Analysts Split on Bitcoin 'Reflation' Trade as PMI Surpasses 50 After Three Years

Experts remain divided over Bitcoin's price trajectory following its correlation with PMI data, which exceeded 50 for the first time since 2022.

Bitcoin (BTC) stands poised to benefit from emerging macroeconomic winds as United States economic indicators establish conditions for a "reflation" trading strategy.

Key points:

- US ISM PMI data for January breaks a full year of contraction during 2025.

- Reactions disagree over the impact on BTC price action despite the previous PMI correlation.

- A hidden bearish divergence between PMI and BTC/USD is now active.

PMI feeds case for BTC price "final bull"

Fresh analysis from various sources, including Andre Dragosch, who serves as European head of research at cryptocurrency asset management firm Bitwise, indicates US financial policies could drive a Bitcoin price recovery.

During this week, the most recent Manufacturing Purchasing Managers Index (PMI) Report released by the Institute of Supply Management (ISM) produced an unexpected upside surprise.

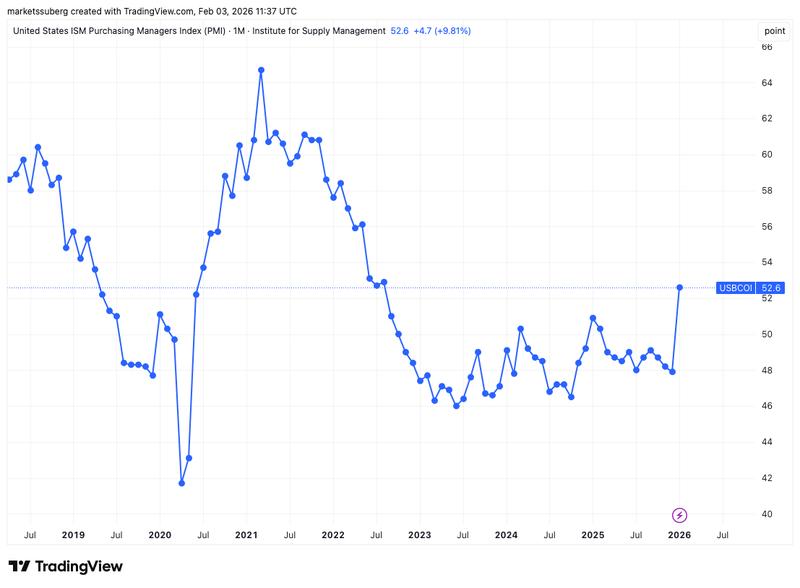

The ISM PMI functions as a composite measurement for United States economic health, and remained in contraction territory throughout 2025. Currently, the indicator has climbed back above the critical 50 threshold for the first time since the middle of 2022, according to data confirmed by TradingView.

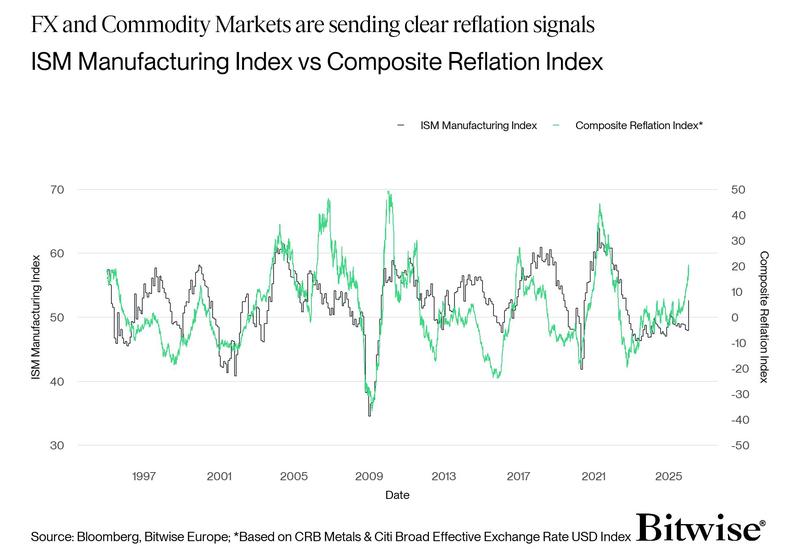

In Dragosch's view, this development, arriving as a result of the substantial surge in precious metals like gold and silver, points to a single conclusion: "reflation."

"You're naive if you believe that there is no valuable information for bitcoin in the latest (precious-)metals rally," he told X followers in a post on Tuesday.

According to Dragosch, the ISM increase represented "no surprise."

"Such macro environments have always been associated with bitcoin bulls runs in the past," he added.

Cryptocurrency trader, market analyst and business entrepreneur Michaël van de Poppe expanded on this perspective, emphasizing the relationship between PMI and Bitcoin price momentum in recent years as part of an overarching risk-on market cycle.

"The ISM Manufacturing PMI is heading into the first 50+ read in more than 3 years. It's been one of the longest 'bear' markets on that regard. Not great for the business cycle, and not great for Bitcoin," he wrote on X.

"The fact that Bitcoin rallied is simply and only due to the launch and liquidity of the ETF. By now, just now, is the moment that the markets start to wake up."

Van de Poppe recognized significant transformations in economic conditions across Bitcoin's prior price cycles, noting that the present situation demanded "perspective."

"In the coming 1-3 years, we'll see a strong, and final bull on Bitcoin and Crypto," he forecast.

Bitcoin vs. PMI: "Probably different outcome"

The term reflation describes intentional policy actions crafted to boost economic activity while avoiding price increases — inflationary pressures.

The United States finds itself currently in a precarious position regarding inflation after recent data publications presented a conflicting picture concerning future trajectory.

As Cointelegraph reported, concerns remain that inflation may reemerge as 2026 goes on.

The PMI reading alone proved insufficient to persuade all observers that Bitcoin would experience upward price relief this year.

"Cherry-picking a single macroeconomic indicator and treating it as the cycle is, in economics, called proxy abuse," trader Titan of Crypto commented on the back of the data.

Titan of Crypto performed a direct comparison between PMI readings and Bitcoin price movements, and identified a critical distinction in the current scenario.

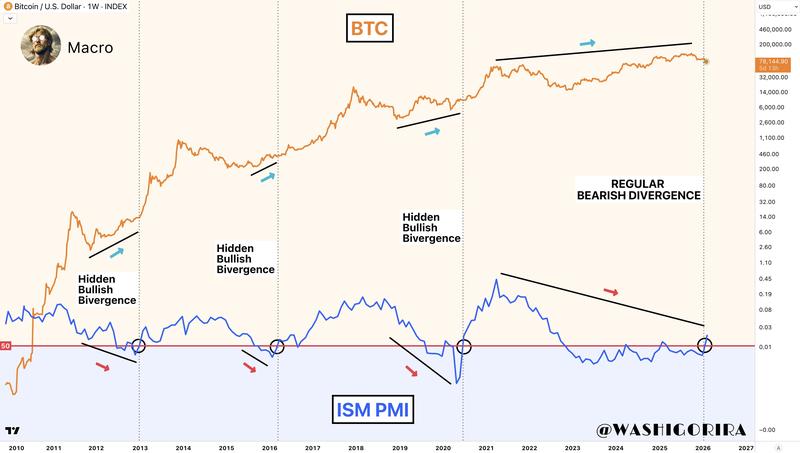

"In 2013, 2016 and 2020, when PMI moved back above 50, Bitcoin showed a hidden bullish divergence. Each time, a bull run followed. Today? PMI just crossed above 50 again but this time we have a regular bearish divergence instead," he concluded.

"Same indicator, different structure, probably different outcome."