Bitcoin's identity struggle: Store of value or just another tech asset?

The digital currency's increasing alignment with technology equities undermines its safe haven reputation, while Ether treasuries, BlackRock and Polymarket execute strategic initiatives.

The original promise of Bitcoin (BTC) positioned it as digital gold — a protective asset against economic volatility and financial system instability. However, current market behavior paints a contrasting picture.

With institutional involvement expanding, especially via exchange-traded funds and conventional financial instruments, Bitcoin has demonstrated an increasing tendency to move in tandem with speculative investments. The recent decline affecting software companies, driven by fresh concerns surrounding artificial intelligence's disruptive potential within the industry, has found its reflection across cryptocurrency markets, sparking renewed debate about Bitcoin's true nature and role.

This evolving relationship forms the foundation for this week's Crypto Biz coverage. Fresh analysis from Grayscale explores Bitcoin's increasing synchronization with growth-oriented stocks, while an Ether (ETH) treasury firm intensifies its commitment despite facing paper losses measured in billions. Additionally, BlackRock continues advancing its tokenization strategy via a Uniswap partnership, and Polymarket brings its dispute regarding state oversight to the federal court system.

Grayscale: Bitcoin is trading like a growth asset, not digital gold

Fresh analysis from Grayscale indicates that Bitcoin's narrative as a store of value has recently been overshadowed, with the cryptocurrency exhibiting behavior patterns more aligned with growth-focused equities.

Within the report, author Zach Pandl explained that although Grayscale maintains its perspective of Bitcoin as a long-term value repository thanks to its capped supply and separation from central banking systems, its near-term market movements mirror those seen in high-growth technology stocks.

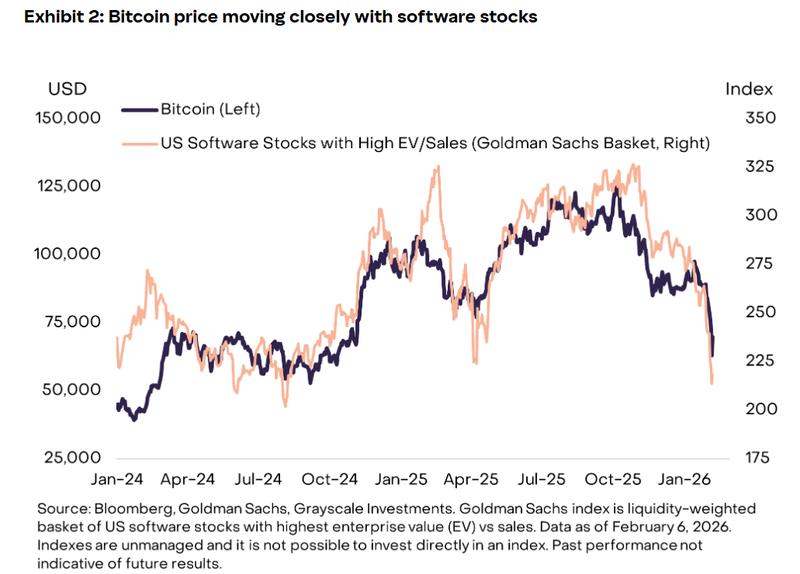

The research identified a robust correlation connecting Bitcoin with software sector equities throughout the preceding two-year period. This connection has grown increasingly evident as software enterprises encounter fresh waves of selling activity driven by fears that artificial intelligence technology might substantially disrupt significant segments of the sector.

Within this context, Bitcoin's recent price decline seems more predictable, given that its valuation has moved in close alignment with the software industry's performance trajectory.

BitMine adds 40,613 ETH during market sell-off

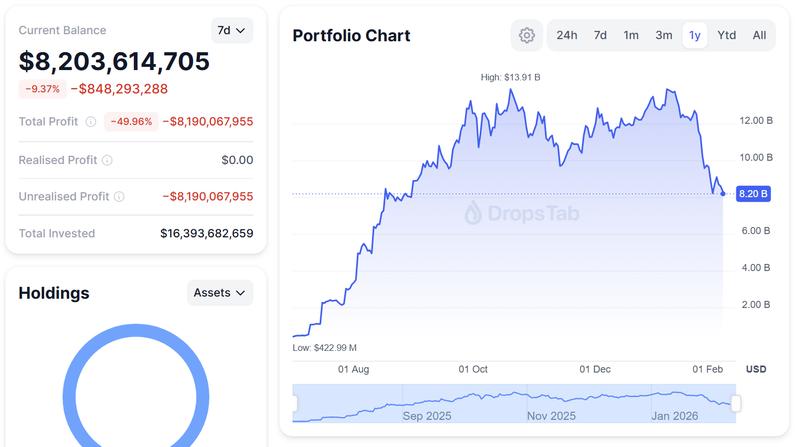

Ether treasury firm BitMine Immersion Technologies acquired an additional 40,613 ETH amid the latest market downturn, strengthening its extended commitment to Ether despite declining valuations and unrealized losses climbing into the billions of dollars.

This acquisition brought BitMine's aggregate Ether reserves beyond 4.326 million ETH, representing approximately $8.8 billion based on prevailing market rates. Data from DropsTab indicates the firm currently carries approximately $8.1 billion in paper losses across its ETH holdings, illustrating a substantial differential between its acquisition costs and present-day market valuations.

Notwithstanding shareholder critiques and downward pressure affecting its equity price, which has experienced steep declines throughout recent months, BitMine chairman Tom Lee stated the corporation's approach is structured to follow Ether's extended trajectory and capitalize on subsequent market rebounds. The firm's comprehensive cryptocurrency and cash holdings total roughly $10 billion in value.

BlackRock buys UNI, brings BUIDL to Uniswap

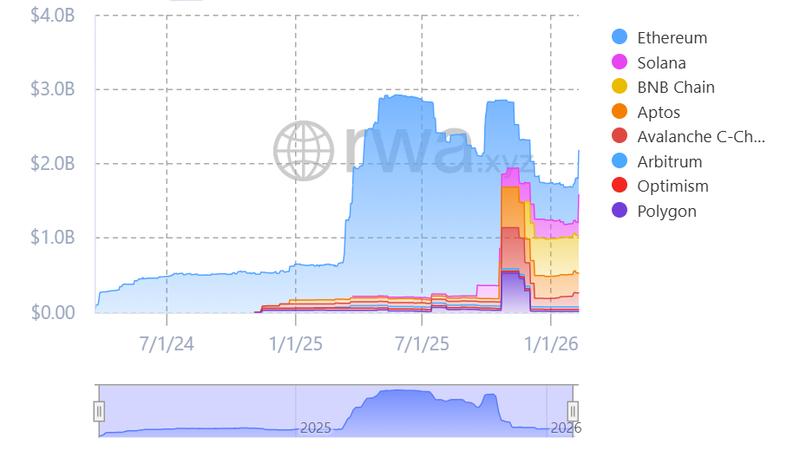

BlackRock is intensifying its expansion into the decentralized finance landscape through listing its tokenized money market product on Uniswap, representing a meaningful advancement for institutional participation in DeFi.

The investment giant's USD Institutional Digital Liquidity Fund (BUIDL) has now been integrated onto the decentralized trading platform, providing approved institutional participants with capabilities to execute transactions involving the tokenized Treasury instrument through blockchain infrastructure. Accompanying this integration, BlackRock is additionally acquiring Uniswap's native governance token, UNI.

BUIDL stands as the premier tokenized money market fund measured by total assets, commanding in excess of $2.1 billion. The product maintains deployment across several blockchain networks, encompassing Ethereum, Solana and Avalanche. Last December marked a milestone when it exceeded $100 million in total distributions derived from its underlying US Treasury portfolio.

Polymarket sues Massachusetts over state regulation of prediction markets

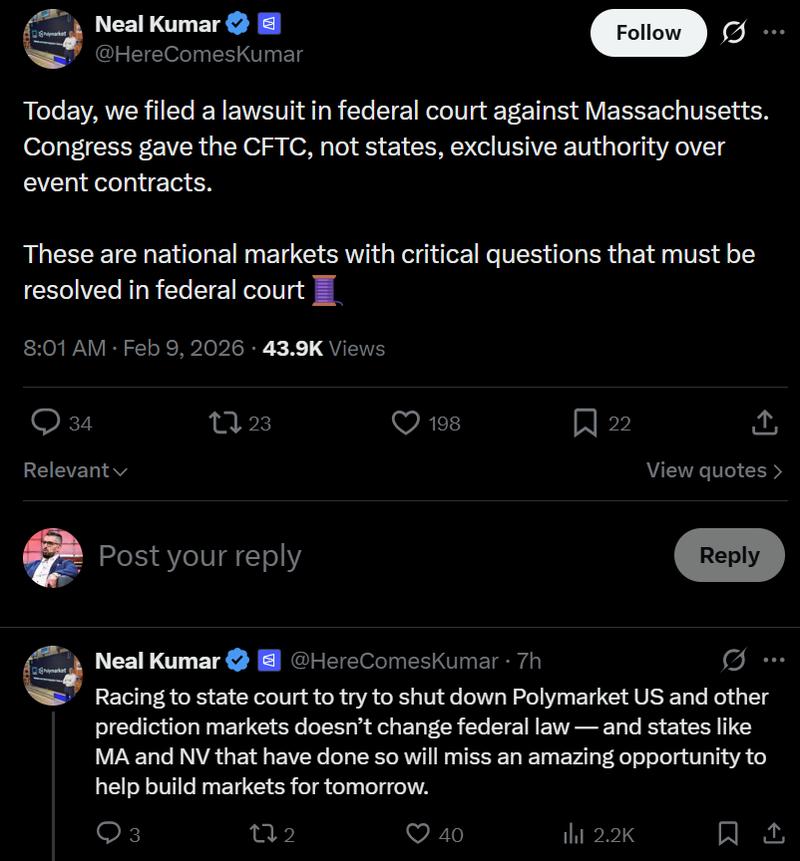

Decentralized prediction platform Polymarket has initiated federal legal proceedings against Massachusetts state authorities, contesting the state's attempts to limit or eliminate its event-based trading offerings.

Polymarket's chief legal officer, Neal Kumar, verified the lawsuit filing on Monday, asserting that outstanding legal matters concerning jurisdictional authority warrant resolution within the federal court system instead of through state-level enforcement mechanisms. The legal action carries preemptive intent, designed to prevent potential measures by Massachusetts Attorney General Andrea Campbell that Polymarket maintains would constitute illegal interference with federally supervised markets.

The platform maintains that the Commodity Futures Trading Commission (CFTC), rather than separate state entities, possesses sole regulatory jurisdiction over event-based contracts such as those provided through its platform, and that state interventions threaten to create fragmentation across national marketplace infrastructure.

Crypto Biz serves as your weekly overview of the commercial landscape powering blockchain and cryptocurrency industries, arriving in your inbox each Thursday.