245K BTC Offloaded by Long-Term Holders Amid Macro Headwinds: Has Bitcoin Found Its Floor?

As Bitcoin dipped below $60,000 last week, long-term holders offloaded 245,000 BTC, yet emerging US macroeconomic indicators and increasing interest from dip-buyers suggest the market may have reached a bottom.

Bitcoin (BTC) is currently changing hands above $70,000 as market participants work to establish price stability after last Friday's dramatic downturn, which momentarily drove BTC beneath $60,000 and wiped out approximately $10,000 in value during a single trading session.

According to onchain analytics, long-term holders (LTHs) decreased their positions at the most aggressive rate observed since December 2024, yet the aggregate supply maintained by long-term investors has continued its upward trajectory throughout 2026, creating a divergence that could suggest traders are reallocating positions and potentially accumulating Bitcoin at discounted prices.

Key takeaways:

- Long-term Bitcoin holders experienced a net position change of –245,000 BTC during the previous week, representing the most significant daily outflow recorded since December 2024.

- Notwithstanding the selling activity, LTH supply climbed to 13.81 million from 13.63 million BTC throughout 2026, demonstrating that investors view the price decline as having created favorable accumulation opportunities.

Bitcoin redistribution accelerates while supply continues maturing

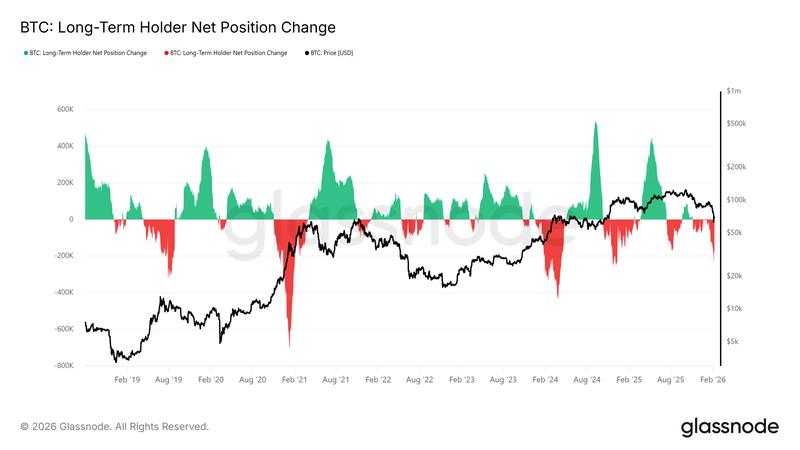

According to Glassnode analytics, the BTC LTH net-position change measured over a 30-day period showed a reduction in exposure totaling 245,000 BTC this past Thursday, representing an extreme level of daily distribution relative to the current cycle. Comparable increases in LTH net position change emerged during correction periods in 2019 and throughout mid-2021, occasions when prices entered consolidation phases instead of evolving into sustained downtrends.

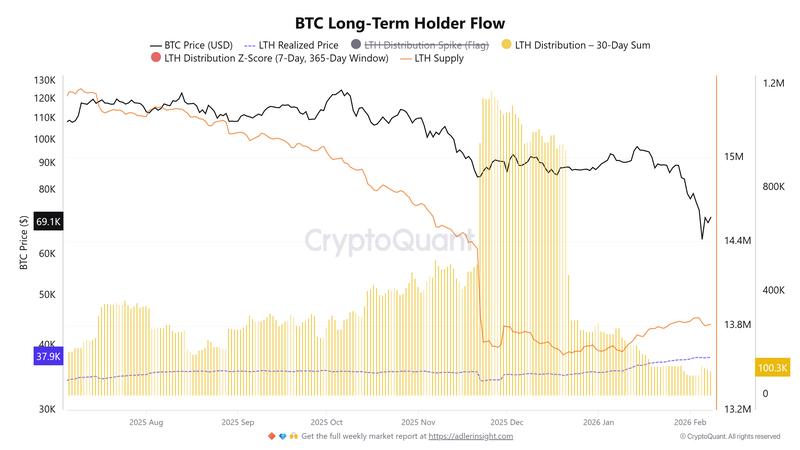

At the same time, data from CryptoQuant reveals that aggregate LTH supply expanded to 13.81 million from 13.63 million BTC during 2026, even as distribution activity persisted. This apparent contradiction can be attributed to the time-dependent methodology used for LTH classification.

When short-term holders curtail their trading behavior during times of market uncertainty, the circulating supply naturally matures into long-term holder status. Consequently, the LTH supply metric can experience growth even as established cohorts engage in selling activity.

The long-term holder spent-output profit ratio (SOPR) returned to a position above 1 on Monday, indicating a recovery following a stretch of realized losses. Given that Bitcoin is trading above the aggregate realized price of $55,000, this market condition could be consistent with a base formation or bottom establishment phase.

Macroeconomic environment continues influencing short-term risk dynamics

Broader macroeconomic considerations are likely to persist as the primary catalyst for near-term price fluctuations, with January U.S. Consumer Price Index (CPI) data scheduled for release Wednesday against a backdrop of heightened policy uncertainty.

Financial markets are currently pricing in 82.2% probability that no rate reduction will occur at the March Federal Open Market Committee (FOMC) meeting, based on CME FedWatch data, highlighting continuing inflation concerns and an expectation for restrictive monetary policy.

Market uncertainty surrounding Kevin Warsh's expected nomination as the US Federal Reserve chair has contributed additional downward pressure on risk-oriented assets. Rising treasury yields alongside constrained financial conditions are continuing to weigh on risk assets, with the US 10-year yield maintaining levels near multi-month peaks of 4.22% while credit spreads stay compressed. Historical periods characterized by elevated real yields have typically corresponded with diminished crypto market liquidity and subdued BTC spot market demand.

Concurrently, the US dollar index (DXY) declined below 97 on Monday, following its recovery from January lows, continuing to serve as a significant volatility driver for Bitcoin.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.