Solana's Jupiter Secures $35M Strategic Investment from ParaFi Capital

The decentralized exchange aggregator announced its inaugural external funding round, which was executed through a token acquisition at current market rates with lengthy vesting periods.

In a significant milestone for the platform, Jupiter has announced the completion of a $35 million strategic funding round led by ParaFi Capital, representing the inaugural instance of the Solana-based decentralized trading and liquidity aggregation platform accepting external investment following several years of self-funded, revenue-generating operations.

According to statements from both organizations, the deal was structured around the acquisition of tokens at prevailing market valuations without any pricing discount and includes an extended vesting schedule, with the entire settlement conducted using Jupiter's proprietary JupUSD stablecoin. Additional financial details beyond the headline $35 million figure were not made public.

This funding arrives at a time when Jupiter has facilitated in excess of $1 trillion in aggregate trading volume throughout the previous year while simultaneously diversifying its offerings beyond simple swap routing to include perpetual futures, lending services, and stablecoin products, the platform confirmed.

As part of the agreement, ParaFi Capital also received warrants that provide the opportunity to purchase additional tokens at elevated strike prices, representing a framework that both parties characterized as demonstrating commitment to sustained, long-term strategic partnership.

This capital raise follows on the heels of Jupiter's recent portfolio expansion initiatives. The platform launched a beta iteration of its decentralized prediction market infrastructure developed in collaboration with Kalshi during October, which was subsequently followed by the January debut of JupUSD, a dollar-backed stablecoin native to the Solana blockchain created through a strategic partnership with Ethena Labs.

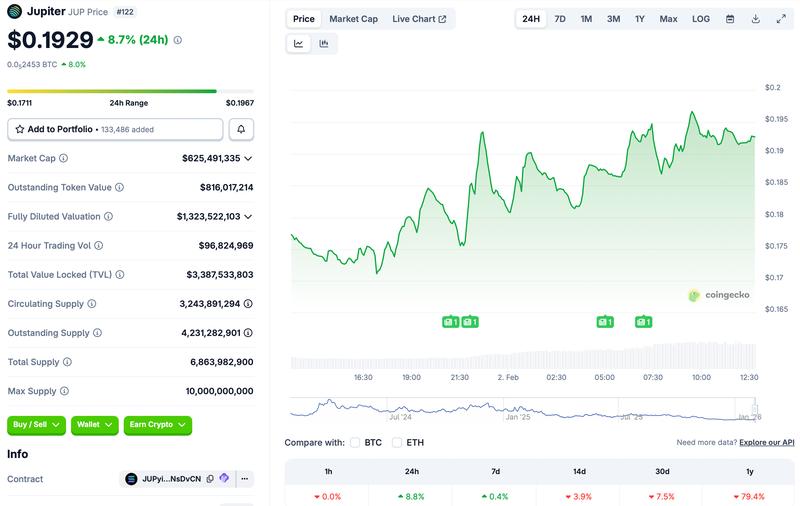

Data from CoinGecko indicates that Jupiter's native token (JUP) experienced an approximate 9% price appreciation during the preceding 24-hour trading period.

Decentralized protocols attract VC attention

Throughout 2025 and into the opening months of 2026, venture capital organizations have maintained their momentum in allocating financial resources toward decentralized protocol infrastructure via token-structured investment vehicles.

During October, a16z Crypto completed a $50 million capital deployment into Jito, a liquid staking protocol operating on the Solana network, structured as a token-based transaction that provided the investment firm with a non-disclosed quantity of Jito's native tokens at a reduced valuation.

The following January witnessed Babylon, a decentralized infrastructure focused on Bitcoin-native staking and lending solutions, successfully completing a $15 million fundraising round from a16z Crypto via the distribution of its BABY token, with the venture firm indicating the capital would be directed toward advancing the protocol's blockchain infrastructure development.

Outside the boundaries of decentralized finance specifically, venture capital participants have additionally provided backing to various other classifications of decentralized protocol projects throughout recent months.

In September, Bio Protocol, a platform focused on decentralized science applications, successfully secured $6.9 million from a consortium of investors that included Maelstrom Fund and Animoca Brands to facilitate the advancement of its artificial intelligence-integrated, blockchain-powered infrastructure designed for biomedical research initiatives.

Most recently last week, Humanity Protocol, which operates as a decentralized identity verification platform, closed a $20 million investment round from Pantera Capital and Jump Crypto at a valuation reportedly reaching $1.1 billion to further build out its Proof of Humanity blockchain-based identity verification framework that leverages biometric data.