BTC plunges beneath Strategy's $76K cost basis amid $2B liquidation cascade

A dramatic weekend liquidity event pushed Bitcoin prices down to approximately $75,000, marking the first time since the April 2025 lows that BTC reached these levels.

During weekend market hours, Bitcoin (BTC) experienced a decline exceeding 7% as a new wave of selling pressure triggered approximately $800 million in liquidations.

Key points:

- Bitcoin reaches near its 2025 low as widespread liquidations gain momentum.

- BTC price movement unable to sustain levels above $80,000 and its critical true market mean threshold.

- Strategy's corporate Bitcoin holdings of 700,000 BTC now underwater relative to its aggregate cost basis.

BTC price tumbles beneath $76,000

Information from TradingView revealed BTC price declines pushing BTC/USD beneath $80,000 for the initial instance since April 2025.

Still recovering from a punishing week of losses, Bitcoin market participants confronted intensified downward pressure as thin weekend liquidity conditions amplified market volatility.

As of this writing, BTC/USD was changing hands beneath $78,000, with the April 2025 floor around $74,500 emerging as the next potential target.

"Local Low at $80.5k was annihilated," responded Keith Alan, cofounder of trading resource Material Indicators, posting on X.

Market analyst On-Chain College observed that Bitcoin had fallen beneath its true market mean — representing the cumulative cost basis for the currently active BTC supply.

"Bitcoin is now BELOW the True Market Mean ($80.7K) for the first time since October 2023, when the price was at $29K," he observed.

"Put simply, this is not good for Bitcoin's short to medium term price action."

Alan provided multiple downside price levels worth monitoring, including the peak of Bitcoin's previous bull market from November 2021 at $69,000.

Previously, Cointelegraph had covered $76,000 as a widely anticipated target as Bitcoin struggled to attract buying interest despite equities and precious metals reaching new all-time highs.

Strategy Bitcoin holdings dip negative

A separate cost basis threshold, in the meantime, carried significant implications for both cryptocurrency market watchers and the broader financial community.

Strategy, the corporation boasting the largest corporate Bitcoin treasury, was confronting the prospect of unrealized losses on its BTC position at $76,037.

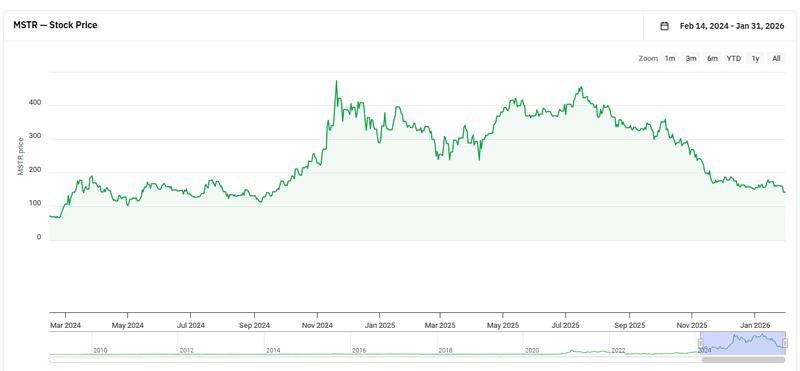

The firm presently maintains holdings exceeding 700,000 BTC, with its stock price currently at $143, having declined almost 70% from its local peak of $455 in July last year.