BTC Exchange-Traded Funds Experience $434M Decline While Bitcoin Drops to $60K, Total Holdings Approach $80B

Bitcoin exchange-traded funds recorded $690 million in weekly net redemptions during the week BTC momentarily dipped to $60,000, sparking renewed debate among analysts regarding "paper Bitcoin" and supply dynamics.

Exchange-traded funds tracking Bitcoin (ETFs) maintained their pattern of capital outflows on Thursday, losing close to $1 billion across the most recent two trading sessions as discussions intensify regarding their possible influence on cryptocurrency markets.

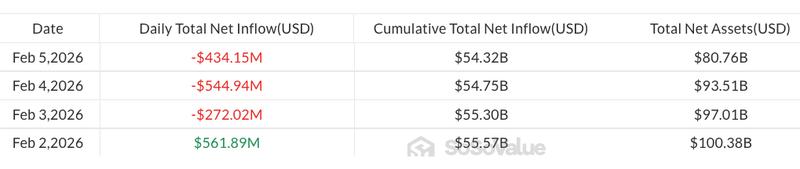

Information compiled by SoSoValue indicates that spot Bitcoin (BTC) exchange-traded funds experienced $434 million in net redemptions on Thursday, coming after $545 million worth of withdrawals during the prior trading session.

The $561 million influx recorded on Monday proved insufficient to counterbalance the subsequent losses, resulting in aggregate weekly net outflows of approximately $690 million by Friday's market open.

These recent redemptions occurred alongside a dramatic decline in the price of Bitcoin, which momentarily reached the $60,000 level for the first time since October 2024, based on data from CoinGecko.

Market participants have found it challenging to pinpoint definitive triggers for the price correction, with some beginning to question Bitcoin ETFs despite analysts highlighting their staying power.

Exchange-traded funds draw "paper Bitcoin" scrutiny

When spot Bitcoin ETFs made their debut in January 2024, it represented one of the most eagerly awaited milestones in the history of Bitcoin, with widespread expectations that it would drive BTC adoption forward through institutional integration.

Certain market analysts, nevertheless, contend that Bitcoin's institutionalization through ETF vehicles may have produced more negative than positive outcomes, asserting it has played a role in weakening the digital asset's scarcity — a fundamental characteristic of Bitcoin's capped supply limited to 21 million coins.

The same 1 BTC can now support an ETF unit, a future contract, a perpetual swap, an options delta, a broker loan, a structured note. All at once.

Bob Kendall, technical analyst and author of The Kendall Report

"That is not a market. That is a fractional reserve price system," he added.

The concerns raised by Kendall align with similar warnings previously articulated by fellow analysts about Bitcoin ETFs transforming into instruments for Wall Street to "trade against" Bitcoin.

Prior to the introduction of cryptocurrency ETFs, Josef Tětek, a Bitcoin analyst at hardware wallet provider Trezor, cautioned that these financial products might facilitate the "creation of millions of unbacked Bitcoin," which could potentially suppress the market value of genuine Bitcoin.

By Friday's trading session, aggregate assets held in spot Bitcoin ETFs totaled approximately $81 billion, with total cumulative net capital inflows reaching $54.3 billion, per SoSoValue data.

Exchange-traded funds tracking alternative cryptocurrencies presented a varied landscape, with Ether (ETH) investment products experiencing $80.8 million in capital outflows, whereas XRP (XRP) and Solana (SOL) ETFs recorded modest inflows measuring $4.8 million and $2.8 million, respectively.