BTC's Plunge Under $60K: Examining Three Explanations for Bitcoin's Collapse

Leveraged Bitcoin positions by Hong Kong-based hedge funds are being identified as the primary catalyst driving BTC's dramatic sell-off spanning a full month.

Over the last month, Bitcoin (BTC) has undergone one of its most severe sell-offs in recent memory, declining more than 40% before hitting a year-to-date bottom of $59,930 this past Friday. The flagship cryptocurrency has now tumbled over 50% from its all-time peak of approximately $126,200, which was recorded in October 2025.

Key takeaways:

- Market analysts are identifying Hong Kong-based hedge funds and ETF-related U.S. banking products as potential catalysts behind BTC's dramatic decline.

- There's potential for Bitcoin to fall back beneath the $60,000 threshold, which would bring pricing closer to the break-even points for mining operations.

Are Hong Kong hedge funds responsible for BTC's decline?

A widely circulated theory proposes that the Bitcoin crash witnessed in recent days may have had its origins in Asian markets, specifically involving Hong Kong-based hedge funds that had established significant, leveraged positions betting on BTC's continued upward trajectory.

According to Parker White, COO and CIO of the Nasdaq-listed DeFi Development Corp. (DFDV), these financial institutions utilized options instruments connected to Bitcoin ETFs such as BlackRock's IBIT, and funded these speculative positions by borrowing Japanese yen at low interest rates.

The borrowed yen was then converted into alternative currencies and channeled into high-risk assets including cryptocurrencies, with the expectation that asset values would continue climbing higher.

This was the highest volume day on $IBIT, ever, by a factor of nearly 2x, trading $10.7B today. Additionally, roughly $900M in options premiums were traded today, also the highest ever for IBIT. Given these facts and the way $BTC and $SOL traded down in lockstep today (normally…

— Parker (@TheOtherParker_) February 6, 2026

However, as Bitcoin's upward momentum stalled and the cost of borrowing yen began rising, these highly leveraged positions rapidly deteriorated. Creditors subsequently issued margin calls demanding additional collateral, compelling the funds to liquidate Bitcoin along with other holdings in a hurry, which further intensified the downward price spiral.

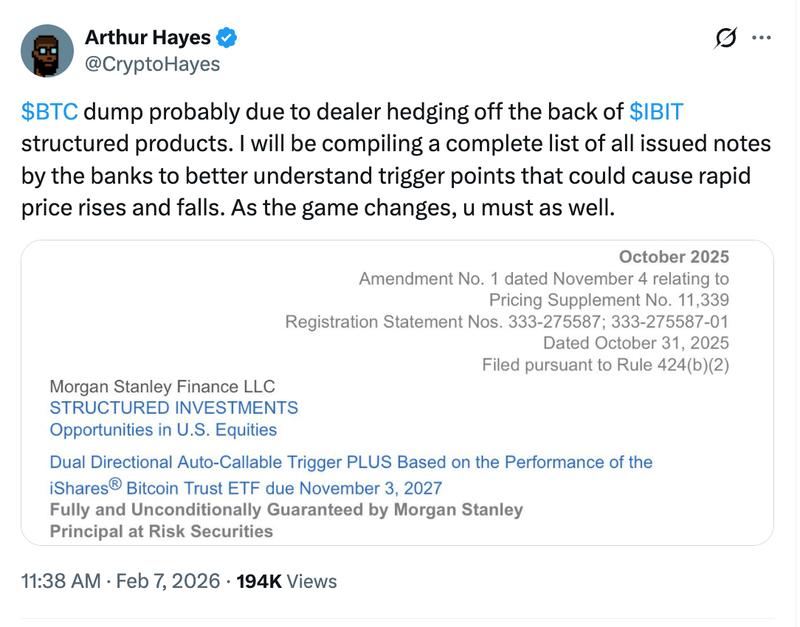

Arthur Hayes claims Morgan Stanley triggered Bitcoin selloff

An alternative explanation that has been gaining considerable attention originates from Arthur Hayes, the former CEO of BitMEX.

Hayes has put forward the hypothesis that financial institutions, notably Morgan Stanley, may have found themselves compelled to liquidate Bitcoin holdings (or associated assets) as a means to hedge their exposures in structured note products linked to spot Bitcoin ETFs, particularly BlackRock's IBIT.

These represent sophisticated financial instruments through which banking institutions provide customers with exposure to Bitcoin's price movements (frequently with principal protection features or barrier protections).

In situations where Bitcoin experiences sharp declines, breaking through critical price thresholds such as the approximately $78,700 level mentioned in one particular Morgan Stanley product, market dealers are obligated to implement delta-hedging strategies by liquidating the underlying BTC holdings or futures contracts.

This dynamic generates what's known as "negative gamma," which means that as market prices continue their descent, the hedging-related sales intensify proportionally, effectively transforming banks from entities that provide market liquidity into forced sellers who amplify the market downturn.

Bitcoin miners transitioning toward AI operations

A less widely discussed but nonetheless circulating hypothesis suggests that what some are calling a "mining exodus" may have contributed to Bitcoin's recent downtrend as well.

In a post shared on X this past Saturday, market analyst Judge Gibson indicated that the expanding demand for AI-focused data center infrastructure is already compelling Bitcoin mining operations to reallocate resources, resulting in a hash rate decline ranging from 10-40%.

As a case in point, Bitcoin mining company Riot Platforms made public its strategic shift in December 2025 toward a more diversified data center business model, simultaneously liquidating $161 million in BTC holdings. Most recently, another mining firm, IREN, revealed its own transition toward AI-focused data center operations.

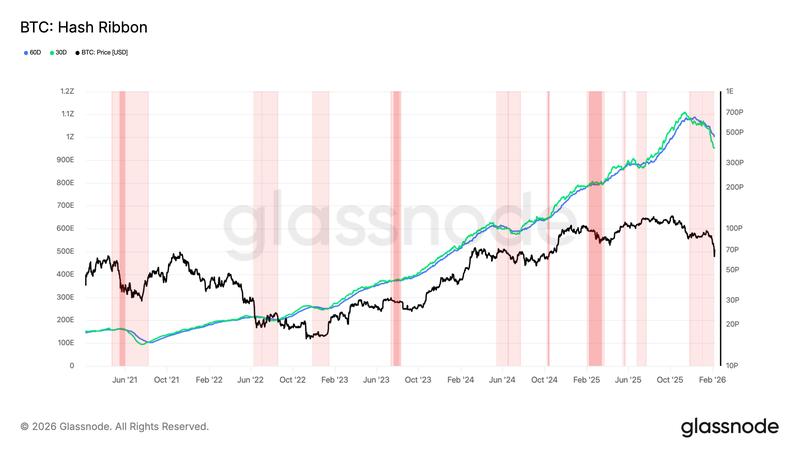

At the same time, the Hash Ribbons technical indicator has issued a cautionary signal: the 30-day moving average of hash rate has fallen beneath the 60-day average, creating a negative crossover pattern that has historically indicated severe financial pressure on miners and heightens the probability of mass capitulation events.

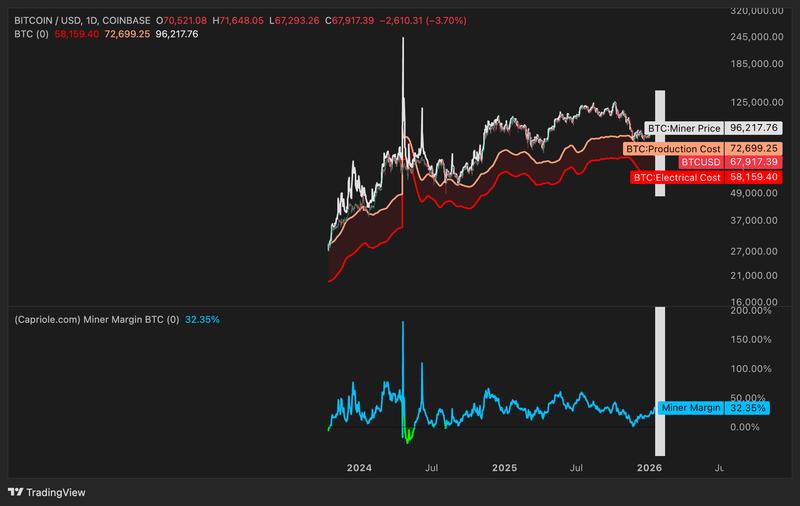

As of this past Saturday, market estimates placed the average cost of electricity required to mine one Bitcoin at roughly $58,160, while the comprehensive net production expenditure stood at approximately $72,700.

Should Bitcoin prices retreat once again below the $60,000 mark, mining operations could begin facing genuine financial distress and operational challenges.

Meanwhile, long-term Bitcoin holders are demonstrating increasingly cautious behavior patterns as well.

Market data reveals that cryptocurrency wallets containing between 10 and 10,000 BTC currently hold their smallest percentage of total supply witnessed over the past nine months, indicating that this particular cohort has been reducing their positions rather than accumulating additional holdings.