BTC Surges Past $69K Mark as Retail Investors Squeeze Short Sellers

Bitcoin recaptures the $69,000 price point as wallets sized for retail investors buy up $613 million in spot BTC throughout February. Can large-scale holders enter the market and help establish $70,000 as a support level?

Bitcoin (BTC) surged to reach $69,482 on Friday, with the upward movement aligning with evidence indicating continuous accumulation by holders with smaller wallet sizes during February.

Market analysts indicate the breakout could develop into a more extensive bullish pattern, though additional data points toward an extended phase of price consolidation forming the foundation of the developing bull trend.

Key takeaways:

- BTC surpassed the $69,000 resistance threshold and its descending channel pattern, resulting in $92 million worth of short liquidations in a four-hour window.

- Smaller wallets increased holdings by $613 million throughout February, whereas whale-sized wallets experienced stagnation with $4.5 billion in outflows.

- The short-term holder profit-ratio metric reached its most depressed level since November 2022, highlighting subdued sentiment during recent weeks.

Can the Bitcoin recovery rally sustain momentum?

Bitcoin has climbed beyond the upper limit of its descending channel formation and successfully retested the $69,000 mark. This movement represents a potentially bullish break of structure (BOS), provided BTC maintains levels above $68,000.

Should BTC sustain trading above this recaptured threshold, the subsequent internal liquidity targets are positioned around $71,500 and $74,000. The 50 and 100-period exponential moving averages (EMAs) are currently converging below the current price level on the one-hour timeframe, strengthening the likelihood of near-term momentum persistence.

The most recent price spike generated approximately $96 million in futures liquidations during the previous four hours, with close to $92 million originating from short positions, indicating a short squeeze affecting bearish market participants.

BTC liquidations were predominantly focused on Bybit (22.5%), Hyperliquid (22%), and Gate (15%), indicating these exchanges represent a substantial portion of active leveraged trading activity in the marketplace.

Retail investor BTC demand supports the breakout

The breakout receives support from consistent purchasing activity by smaller-sized market participants. Order flow information from Hyblock reveals that small wallets ($0–$10,000) have purchased approximately $613 million in cumulative volume delta (CVD) throughout February, maintaining buy orders during the price pullback.

The mid-sized wallets ($10,000–$100,000) stand at approximately -$216 million for the month, however this group purchased roughly $300 million following BTC's decline beneath $60,000, indicating targeted accumulation during discounted price levels.

Whale wallets ($100,000 and above) recorded their CVD reaching a low point around -$5.8 billion in early February and have subsequently traded sideways. This stabilization suggests that the intense distribution phase has ceased, although a definitive accumulation pattern from these large holders remains absent.

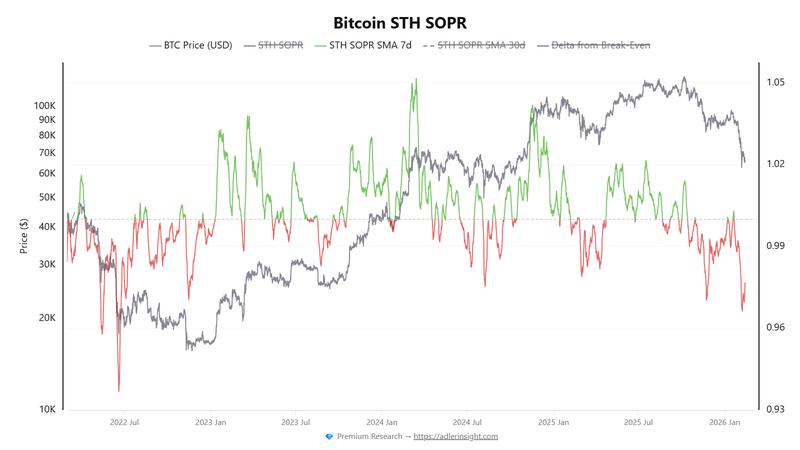

For the upward movement to persist, purchasing activity from whales may be required, and the short-term holder spent output profit ratio (SOPR) may need to climb back above 1, demonstrating that recent purchasers are no longer realizing losses on their positions.

Significantly, the short-term holder SOPR recently declined to its weakest point since November 2022, revealing that numerous recent purchasers have been crystallizing losses, a signal that confidence may continue to be uncertain despite the price recovery.