Beneath ETH's Weakness Lies Strength: Institutional Interest Hints at $2.4K Target

Despite lackluster price performance, Ether shows promise as institutional capital flows increase and network engagement intensifies, potentially laying groundwork for a climb toward $2,400.

Critical highlights:

- Exchange-traded funds focused on Ether attracted $71 million in fresh capital, indicating robust institutional interest.

- Decentralized exchange activity on a weekly basis surged twofold to reach $20 billion, reducing the earnings differential with Solana.

The price of Ether (ETH) was unable to maintain momentum above the $2,000 mark on Thursday, prompting market participants to evaluate which factors might drive a recovery. Although sentiment has deteriorated following last Friday's plunge to $1,745, data from exchange-traded fund (ETF) movements and ETH derivatives indicators are beginning to demonstrate early signals of a potential reversal.

Market participants are now questioning whether sufficient momentum exists to propel prices back toward the $2,400 level.

Ether-focused ETFs trading in the United States recently ended a three-consecutive-day pattern of withdrawals, recording $71 million in new investments spanning Monday through Tuesday. Notably, the total assets under management have remained steady at $13 billion, a figure adequate to sustain ongoing institutional participation. Daily trading volume for Ether ETFs currently exceeds $1.65 billion on average, representing a liquidity threshold that permits engagement from the globe's most prominent hedge funds.

For context regarding Ether ETF activity, consider that the State Street Energy Select Sector SPDR ETF (XLE US)— the predominant fund in America's energy sector — generates approximately $1.5 billion in average daily trading volume. This particular instrument provides exposure to a combined market capitalization exceeding $2 trillion through holdings in corporations including Exxon (XOM US), Chevron (CVX US), ConocoPhillips (COP US), The Williams Companies (WMB), and Kinder Morgan (KMI US).

Derivatives data and ETF capital flows suggest brewing recovery

Although strong institutional participation in Ether ETF markets represents an encouraging development, this alone cannot confirm that ETH derivatives demand trends bullish.

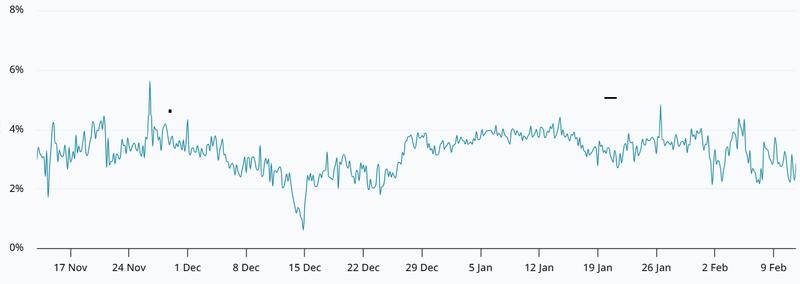

As of Wednesday, the annualized premium (basis rate) for ETH futures continued trading beneath the 5% neutral benchmark. This underwhelming appetite for leveraged bullish positions has persisted as a recurring pattern throughout the previous three months. Nevertheless, the metric has found stability around 3%, despite ETH reaching its weakest valuation in nine months. Such derivative market behavior reflects moderate durability, representing a favorable development for those holding Ether positions.

The declining price of Ether has pushed Ethereum's Total Value Locked (TVL) down to $54.2 billion, a substantial decrease from the $71.2 billion recorded one month earlier, based on DefiLlama statistics. Diminishing deposits within the network's smart contract infrastructure pose significant concerns, given that reduced transaction fees negatively impact the native staking rewards. Additionally, Ethereum's token supply burn mechanism continues to rely heavily on elevated demand for processing capacity on the blockchain.

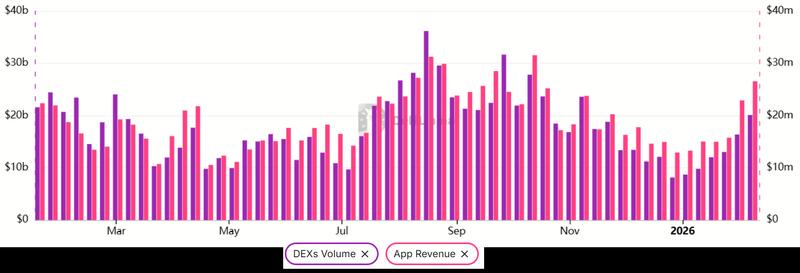

Notwithstanding these deteriorating circumstances, user engagement with Ethereum decentralized applications (DApps) has shown consistent improvement throughout 2026.

Decentralized exchange (DEX) transaction volumes across the Ethereum blockchain on a weekly basis climbed to $20 billion, representing significant growth from the $9.8 billion figure recorded one month ago. This heightened network utilization pushed DApps revenue to $26.6 million during the seven-day period concluding Feb. 8, offering a robust signal of underlying ETH demand. Although Solana maintained its dominant position with $31.1 million in weekly DApps revenue, the distance separating these two blockchain networks continues to contract.

Observers who concentrate exclusively on Ether's price movements overlook the reality that ETH onchain fundamentals and derivatives markets have demonstrated remarkable resilience, particularly given the resumption of capital inflows into Ether ETFs. Although several weeks may be necessary for market participants to completely restore their confidence, compelling evidence suggests that a short-term advance toward $2,400 remains within reach.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.