BTC presents superior investment prospect compared to 2017, analysis of gold comparison reveals

Analysts suggest Bitcoin may begin closing the gap with gold by February, following BTC's unprecedented decline against the precious metal throughout this year.

In January, Bitcoin (BTC) reached an unprecedented bottom against gold (XAU), creating what analysts describe as a more attractive entry point than the conditions that existed before the 2015–2017 bull run.

Key takeaways:

- The BTC versus gold ratio reached an all-time low, a threshold that has historically aligned with significant market bottoms.

- Certain analysts caution that a shift from gold to BTC isn't necessarily inevitable.

Transition from gold to Bitcoin may commence in February

Last Saturday, the comparative value of Bitcoin against gold dropped to its most extreme level on record when adjusted for worldwide money supply, according to information from Bitwise Europe.

This particular metric reveals periods when Bitcoin demonstrates unusual strength or weakness in relation to gold. It has currently approached an extreme territory (specifically the -2 threshold shown in the chart below) that historically has emerged near BTC market bottoms.

The previous occurrence of this indicator falling to comparable levels occurred in 2015, signaling severe BTC undervaluation relative to gold. What followed was an extraordinary BTC price surge of 11,800% reaching $20,000 from approximately $165 in a mere two-year span. In a Saturday post on X, analyst Michaël van de Poppe stated:

Today represents a better opportunity to be buying Bitcoin than 2017.

His statement mirrored the perspective of analysts anticipating capital flows to shift from gold toward Bitcoin during the current year.

Among those holding this view are André Dragosch, Bitwise European head of research, along with Pav Hundal, lead analyst at Swyftx. Hundal suggested that these rotations might begin materializing as early as February or March.

Capital rotation "might not happen quickly"

These optimistic perspectives surfaced as gold valuations have experienced a twofold increase throughout the past year, whereas Bitcoin has experienced an 18% decline during the identical timeframe.

However, not all observers shared the belief that a transition from precious metals into Bitcoin is approaching, with analyst Benjamin Cowen among the skeptics.

His assessment suggested Bitcoin's declining trend could persist beyond what many investors anticipate, contending BTC is "likely going to keep bleeding against the stock market" and that expectations for a "massive rotation" away from gold and silver might prove unfounded in the near term.

According to Citi, silver has the potential to continue its upward trajectory over the coming months driven by Chinese demand and dollar weakness. Similarly, projections from RBC Capital Markets forecasted gold reaching a price point of $7,000 before 2026 concludes.

Even should precious metals maintain their strength, Cowen emphasized that any migration toward Bitcoin is "probably not going to happen" with speed.

Bitcoin long-term holders absorb January sell-off

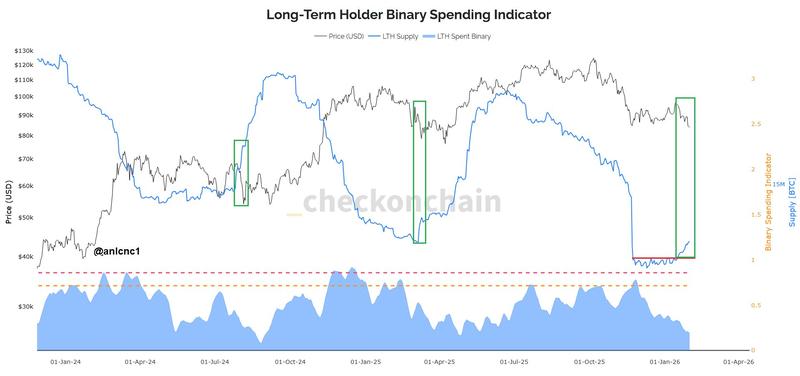

Notwithstanding Bitcoin's dramatic decline throughout January, blockchain data indicates long-term holders are discreetly accumulating positions.

The amount of supply controlled by Bitcoin's Long-Term Holders (LTH), defined as entities maintaining BTC for periods exceeding 155 days, started increasing throughout the January price decline.

Furthermore, the LTH Spent Binary, an indicator reflecting whether long-term Bitcoin holders are distributing or holding their positions, maintained its downward trajectory during this same interval.

Throughout historical cycles, rising LTH supply combined with decreasing LTH Spent Binary has preceded the establishment of sustainable BTC price floors, as noted by analyst Anil.

A contemporary illustration appeared following the April 2025 lows: supply held by long-term holders started recovering initially, with BTC subsequently experiencing a pronounced recovery approximately one month afterward, surging roughly 60% from its bottom.

These patterns indicate that the more disciplined holders are capitalizing on BTC's January price weakness, representing the type of consolidation phase that typically enables Bitcoin to establish a more resilient foundation for subsequent price appreciation.