Bitcoin Bollinger Bands Squeeze to Historic Levels, Signaling Major Price Movement Ahead

Bitcoin's Bollinger Bands have compressed to an unprecedented tight range, creating a technical pattern that market analysts identify as a precursor to a significant directional breakout.

An important volatility metric tracking Bitcoin (BTC) has compressed to its most narrow reading ever recorded, establishing a technical formation that historically preceded extended rallies spanning multiple months during both bullish and bearish market cycles. The question remains whether the Bollinger Bands indicator will successfully predict another market bottom.

Historic Bitcoin Bollinger Band squeeze suggests incoming volatility

Examining BTC's monthly price chart, cryptocurrency analyst Dorkchicken observed that Bitcoin's Bollinger Bands have reached their most compressed state in the asset's trading history. These conditions have historically resulted in bullish price breakouts, with the sole exception being a bearish move during 2022, when Bitcoin fell from $20,000 to $16,000.

The Bollinger Bands indicator tracks price volatility levels, and when extreme compression occurs, it frequently precedes sharp volatility expansion. The analyst emphasized that probability favors an upward price movement when the bands begin expanding.

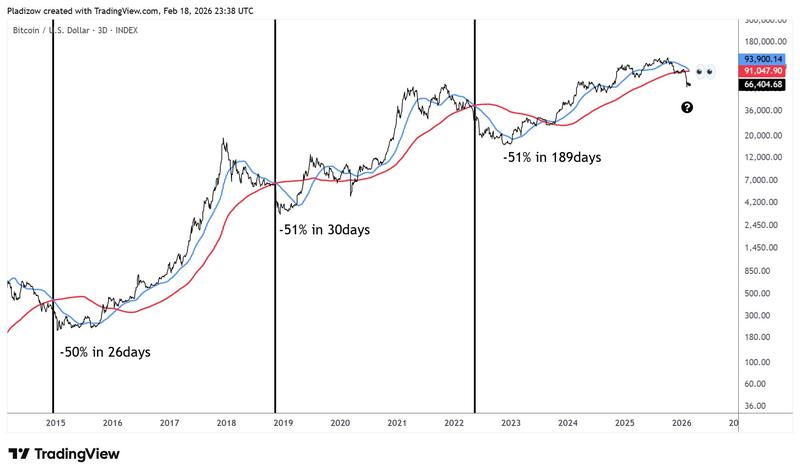

Conversely, cryptocurrency trader Nunya Bizniz highlighted an imminent death cross formation between the 50-period and 200-period simple moving average (SMA) on BTC's three-day timeframe. This death cross pattern emerges when a shorter-term moving average crosses beneath its longer-term counterpart, indicating deteriorating price momentum.

Looking at the three previous occurrences of this pattern, each instance preceded price declines of approximately 50% over subsequent periods ranging from one to six months, and these drawdowns corresponded with final capitulation events in each market cycle.

Following a comparable trajectory could suggest a possible bottom formation between March and August in the vicinity of $33,000. The trader additionally noted that BTC has remained below its short-term holder cost basis of $89,800 for 110 consecutive days. Historical data from previous cycle bottoms shows that prices typically stayed beneath this threshold for approximately 200 days on average.

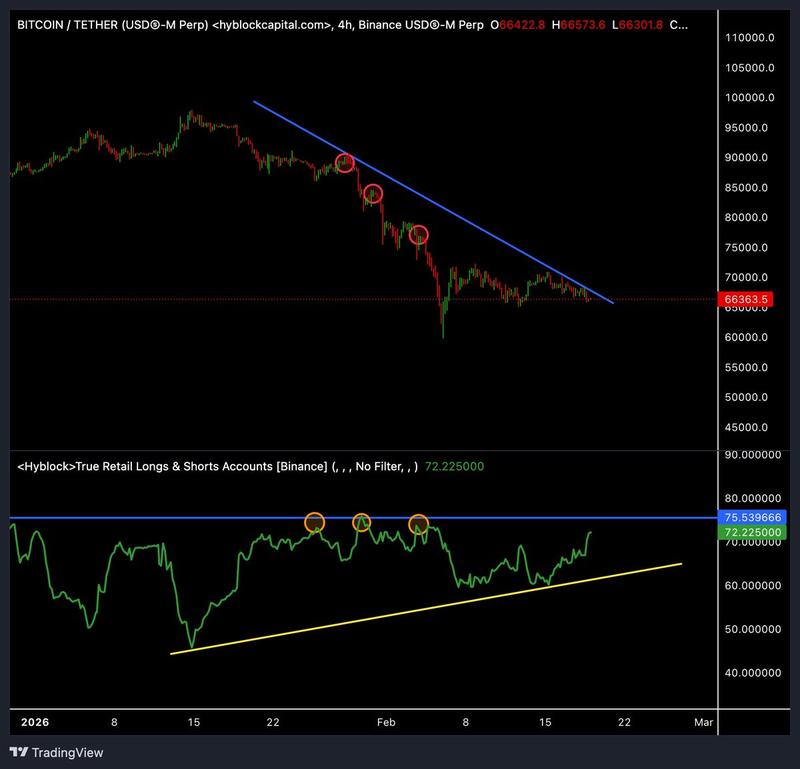

Cryptocurrency market analyst Ardi observed that retail trader long futures positioning has accumulated during each price decline from $88,000 down to $68,000. At present, 72% of monitored retail trading accounts maintain long positions against a descending trend line resistance.

Though this demonstrates emerging market optimism, every recent increase in long position concentration has been succeeded by significant price sell-offs. Given that positioning has reached elevated levels again, these long positions face substantial liquidation risk, amplifying the possibility of a liquidity hunt should prices decline further.

Bitcoin's Sharpe ratio reaches extreme levels, though $70,000 remains critical resistance

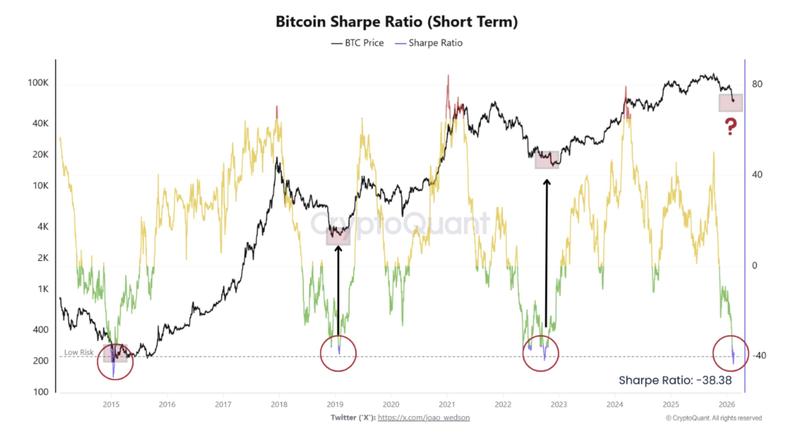

Cryptocurrency analyst MorenoDV reported that Bitcoin's short-term Sharpe Ratio has fallen to -38.38, equaling levels previously observed in 2015, 2019, and late 2022.

This Sharpe ratio metric evaluates risk-adjusted returns, with extremely negative values indicating periods characterized by severe drawdowns and elevated volatility. Every instance of such extremely low ratio readings has coincided with major market cycle bottoms, subsequently triggering substantial BTC price rallies, leading the analyst to suggest that current price levels may represent a "generational buy zone."

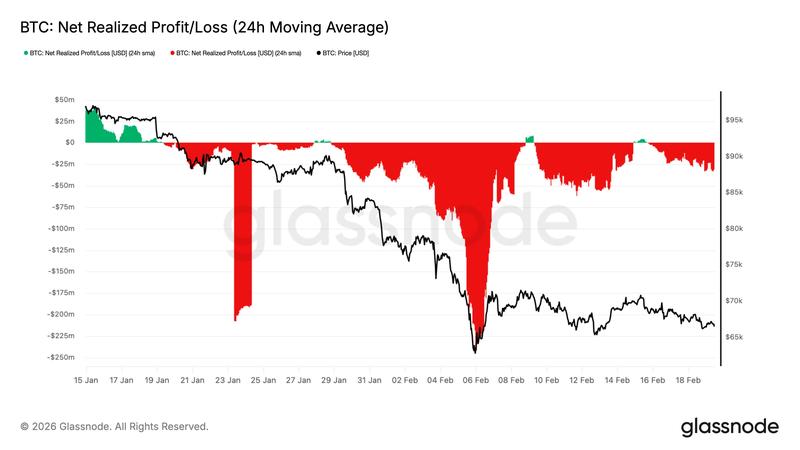

Data from Glassnode indicates the need for validation through more robust BTC demand absorption patterns. Beginning in early February, every attempt to break above the $70,000 price level has encountered resistance as net realized profits surpassed $5 million per hour.

Glassnode further noted that during Q3 2025, profit-taking activity ranging from $200 to 350 million per hour failed to prevent the subsequent advance to fresh all-time highs in Q4.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.