Bitcoin ETFs see $2.9B exodus while BTC hits fresh 2026 lows

A consecutive 12-day stretch of ETF withdrawals, combined with derivatives indicators and crypto's correlation with technology equities, points to ongoing risk asset reduction by market participants.

Key takeaways:

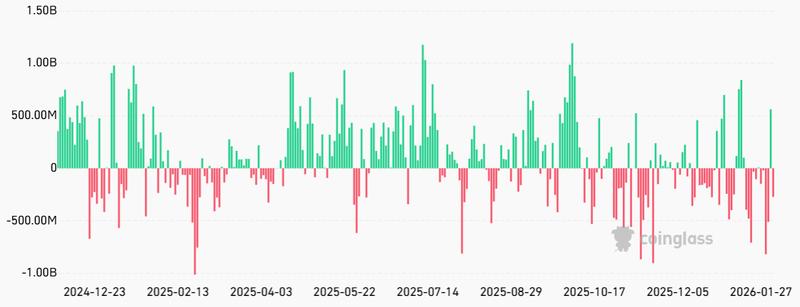

- Substantial withdrawals from Bitcoin exchange-traded products and extensive liquidation events indicate the market is eliminating highly leveraged market participants.

- Derivatives market indicators for Bitcoin options demonstrate that sophisticated traders are positioning for additional downside movement during technology stock selloffs.

Bitcoin (BTC) fell beneath the $73,000 threshold on Wednesday following a short-lived rebound to $79,500 on Tuesday. The decline paralleled weakness in the technology-focused Nasdaq Index, which was fueled by underwhelming revenue projections from semiconductor manufacturer AMD (AMD US) and lackluster employment figures from the United States.

Market participants are now concerned about additional downward pressure on Bitcoin's price following the accumulation of more than $2.9 billion in withdrawals from spot exchange-traded funds (ETFs) over a twelve-day trading period.

The daily average net outflow of $243 million from United States-listed Bitcoin ETFs beginning Jan. 16 almost perfectly aligns with Bitcoin's failure to maintain levels above $98,000 on Jan. 14. The ensuing 26% price correction spanning three weeks resulted in $3.25 billion worth of liquidations affecting leveraged long BTC futures positions. Assuming traders did not contribute additional margin requirements, any positions utilizing leverage beyond 4x would have been completely eliminated.

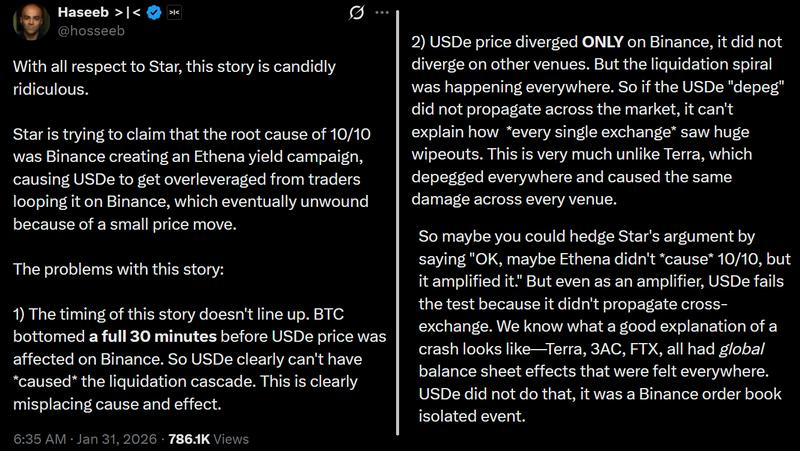

Certain market observers attributed the recent price crash to lingering consequences from the $19 billion liquidation event that occurred on Oct. 10, 2025. That particular incident was purportedly caused by a performance malfunction in database query systems at Binance exchange, which led to delayed transfer processing and inaccurate data distribution. The exchange acknowledged responsibility and distributed more than $283 million in compensation payments to impacted users.

According to Haseeb Qureshi, managing partner at Dragonfly, massive liquidations at Binance "could not get filled, but liquidation engines keep firing regardless. This caused market makers to get wiped out, and they were unable to pick up the pieces." Qureshi added that the October 2025 crash did not permanently "break the market," but noted that market makers "will need time to recover."

The assessment indicates that liquidation systems employed by cryptocurrency exchanges "are not designed to be self-stabilizing the way that TradFi mechanisms are (circuit breakers, etc.)" and instead prioritize exclusively the minimization of insolvency exposure. Qureshi observes that cryptocurrencies represent a "long series" of "bad things" occurring, though historically, market recovery has consistently materialized.

BTC options skew signals traders doubt $72,100 bottom

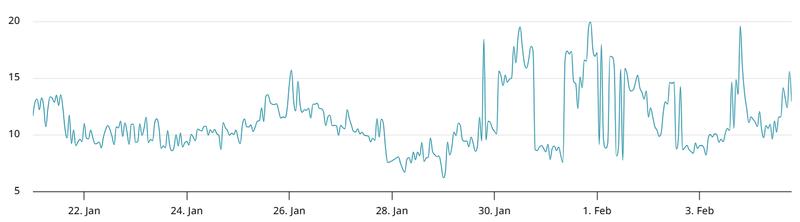

To gauge whether professional market participants shifted to a bearish outlook following the crash, one must examine BTC options market dynamics. During stressful market conditions, appetite for put (sell) contracts increases dramatically, driving the delta skew indicator beyond the 6% neutral benchmark. Elevated demand for downside hedging instruments generally indicates insufficient confidence among bullish traders.

The BTC options delta skew climbed to 13% on Wednesday, providing unmistakable evidence that professional market participants remain unconvinced that Bitcoin's price has established a firm bottom at $72,100. This wariness originates partially from concerns that the technology sector may face headwinds from intensifying competition as Google (GOOG US) and AMD introduce their own proprietary artificial intelligence processing chips.

An additional source of unease for Bitcoin position holders concerns two separate and baseless rumors. The first involves a $9 billion Bitcoin liquidation by a Galaxy Digital client in 2025 that was previously linked to quantum computing threats. Nevertheless, Alex Thorn, Galaxy's head of research, refuted those rumors in an X post on Tuesday.

The second piece of speculation centers on Binance's financial stability, which garnered attention after the exchange experienced technical difficulties that briefly suspended withdrawals on Tuesday. Present onchain data indicators reveal that Bitcoin deposit levels at Binance have remained comparatively steady.

Considering the prevailing uncertainty surrounding macroeconomic trajectories, numerous traders have chosen to withdraw from cryptocurrency markets entirely. This transition creates difficulty in forecasting whether Bitcoin spot ETF withdrawals will persist in exerting negative pressure on the price.