Bitcoin's Historic Plunge Under 200-Day Moving Average Surpasses FTX and COVID-19 Selloffs

BTC price action registered one of its most dramatic downturns in history as the 200-day moving average data exposes an unprecedented bearish milestone.

The probability of a Bitcoin (BTC) recovery is now "highly probable" following BTC price movements that have established yet another record on the bearish side.

Key points:

- Bitcoin has never traded so far below its 200-day moving average, data shows.

- BTC price action is due "mean reversion" as a result.

- Analysis describes a "macro-driven" Bitcoin bear market now in progress.

Bitcoin experiences one of its most rapid price collapses

Fresh analysis coming from Martin Leinweber, who serves as director of digital asset research and strategy at MarketVector Indexes, a European index provider, indicates that the long-term investment case for Bitcoin remains "intact."

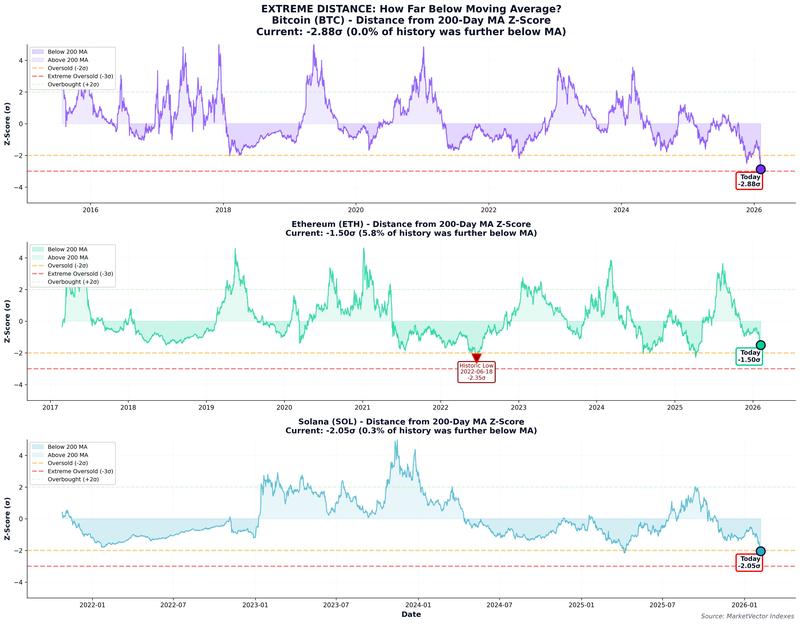

The movement of BTC price has never deviated to such an extreme degree from its 200-day simple moving average (SMA) — and according to Leinweber, the plunge beneath the $60,000 level was far from "normal."

"Bitcoin is -2.88σ below its 200-day moving average. In 10 years of data, this has literally NEVER happened before. Not during COVID. Not during FTX. Never," he summarized in an X thread on Friday.

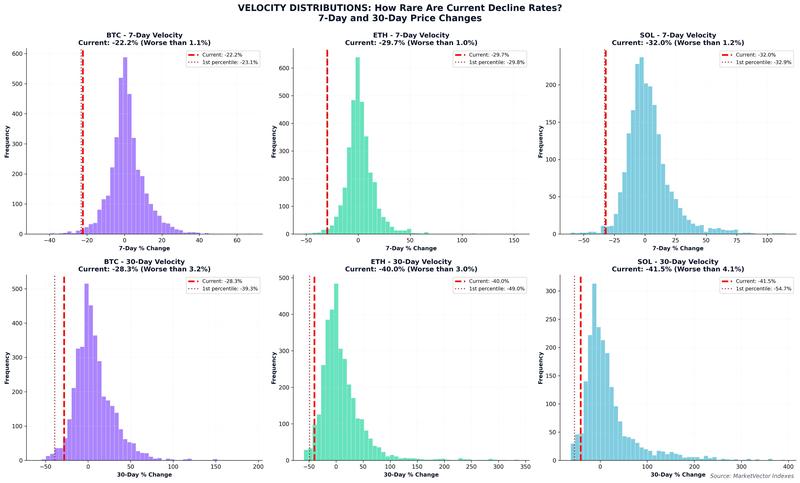

According to the analysis, this week's collapse ranks among the 15 fastest in Bitcoin's history, with BTC/USD experiencing a decline exceeding 22% within just one week — a rate more severe than 98.9% of all historical periods.

"When you're in the 99th percentile of bad outcomes, mean reversion becomes highly probable," Leinweber continued.

However, trading 2.88 standard deviations beneath the 200-day SMA represents an unprecedented occurrence, with Bitcoin surpassing the drawdown levels experienced by major alternative cryptocurrencies Ether (ETH) and Solana (SOL).

"We're not at generational lows yet. But we ARE at statistical extremes across multiple indicators," the analysis confirmed.

That said, Leinweber is not rushing to declare a long-term bottom for BTC price, suggesting instead that the present floor might merely be a "local" one.

Taking a broader perspective, however, there continues to be justification for maintaining confidence in the bullish case for Bitcoin.

"Bear market = macro driven, not tech failure. Long-term thesis intact," the X thread concluded.

Bitcoin dip-buying requires "patience"

Previously, Cointelegraph provided coverage on the historic magnitude of the recent losses in BTC price.

On Thursday, Bitcoin recorded its first-ever $10,000 red daily candle, with liquidation volumes exceeding those witnessed during major bearish episodes in the past, including the COVID-19 crash and implosion of exchange FTX.

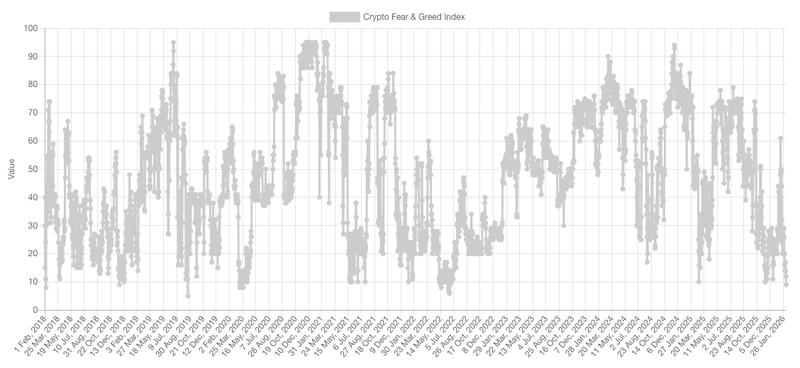

Market sentiment plummeted to extreme lows, as reflected by the Crypto Fear & Greed Index's reading of 9/100.

Simultaneously, indications that high-volume investors were taking advantage of the dip to buy swiftly surfaced, with particular attention on hedge funds and Binance.

In his assessment of the liquidation wave witnessed in recent weeks, trader Daan Crypto Trades was among those identifying a potentially profitable buying opportunity.

"$BTC Bouncing from the middle of the 2024 range. Price sold off -38% in just a few weeks and a lot of large leveraged positions have been wiped out," he told X followers.

"Great time if you are more cash heavy and have the patience to accumulate or profit from the volatility."