Bitcoin Whale Holdings Drop to Lowest Level in Nine Months as Prices Tumble

According to Santiment, the historical pattern of major investors divesting while smaller investors accumulate Bitcoin typically signals the onset of bear market conditions.

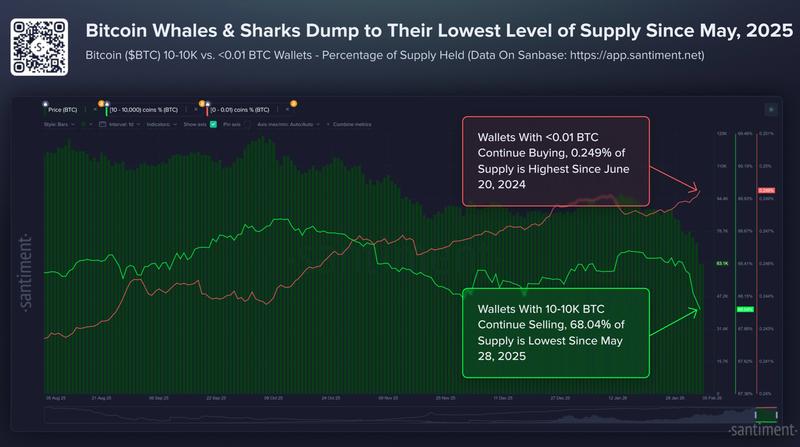

Major Bitcoin holders have reached their lowest percentage of the digital currency's total supply since the end of May, a period when Bitcoin initially surpassed the $100,000 threshold again following a three-month-plus hiatus, data from cryptocurrency sentiment analysis platform Santiment reveals.

In a Thursday post on X, Santiment reported that wallets categorized as "whale and shark" addresses—those containing anywhere from 10 to 10,000 Bitcoin (BTC)—have decreased to their lowest point in nine months, now representing approximately 68.04% of Bitcoin's complete circulating supply.

"This includes a dump of -81,068 BTC in just the past 8 days alone," Santiment said, as Bitcoin fell from around $90,000 to $65,000 over the same period, a roughly 27% decline, according to CoinMarketCap. Bitcoin is trading at $64,792 at the time of publication, up from a 24-hour low of just over $60,000.

Market observers in the cryptocurrency space frequently monitor the behavior of substantial Bitcoin holders to identify indicators of either accumulation or distribution, given that such movements can reveal whether these whales anticipate the asset reaching its peak or preparing for a bullish trend reversal.

It isn't just large Bitcoin holders that are showing signs of caution. CryptoQuant CEO Ki Young Ju posted to X on Wednesday that "every Bitcoin analyst is now bearish."

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, dropped to a score of 9 out of 100 on Friday, its lowest score since mid-2022, when the market was reeling from the collapse of the Terra blockchain.

While there has been a sell-off among large holders, retail investors have been aggressively accumulating. Santiment said, "This combination of key stakeholders selling and retail buying is what historically creates bear cycles."

Wallets classified as "Shrimp" addresses by Santiment—defined as those containing fewer than 0.1 Bitcoin—have climbed to their highest level in 20 months since June 2024, when Bitcoin was valued at approximately $66,000, before experiencing a decline to $53,000 merely two months afterward in August.

However, by December 2024, it had reached $100,000 for the first time amid a booming market after Donald Trump won the US presidential election.

The cohort now accounts for 0.249% of Bitcoin's total supply, which is equivalent to roughly 52,290 Bitcoin.