Bitnomial Introduces XTZ Futures Trading Under US Regulation, Opening Tezos Access for Retail Investors

This new offering arrives after Bitnomial introduced Aptos futures in January, representing the exchange's ongoing effort to broaden US-regulated crypto derivatives markets past Bitcoin and Ethereum.

Bitnomial, the cryptocurrency exchange headquartered in Chicago, has introduced futures contracts linked to the XTZ token from Tezos, representing the inaugural futures offering for this digital asset on an exchange regulated by the US Commodity Futures Trading Commission.

Based on the announcement made Wednesday, these futures contracts have gone live and enable both institutional participants and retail investors to access XTZ price exposure through margin posted in either digital currency or United States dollars.

Through futures contracts, market participants can manage risk exposure or obtain price positioning by entering agreements to purchase or sell assets at predetermined prices on specified future dates, eliminating the need for direct asset ownership.

The establishment of regulated futures marketplaces is frequently considered an essential step toward increased institutional involvement in the United States market, including the possibility of spot exchange-traded funds (ETFs), as these markets deliver standardized mechanisms for price discovery along with CFTC oversight.

CFTC-regulated futures market with six months of trading history checks a key box under the SEC's generic listing standards for spot ETFs

Michael Dunn, Bitnomial president

In his comments to Cointelegraph, Dunn indicated the company remains "actively looking at new tokens" as candidates for potential United States institutional and retail derivatives offerings, though he refrained from naming particular assets under consideration.

In the past, Bitnomial has introduced US-regulated futures contracts connected to digital assets such as Cardano (ADA), XRP (XRP) and Aptos (APT), establishing its position as one of the limited platforms providing regulated cryptocurrency derivatives extending past Bitcoin (BTC) and Ether (ETH) within the United States.

The exchange's campaign to introduce futures contracts for altcoins has encountered regulatory challenges along the way. During August 2024, Bitnomial attempted to self-certify XRP futures through the CFTC, though the Securities and Exchange Commission (SEC) raised objections, contending the contracts necessitated registration as a securities exchange.

Following legal action against the SEC in October 2025 and subsequently withdrawing the lawsuit, Bitnomial proceeded to launch XRP futures during March, pointing to the agency's changing stance on cryptocurrency regulation.

A brief history of Tezos

The Tezos mainnet went live in June 2018 after a 2017 initial coin offering that generated approximately $232 million in Bitcoin and Ether contributions. Though not the pioneering proof-of-stake blockchain, Tezos ranked among the earliest layer-1 networks merging proof-of-stake consensus with formal onchain governance mechanisms, empowering token holders to validate protocol upgrades that facilitated network evolution without requiring hard forks.

Throughout the 2021–2022 non-fungible token surge, the blockchain established a distinct position as a more affordable, environmentally sustainable option to Ethereum for creating and exchanging NFTs. With Ethereum gas fees climbing, creative professionals and gaming companies like Ubisoft migrated to Tezos, emphasizing reduced transaction expenses and the network's proof-of-stake architecture.

Throughout this period, Tezos additionally obtained prominent sports sponsorships with Red Bull Racing and McLaren Racing, and subsequently faced reports regarding preparations for a multi-year training kit partnership with Manchester United estimated at over $27 million annually.

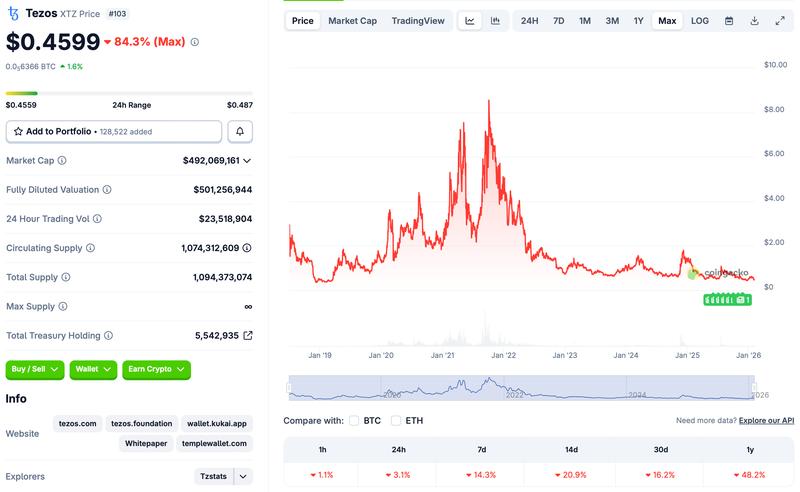

The native token of Tezos, XTZ, reached an all-time peak of $9.12 during October 2021, based on CoinGecko statistics, though it has experienced roughly a 95% decline since then and currently trades near $0.46.

On Jan. 25, Tezos executed its Tallinn protocol enhancement, reducing base-layer block times down to six seconds as an element of the network's 20th onchain upgrade implementation.