Spot Bitcoin ETFs demonstrate resilience amid market downturn, says expert

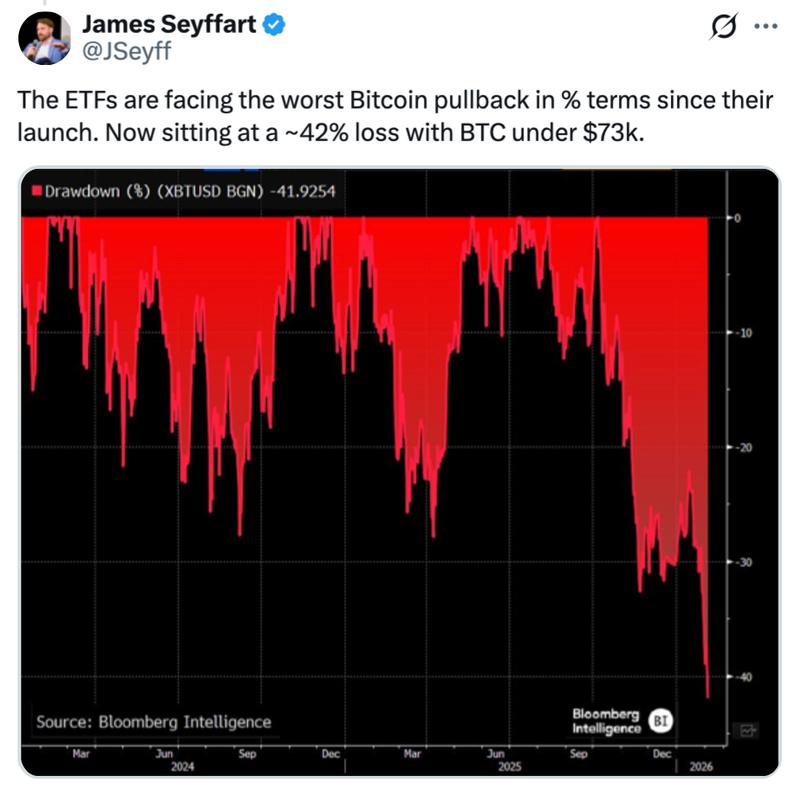

Despite experiencing their most significant drawdown since their January 2024 debut, Bitcoin exchange-traded funds show encouraging signs of stability, an industry expert notes.

Investors in United States spot Bitcoin exchange-traded funds (ETFs) are demonstrating comparatively strong resolve even as Bitcoin experiences a four-month decline, according to industry analyst James Seyffart specializing in ETF products.

"The ETFs are still hanging in there pretty good," Seyffart stated via a post on the social media platform X on Wednesday.

Although Seyffart acknowledged that holders of Bitcoin (BTC) ETFs are currently experiencing their most substantial losses since these American investment products debuted in January 2024 — sitting at approximately 42% in unrealized losses with Bitcoin trading under $73,000 — he maintains that the recent capital outflows remain relatively modest when compared against the massive inflows witnessed during bull market conditions.

Bitcoin ETF holders are "underwater and collectively holding"

Prior to the market decline that commenced in October, net capital flowing into spot Bitcoin ETF products totaled approximately $62.11 billion. Current figures show this has decreased to roughly $55 billion, based on preliminary information from Farside.

"Not too shabby," Seyffart remarked.

At the same time, Jim Bianco, an investment research professional, noted in his X post on Wednesday that the typical spot Bitcoin ETF investor is currently 24% "underwater and collectively holding."

Investors holding Bitcoin frequently monitor the trading performance and capital movement patterns of spot Bitcoin ETFs as indicators to assess overall market sentiment and possible short-term price movements.

Bitcoiners are being "very short-sighted"

Rand, a crypto analytics account, highlighted in a Tuesday X post that this marks "the first time in history there have been three consecutive months of outflows."

These prolonged outflows are occurring while Bitcoin's current market price has declined 24.73% during the last 30 days, with the digital asset trading at $70,537 as of the time of publication, based on data from CoinMarketCap.

Certain market analysts contend that investors in Bitcoin are failing to consider the broader context.

Eric Balchunas, an ETF analyst, commented on Jan. 28 that Bitcoiners are demonstrating behavior that is "very short-sighted," considering Bitcoin's gains since 2022 have exceeded 400%, while gold has risen 177% and silver has climbed 350%.

"In other words, bitcoin spanked everything so bad in '23 and '24 (which ppl seem to forget) that those other assets still haven't caught up even after having their greatest year ever and BTC being in a coma," Balchunas said.

In related news, Ki Young Ju, the chief executive officer of CryptoQuant, stated in an X post on Wednesday that "every Bitcoin analyst is now bearish."