BTC Surges Beyond $69K Following Cooler-Than-Expected CPI Data, Though Fed Cut Probability Remains Minimal

A surge to $69,000 delighted Bitcoin investors following milder-than-anticipated US inflation figures, sparking optimism that BTC could establish a "higher low" in its price trajectory.

The cryptocurrency Bitcoin (BTC) experienced upward momentum as Friday's Wall Street trading session commenced, driven by encouraging US inflation statistics that lifted market sentiment.

Key points:

- BTC price movement approaches critical resistance levels following US CPI inflation figures that declined more sharply than market forecasts.

- Digital assets emerge as the day's top performers while traditional macro assets demonstrate muted responses to moderating inflation.

- Market participants maintain cautious perspectives regarding BTC's overall price momentum.

BTC experiences upward spike following mild January inflation report

According to TradingView analytics, BTC price experienced daily increases approaching 4% during the reporting period, with the BTC/USD trading pair touching $69,190 on the Bitstamp exchange.

This fresh bullish momentum materialized following the release of January's US Consumer Price Index (CPI) figures, which came in below market projections.

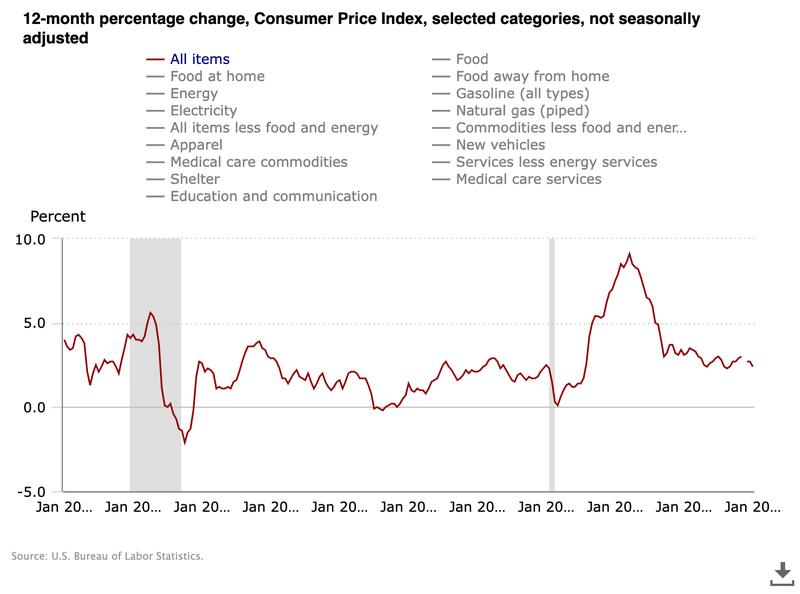

According to data published by the Bureau of Labor Statistics (BLS), the core CPI measurement aligned with the projected 2.5%, whereas the headline figure registered 2.4% — falling 0.1% beneath market consensus.

In response to the data, market analysis platform The Kobeissi Letter observed that inflation as measured by CPI had reached levels not witnessed in several years.

"Core CPI inflation is now at its lowest level since March 2021," the platform stated in an X platform update.

"Odds of further interest rate cuts are back on the rise."

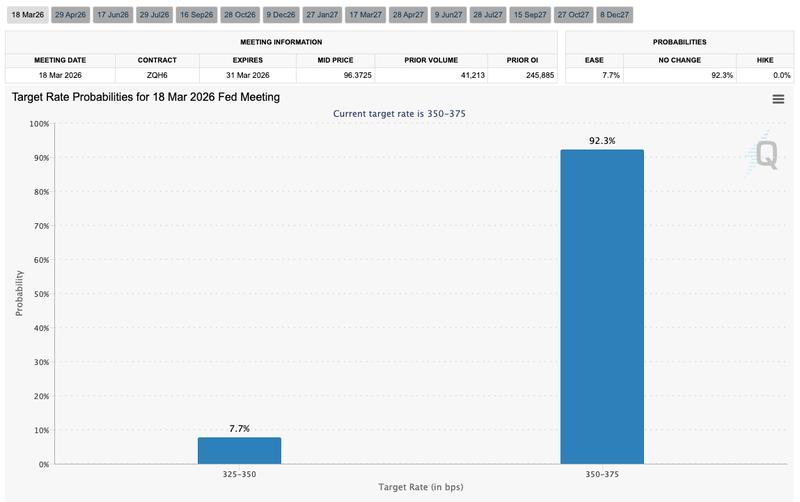

The Kobeissi Letter's commentary addressed the possibility of the Federal Reserve implementing interest rate reductions during its upcoming March policy meeting. According to previous Cointelegraph coverage, market sentiment regarding such a policy shift had reached extremely low levels, further dampened by robust employment data.

Following the inflation data disclosure, the probability of even a modest 0.25% rate reduction stayed below the 10% threshold, according to information from CME Group's FedWatch Tool.

Meanwhile, Andre Dragosch, who serves as European head of research at digital asset manager Bitwise, contended that when analyzed using Truflation, an alternative inflation measurement system, the CPI decline was "not really a surprise."

In other macroeconomic developments, gold made efforts to recapture the $5,000 per ounce threshold, whereas the US dollar index (DXY) pursued a rebound following an initial post-CPI decline to 96.8.

Conversely, US equity markets did not mirror Bitcoin's bullish sentiment, registering modest declines during the reporting timeframe.

Market analyst identifies current price zone as potential location for BTC higher low formation

When evaluating the prospects for BTC price movement, market observers found minimal justification to modify their conservative stances.

"$BTC Still consolidating in this falling wedge," trader Daan Crypto Trades communicated in his most recent X platform post.

"Attempted a break out yesterday but got slammed back down at the $68K level. That's the area to watch if this wants to see another leg up at some point."

In earlier analysis, Cointelegraph highlighted the importance of the $68,000-$69,000 price range, a zone that contains both Bitcoin's previous 2021 peak price level and its 200-week exponential moving average (EMA).

"Whether you like it or not: Bitcoin remains to be in an area where I think that we'll see a higher low come in," crypto trader, analyst and entrepreneur Michaël van de Poppe projected in his own market assessment.

"It's fragile, for sure, but it doesn't mean that we're not going to be seeing some momentum coming in from the markets."