Aster Activates Layer-1 Blockchain Testing Phase, Eyes Q1 Mainnet Launch

The decentralized perpetual futures and crypto trading platform Aster has activated its testnet phase for a new layer-1 blockchain infrastructure, going live on Thursday.

On Thursday, Aster—a platform dedicated to decentralized crypto trading (DEX) and perpetual futures contracts—revealed that its proprietary layer-1 blockchain testnet has been activated and made accessible to all users, with plans to deploy the Aster layer-1 mainnet potentially in Q1 2026.

According to the Aster roadmap, multiple new capabilities are scheduled for introduction during the Q1 period, encompassing fiat currency on-ramp solutions, the public release of Aster's codebase for developer use, and the forthcoming L1 mainnet deployment.

Throughout 2026, Aster plans to concentrate its efforts on infrastructure development, enhancing token utility, and expanding both its ecosystem and community base, as outlined in the roadmap.

In March 2025, Aster underwent a rebranding transformation to position itself as a perpetual futures DEX, establishing itself as a direct rival to Hyperliquid, another perpetual futures DEX that similarly operates on its own application-specific layer-1 blockchain infrastructure.

The introduction of a proprietary layer-1 chain for Aster is emblematic of a broader trend among Web3 projects migrating toward custom-designed blockchains to accommodate high-throughput transaction volumes, moving away from dependence on general-purpose chains such as Ethereum or Solana, which manage diverse traffic types.

2025 was the year perp DEXs gained momentum

Hyperliquid's remarkable success as a perpetual decentralized exchange (perp DEX) catalyzed growing attention toward other perpetual DEX platforms, including Aster.

Conventional futures contracts incorporate an expiration date and require manual rollover procedures, while perpetual futures contracts operate without any expiration date.

Rather than facing expiration, traders compensate with a funding rate to maintain their positions open for unlimited durations, enabling markets to operate continuously 24 hours a day, seven days a week.

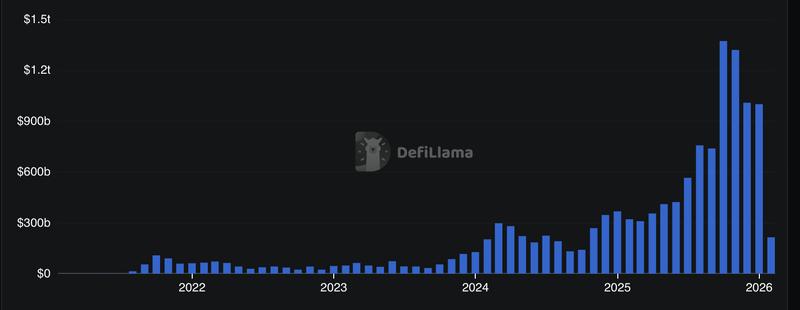

Throughout 2025, cumulative trading volume across perp DEX platforms nearly tripled, climbing from approximately $4 trillion to exceed $12 trillion by year's end.

According to data from DefiLlama, approximately $7.9 trillion of this total cumulative trading volume was produced during 2025.

Data from DefiLlama reveals that monthly trading volume across perpetual exchanges achieved the $1 trillion threshold during October, November and December.

The dramatic increase in trading volume throughout 2025 demonstrates escalating interest and investor appetite for cryptocurrency derivatives products and trading platforms, reflecting the broader trend of the world's financial transactions migrating onchain.