Asset Manager F/m With $18B AUM Requests SEC Permission for Treasury ETF Tokenization

Investment firm F/m has petitioned the SEC for regulatory exemption to maintain ownership records of its $6 billion Treasury ETF through permissioned blockchain technology amid growing Wall Street tokenization adoption.

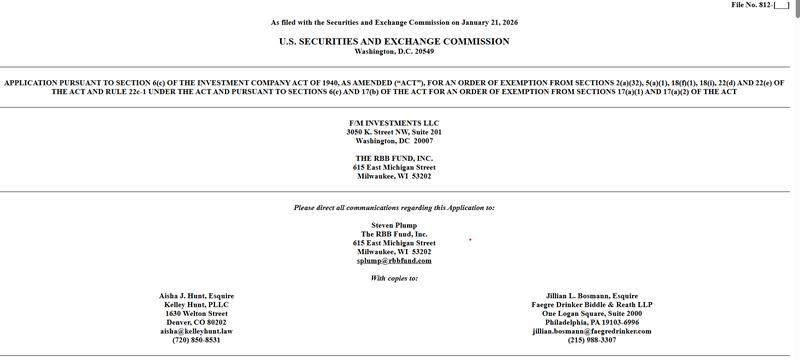

Investment management firm F/m has submitted a formal request to the United States Securities and Exchange Commission (SEC) seeking authorization to convert shares of its primary Treasury exchange-traded fund (ETF) into tokenized format.

On Wednesday, the asset management company overseeing $18 billion in total assets submitted an application for exemptive relief that would enable the F/m US Treasury 3 Month Bill ETF (TBIL) to maintain ownership documentation of approximately $6 billion worth of shares through a permissioned blockchain system, all while continuing to operate as a conventional exchange-traded fund under the 1940 Act.

According to F/m's official press statement, this application represents the "first of its kind" submission by an ETF provider pursuing United States regulatory exemption designed explicitly for blockchain-based shares of a registered investment vehicle.

The asset manager explained that the blockchain-based representation would utilize the identical Committee on Uniform Securities Identification Procedures number, and maintain equivalent rights, expense ratios, shareholder voting privileges and financial characteristics as current TBIL shares hold today, essentially positioning tokenization as an alternative method for documenting shareholder ownership rather than creating a distinct new investment instrument.

A broader tokenization trend in traditional funds

The strategy employed by F/m mirrors closely the recent experimental initiatives undertaken by Franklin Templeton, a prominent United States asset management firm that has introduced blockchain-powered US government money market funds alongside other tokenization trial programs, transitioning shareholder ownership documentation for its digital US government money market fund onto a public blockchain infrastructure while maintaining regulatory compliance under the Investment Company Act.

With F/m's proposal, tokenization technology would be integrated into an exchange-listed Treasury ETF structure as opposed to a money market mutual fund format, which could potentially expand the range of blockchain-enabled, regulated fixed-income investment vehicles available to market participants.

F/m distinguishes its approach from "stablecoins or unregistered digital tokens," stressing that tokenized TBIL shares would remain under independent board governance, daily portfolio disclosure requirements, third-party custodial arrangements and external audit procedures, along with the comprehensive regulatory safeguards mandated for 1940 Act investment funds.

Should the SEC approve the exemptive relief being requested, F/m indicates that TBIL would gain the capability to accommodate both conventional brokerage infrastructure and digitally-native, "token-aware" distribution platforms via a unified share class structure, all without modifying its core investment strategy or underlying portfolio holdings.

The filing was submitted merely days following the New York Stock Exchange's announcement of blueprints for a novel trading venue designed to facilitate round-the-clock trading and blockchain-based settlement for tokenized equity securities and ETFs, reflecting tokenization's transition from experimental programs toward widespread market integration.

Cointelegraph contacted F/m Investments seeking further commentary on the matter, but no response had been received at the time of publication.