $62,300 on Thursday demonstrates the uncertainty surrounding economic expansion and US employment conditions, rendering a recovery approaching $90,000 in the immediate future progressively improbable.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.