BTC Price Volatility Surges Following Stronger-Than-Expected Jobs Report as Federal Reserve Pause Probability Hits 95%

Strong US nonfarm payrolls data triggered significant Bitcoin price fluctuations, though market participants continue to eye $50,000 BTC price levels. Will the upcoming Federal Reserve interest rate decision result in positive market momentum?

Bitcoin (BTC) experienced sudden price volatility surrounding Wednesday's opening bell on Wall Street following the release of US employment figures that significantly exceeded market forecasts.

Key points:

- Bitcoin works to recover intraday losses following the release of robust US nonfarm payrolls figures.

- Conflicting indicators lead to divergent responses among risk assets to the employment data.

- Bitcoin market participants remain cautious about potential further BTC price declines.

Analysis: Fed interest-rate pause to "continue"

According to TradingView data, the BTC price experienced a rapid surge approaching $69,000 before quickly reversing course, pushing daily losses beyond 4% as of this writing.

The US nonfarm payrolls report significantly exceeded expectations for the day, delivering 130,000 new jobs in January compared to the forecasted 55,000.

Robust employment market data generally suggests diminished pressure to cut interest rates — conventionally representing negative conditions for cryptocurrency and risk assets. Simultaneously, the decreased probability of an economic recession presents a complex scenario for risk-asset valuations.

Consequently, the S&P 500 posted an initial increase of 0.5%, whereas the Nasdaq Composite Index declined 0.6% before both indices reversed their respective movements.

Precious metal markets also exhibited indecisive price behavior, with gold establishing fresh February peaks before surrendering gains to approach $5,000 support levels.

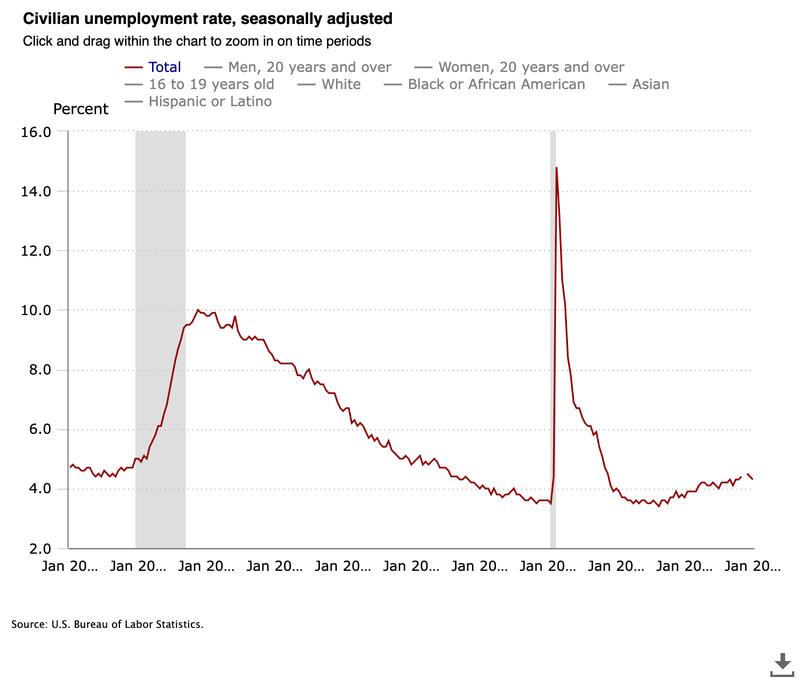

In response, market analysis resource The Kobeissi Letter also cited declining unemployment levels in forecasting that the Federal Reserve would maintain current interest rates at its upcoming March meeting.

"The unemployment rate FELL to 4.3%, below expectations of 4.4%. This was a much stronger than expected jobs report, all around the board," it wrote in a post on X.

"The Fed pause will continue."

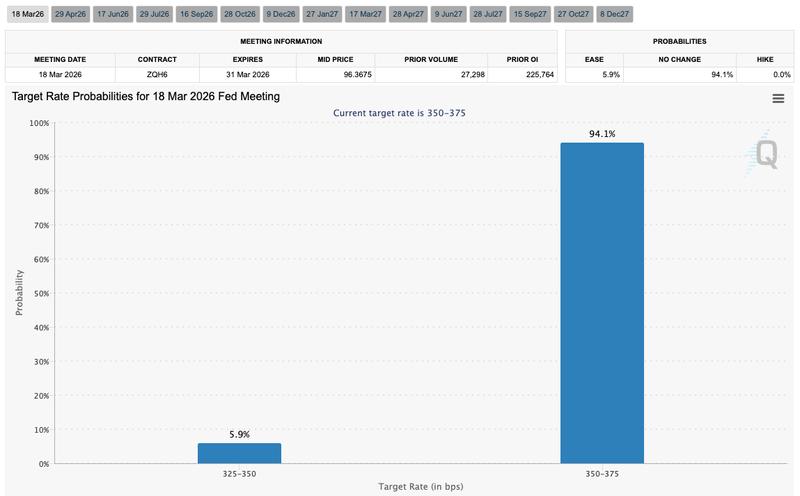

According to the most recent data from CME Group's FedWatch Tool, the probability of a March interest rate pause exceeded 90%.

Market focus now shifts to Friday's Consumer Price Index (CPI) release for additional insight regarding the trajectory of inflation.

Trader eyes BTC price "slow bleed" toward $50,000

Analyzing recent BTC price movements, market traders remained unconvinced and continued to anticipate additional downside pressure.

Daan Crypto Trades identified Fibonacci retracement targets at $64,569, $62,474 and $59,805 while monitoring the possibility of a more substantial retracement.

"Pretty weak showing overall after the initial bounce. Bulls failed to push higher past that $72K+ mark and instead saw price break down again," he summarized.

"Unless ~$68k is retaken, the fib retracement levels are the ones to watch in the short term."

Previously, Cointelegraph documented the critical long-term importance of the $69,000 level, with the possibility of a prolonged sideways trading environment forming around that price point now increasingly likely.

Price targets of $50,000 for a Bitcoin bottom also remained prevalent, with market analyst Jelle contending that BTC/USD was replicating 2022 bear market patterns "closely."

"Would see a relatively slow bleed towards the low $50ks from here - before bouncing back up; if it keeps playing out the same," he told X followers.

"Lots of people talk about buying there. I wonder if they will if price gets there."