NYSE's blockchain tokenization initiative dismissed as 'vaporware' by Columbia academic

An academic from Columbia University's business school criticized the NYSE's tokenization reveal for missing crucial information and originating from an organization favoring a "highly centralized and oligopolistic architecture."

An academic from Columbia Business School is voicing skepticism regarding the limited information provided in the New York Stock Exchange's strategy to create a blockchain infrastructure for tokenizing real-world assets, expressing worry that it may contradict fundamental crypto principles.

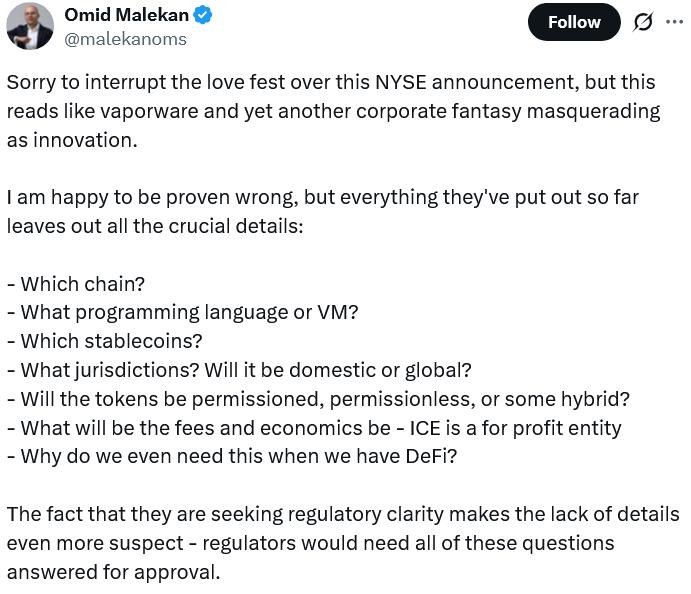

Through a Tuesday post on X, Omid Malekan stated that the NYSE's public announcement appeared to be "vaporware" and that numerous critical questions still lack answers, such as which blockchain network would serve as the foundation, whether the tokens would operate under permissioned or permissionless protocols or potentially both, and how the tokenomics and fee structure would be configured.

The term vaporware describes a product that receives announcements and marketing buzz but exists without any working version, typically missing specific information about the product's actual implementation strategy.

The NYSE along with its parent company, the Intercontinental Exchange, announced on Monday that their platform would facilitate around-the-clock trading and immediate settlement for stocks and exchange-traded funds through a blockchain-based post-trade infrastructure, featuring support for multiple chains and integrated custody capabilities.

Nevertheless, Malekan contended that the NYSE's operational framework is built upon a "highly centralized and oligopolistic architecture," while further noting in a Fortune opinion article that no degree of computer science innovation and cryptographic technology will change that fundamental reality unless the NYSE chooses to abandon relationships with numerous existing partners.

Malekan drew a parallel between the NYSE's strategy and telecommunications giant AT&T's efforts in the late 1990s when it sought to control the emerging internet landscape, pointing out that being a leader in one technological generation doesn't guarantee dominance in the subsequent one.

"Tokenization represents a radically different architecture. It requires different skills and business models to be useful,"

he stated in his X post, finishing with his assessment that he cannot envision a scenario where the NYSE's blockchain project centered on tokenization achieves success.

Cointelegraph has reached out to NYSE seeking additional information regarding their tokenization strategy.

NYSE's tokenization plan is a game-changer, crypto execs say

In spite of Malekan's reservations, additional industry commentators have interpreted the NYSE's tokenization initiative as a beneficial development for the blockchain sector.

"On-chain trading of native tokenized equities coming from NYSE, no wrappers, no derivatives, no tokenized entitlements, bullish,"

Carlos Domingo, who serves as founder and CEO of Securitize, an RWA tokenization platform, commented on Tuesday.

"It's about time we put the best tech to use," Alexander Spiegelman, head of research at Aptos Labs, chimed in.

ARK Invest projected on Wednesday that the market for RWA tokenization would expand from $22.2 billion to reach $11 trillion by 2030, driven by enhanced regulatory clarity and superior institutional-grade infrastructure development.