High-risk crypto ventures dominate press release distribution, new study reveals

Fresh analysis reveals the majority of cryptocurrency press releases originate from suspicious and high-risk ventures, sparking concerns over transparency, promotional excess and potential price manipulation.

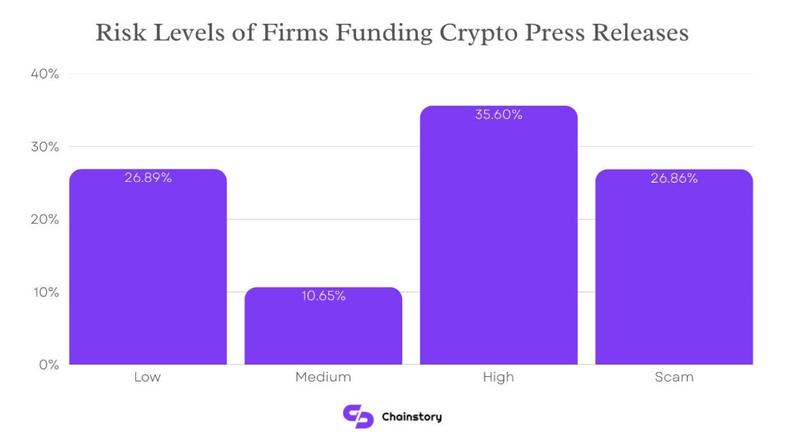

A recently released industry analysis reveals that over 60% of cryptocurrency press releases distributed during the June through November 2025 period originated from ventures classified as either "high risk" or outright fraudulent schemes.

Chainstory, a communications firm specializing in cryptocurrency, reported that its researchers examined a comprehensive data set containing 2,893 press releases, classifying the issuers according to risk levels and evaluating each announcement based on its tone and substantive content.

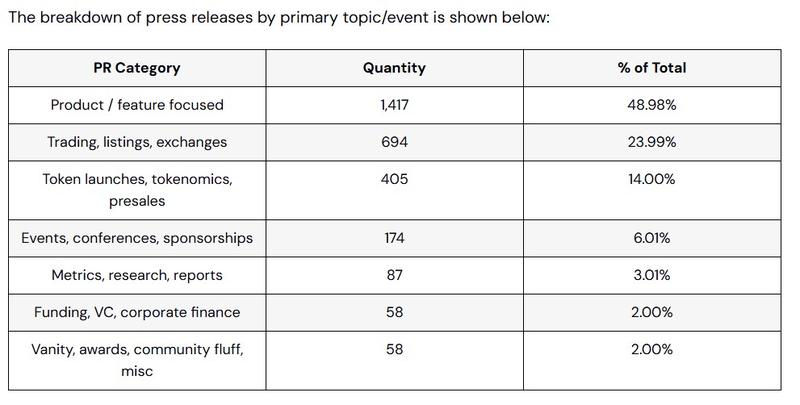

The analysis determined that 62.5% of these releases were associated with high-risk operations or fraudulent schemes, with announcements regarding product or feature updates alongside trading or listing notices representing 74% of the total. Releases categorized as high-risk frequently featured implausible yield commitments and duplicated website content.

"Incomplete data alone never pushed an issuer beyond medium risk. We escalated a project to high risk only when we identified multiple independent red flags," Tal Shmuel Harel, co-founder of Chainstory, told Cointelegraph.

The fundamental purpose of press releases is to disseminate material developments to the broader public. However, when these tools are exploited as inexpensive marketing instruments, they have the potential to overshadow genuine news coverage and, in certain instances, artificially influence token valuations.

High-risk projects dominate crypto press release volume

Ventures categorized as high risk were responsible for 35.6% of all releases within the examined data set, while confirmed scams contributed an additional 26.9%. Meanwhile, low-risk ventures published 27% of the analyzed releases.

According to Chainstory's findings, legitimate ventures typically demonstrate reduced reliance on widespread press release distribution, either due to their ability to generate organic media attention or their preference for more focused communication approaches. In stark contrast, ventures carrying higher risk profiles demonstrate a greater tendency to saturate distribution channels.

Press releases can serve as a mechanism to circumvent editorial oversight. When news organizations choose not to provide coverage for a particular venture, companies can effectively publish their preferred narrative by distributing syndicated releases across numerous websites.

Trading platforms emerged as some of the most prolific users of mass distribution tactics, with approximately one-quarter of all analyzed releases connected to trading operations, token listing announcements or various promotional initiatives.

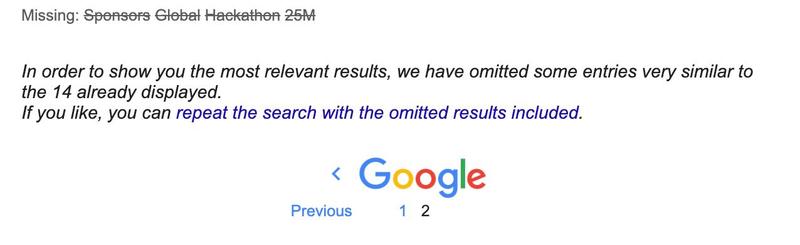

This approach also operates as a volume-driven visibility tactic that spreads identical announcements across multiple distribution networks and syndication platforms, a practice commonly referred to as shotgun distribution.

However, Chainstory noted that search engine algorithms typically demote duplicated content. When virtually identical releases proliferate throughout the internet, the majority of placements get excluded from search results, leaving just one or two indexed versions accessible to online users.

"If you shotgun-distribute one press release, which gets syndicated dozens of times to third-party websites, Google will most likely hide a big chunk of the duplicated content," Harel said.

Market manipulation concerns trace back to TradFi

Promotional activities, customer acquisition efforts and brand awareness campaigns represent standard business operations. The mere act of seeking public attention does not inherently constitute an ethical violation.

However, historical enforcement actions have established connections between deceptive press releases and promotional efforts to market manipulation orchestrated by company insiders and compensated promoters. Chainstory referenced US Securities and Exchange Commission (SEC) enforcement trends to support the argument that "cheap talk (press releases) can move prices."

In a 2017 academic working paper, economist Thomas Renault analyzed SEC pump-and-dump cases from 2002 to 2015. The paper found that press releases were the most common channel for distributing misleading claims, appearing in 73.3% of the cases.

"The crypto equivalent is similar. We've seen tokens that barely have any real user base jump in price after a series of press releases announcing partnerships or future plans (which often never materialize beyond the press release)," Chainstory reported.

On certain occasions, fraudulent press releases have successfully penetrated editorial safeguards. In 2021, a false press release claimed that retail giant Walmart had started accepting Litecoin (LTC), causing a 30% spike in the cryptocurrency's price. Walmart denied the claim, and the price quickly fell back down.

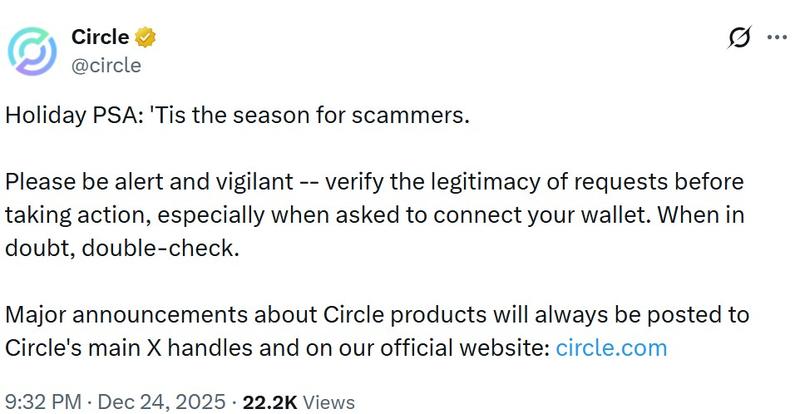

In a more recent incident, a platform impersonating Circle, the issuer of the USDC (USDC) stablecoin, attracted attention on Christmas Eve 2025 through a fraudulent press release announcing a new platform. The questionable venture's website has since been removed, but during its operational period, it encouraged visitors to connect their cryptocurrency wallets.

Press releases have additionally been employed to construct fraudulent legitimacy gradually over extended periods rather than through isolated scam attempts.

For example, a July 2023 press release by defunct crypto exchange JPEX announced a partnership and presented itself as a licensed trading platform.

Two months later, Hong Kong's Securities and Futures Commission warned that the exchange was not licensed and had not applied for a license. JPEX soon became the center of what has been described as the largest crypto fraud case in the city.

Press releases between disclosure and abuse

Prior to cryptocurrency's entry into mainstream financial markets, press releases had already established themselves as a regular element in market manipulation investigations involving assets with limited trading activity.

Chainstory's report identified a comparable trend within the cryptocurrency sector, where inexpensive distribution costs and insufficient gatekeeping mechanisms transform press releases into an accessible channel for questionable ventures to promote their preferred narratives.

Promotional activities and disclosure requirements represent legitimate business functions. However, when the predominant share of press release distribution originates from high-risk ventures and fraudulent schemes, volume ceases to serve as an indicator of credibility and instead reflects which entities are most aggressive in pursuing public attention.

Press releases continue to hold value as instruments for conveying official information to public audiences. The fundamental issue lies not within the format itself, but rather in the ease with which it can be manipulated given minimal oversight and frictionless distribution infrastructure.